NOTES

Consolidated financial statements • 83

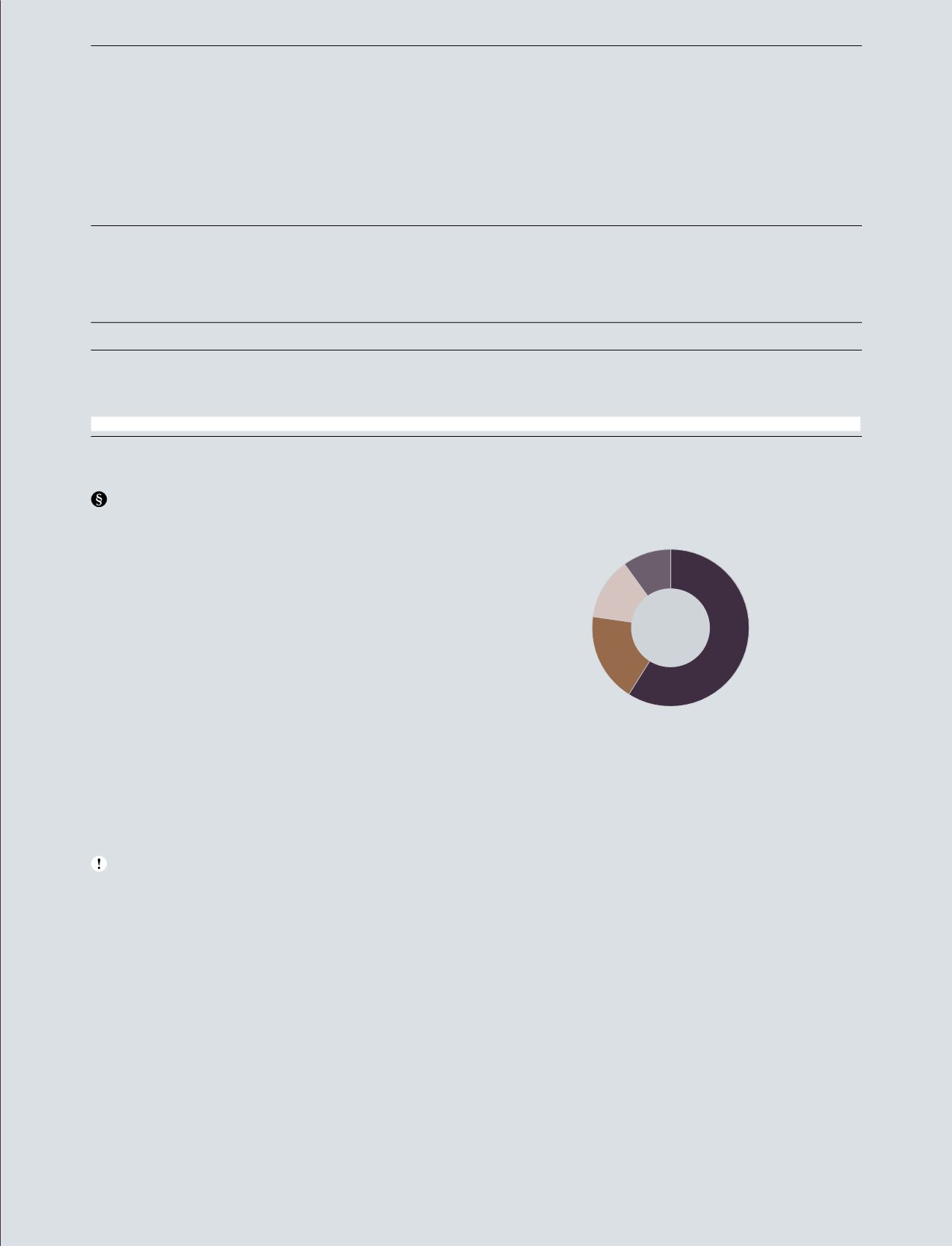

REVENUE BY PRODUCT CATEGORY

DKK million

11,991

Charms

3,672

Bracelets

2,643

Rings

1,975

Other jewellery

Accounting policies

Revenue is recognised to the extent that it is probable that

economic benefits will flow to PANDORA, the revenue

can be reliably measured and when the significant risks

and rewards of ownership of the goods have passed to

the buyer, usually on delivery of the goods. Revenue is

measured at the fair value of the consideration received,

excluding discounts, rebates and sales taxes and duties

when they are passed on to customers. Sales taxes and

duties incurred on sales that are not recoverable from the

taxation authority are reported gross as part of revenue and

cost of sales.

Provisions for rebates and discounts granted to

wholesalers and franchisees are recognised as a reduction

of revenue, whereas the effect of expected returns is

recorded as a reduction of gross profit, i.e. revenue and cost

of sales. The provisions are measured on the basis of the

terms in the specific agreements and historical experience.

Significant accounting estimates

Recognition and measurement of revenue is based on

estimates and judgements relating to the expected sales

returns allowed to customers in most countries. These

judgements can have a material impact on the timing and

measurement of the recognised revenue as well as the

level of the return provision. Reductions in revenue from

expected sales returns is calculated based on historical

return patterns and on a case-by-case basis, if extended

returns are allowed for specific goods for commercial

reasons.

REVENUE

Revenue by product category

1

DKK million

2016

2015

Charms

11,991

10,833

Bracelets

3,672

2,690

Rings

2,643

2,066

Other jewellery

1,975

1,148

Total revenue

20,281

16,737

1

Figures include franchise fees of DKK 155 million (2015: DKK 138 million), which are allocated to the product categories.

SECTION 2: RESULTS FOR THE YEAR, CONTINUED

2.1