56• FINANCIAL REVIEW

PANDORAANNUAL REPORT2014

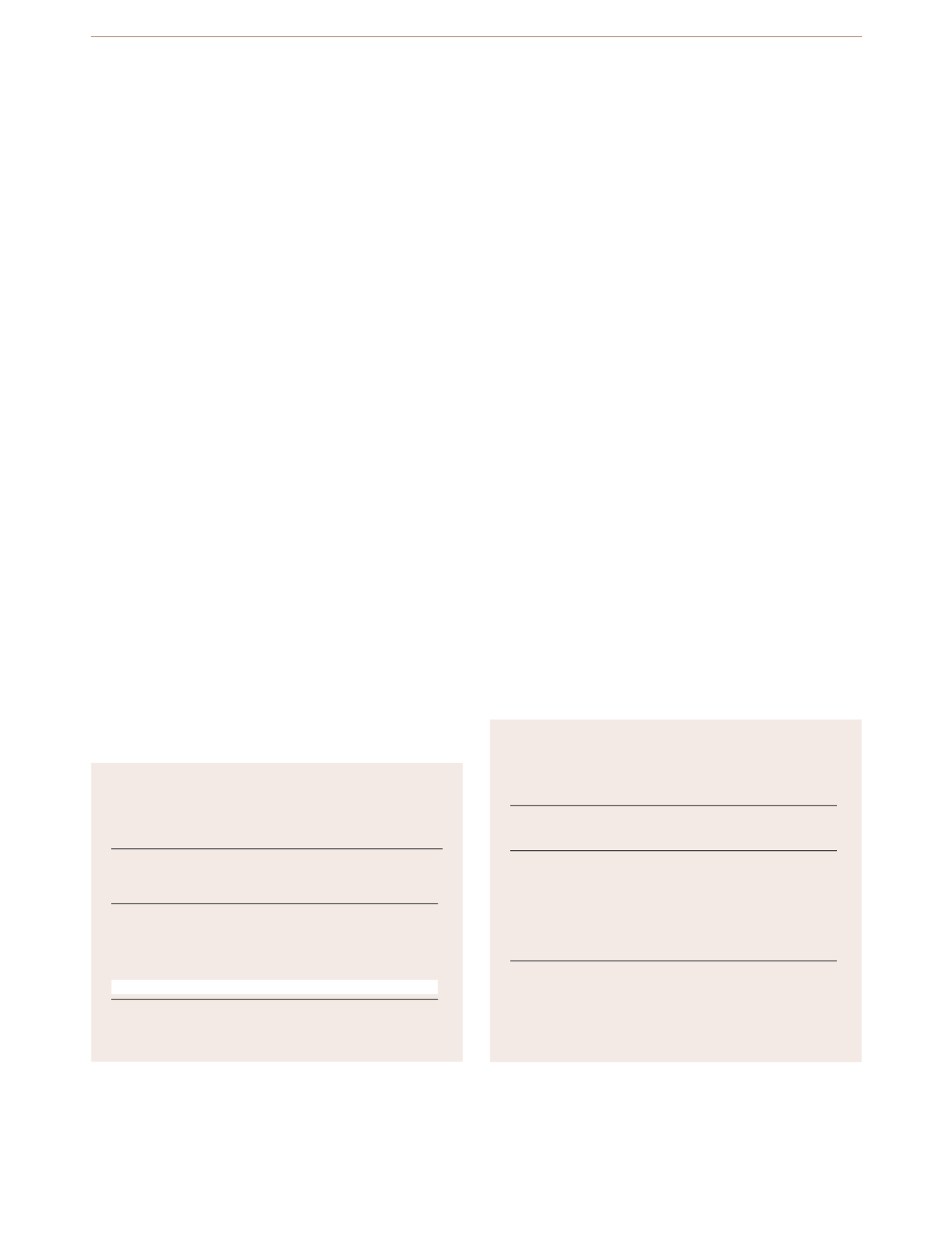

REGIONAL

EBITDAMARGINS

2014

vs. 2013

2014

2013

(%pts)

