PARENT COMPANY FINANCIAL STATEMENTS • 133

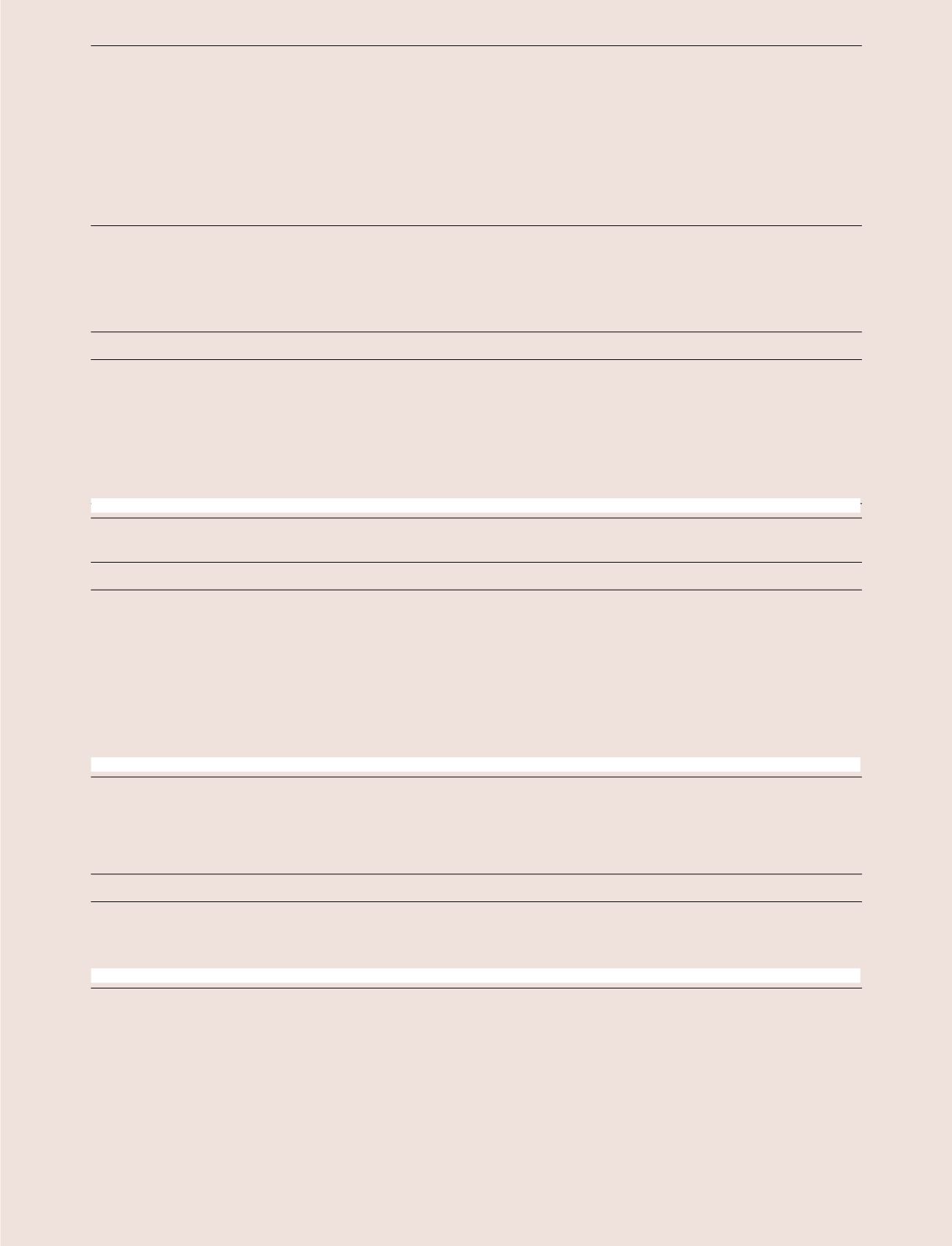

NET FINANCIALS

Finance income

DKK million

2016

2015

Finance income from financial assets and liabilities at fair value through the income statement:

Fair value adjustments, derivative financial instruments

203

2

Total finance income from derivative financial instruments

203

2

Finance income from loans and receivables measured at amortised cost:

Interest income from subsidiaries

61

66

Foreign exchange gains

111

117

Total finance income from loans and receivables

172

183

Total finance income

375

185

Finance costs

DKK million

2016

2015

Finance costs from financial assets and liabilities measured at fair value through the income statement:

Fair value adjustments, derivative financial instruments

15

200

Total finance costs from derivative financial instruments

15

200

Finance costs from financial liabilities measured at amortised cost:

Interest costs to subsidiaries

5

5

Foreign exchange losses

7

239

Interest on loans and borrowings

22

9

Other finance costs

9

117

Total finance costs from loans and borrowings

43

370

Total finance costs

58

570

NOTES FOR THE

PARENT COMPANY

4.4

4.5

Other non-cash adjustments

DKK million

2016

2015

Other non-cash adjustments can be split into the following:

Effects from exchange rate adjustments

104

-122

Effects from derivative financial instruments

258

-184

Other, including gains/losses from the sale of property, plant and equipment

-

11

Total other non-cash adjustments

362

-295

OTHER NON-CASH ADJUSTMENTS