Americas

41.4% 42.6% -1.2%

Europe

43.3% 36.1% 7.2%

Asia Pacific

49.5% 37.8% 11.7%

Unallocated costs

-7.4% -7.4%

-

Group EBITDAmargin

36.0% 32.0% 4.0%

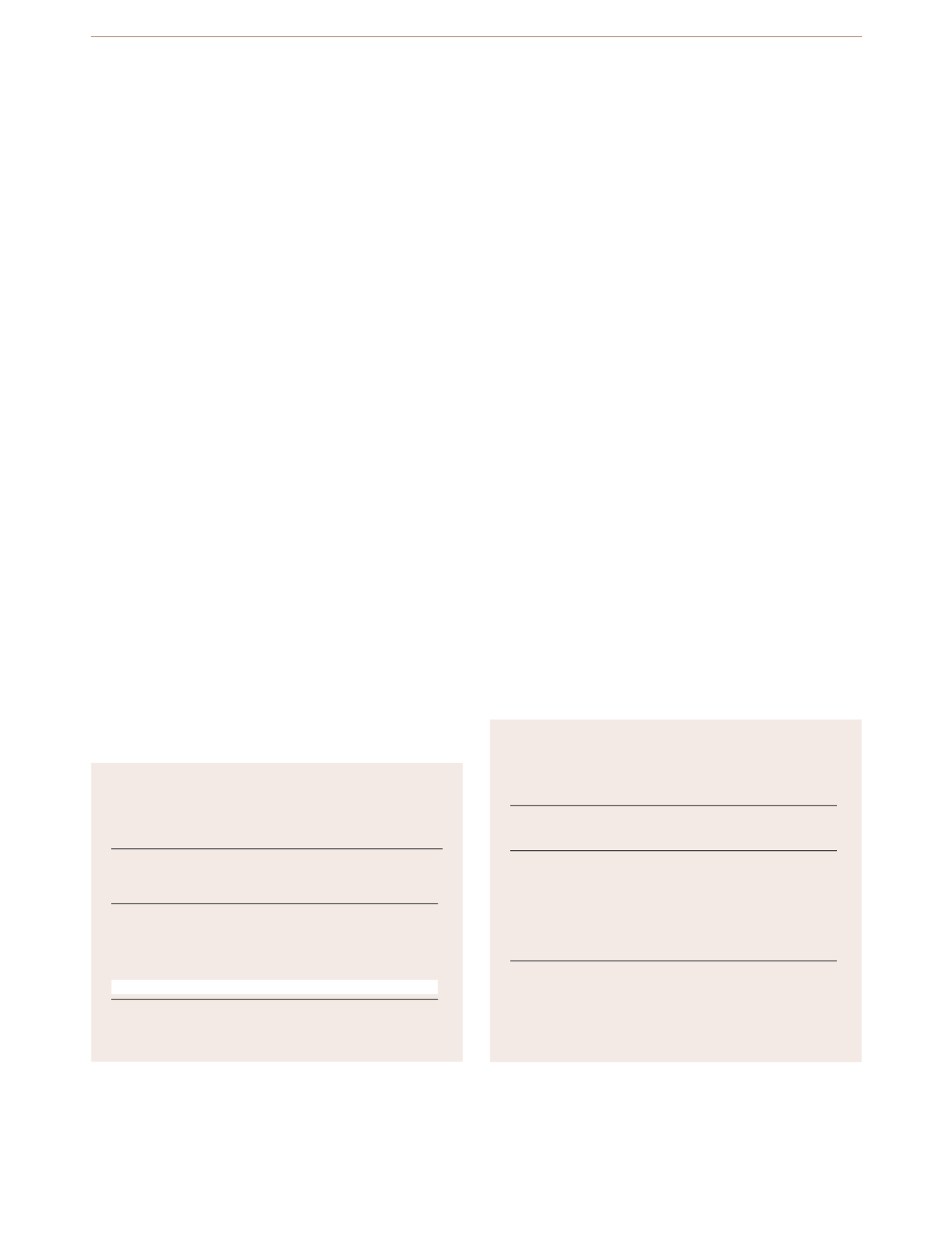

SENSITIVITYANALYSIS

ONCURRENCY

1

Change in

DKKmillion

exchange rate Revenue

EBITDA

USD

+10% 452

164

CAD

+10%

84

73

AUD

+10%

81

60

GBP

+10% 169

138

EUR

+1%

31

21

THB

+10%

-

-163

1

Revenue and EBITDAwouldhave been impactedby the above

amounts if exchange rates in2014had beenhigher than the real-

ised exchange rates.The impact would have been the opposite if

exchange rates had been lower.

EBITDA

EBITDA for 2014 increasedby 49.0% toDKK 4,294

million, resulting in an EBITDAmargin of 36.0% compared

with 32.0% in 2013.

TheEBITDAmargin forAmericaswas 41.4%, down1.2

percentagepoints comparedwith2013.Thedecreasewas

partiallydue to the inclusionof Brazil inOtherAmericas

(previously included inOther Europe),whichhadadiluting

effect onmargins of approximatelyonepercentagepoint.

Furthermore, EBITDAmarginwas negatively impactedby the

purchaseof inventory fromanet total of 22concept stores

fromUS jewellerHannoushatwholesalepriceswhichwill

continue to impact EBITDAnegativelyuntil soldout.The

EBITDAmarginwas alsoaffectedby the improvement ingross

margin from lower rawmaterial prices,whichwas partially

offset bynominallyhigher customs cost inCanadaandBrazil.

TheEBITDAmargin for Europe increased from36.1% in

2013 to43.3% in2014.The increase inEuropewas primarily

drivenby the increase ingrossmarginaswell as improved

leverageon thecost base froman increase in revenue -

primarily in theUK, ItalyandFrance.

TheEBITDAmargin forAsiaPacific region improvedby

11.7percentagepoints to49.5% in2014.The improvement

was primarilydrivenbyhigher revenue in the regionaswell

as improvedgrossmargin.

Unallocated costswere 7.4% of revenue in 2014

comparedwith 7.4% in 2013.

EBITDA is impacted by different currencies. A 10% increase

in average exchange rates for themain currencies (1%

deviation for EUR) would impact EBITDA by approximately

DKK164million for USD, DKK 138million for GBP, DKK

73million for CAD, DKK21million for EUR, DKK 60

million forAUD andDKK -163million forTHB.

EBIT

EBIT for 2014 increased toDKK4,072million (2013:DKK

2,681million), an increaseof 51.9%comparedwith2013,

resulting inanEBITmarginof 34.1% for 2014versus 29.8%

in2013.

NET FINANCIALS

Net financials amounted toanexpenseofDKK200million in

2014comparedwith incomeofDKK61million in2013.The

decrease innet financialswasmainly related tounrealised

exchange rate losses.

INCOMETAX EXPENSE

Income tax expensewasDKK 774million in2014

comparedwithDKK522million in 2013, corresponding to

an effective tax rate of 20% for 2014 comparedwith 19%

in2013.