NOTES

Consolidated financial statements • 111

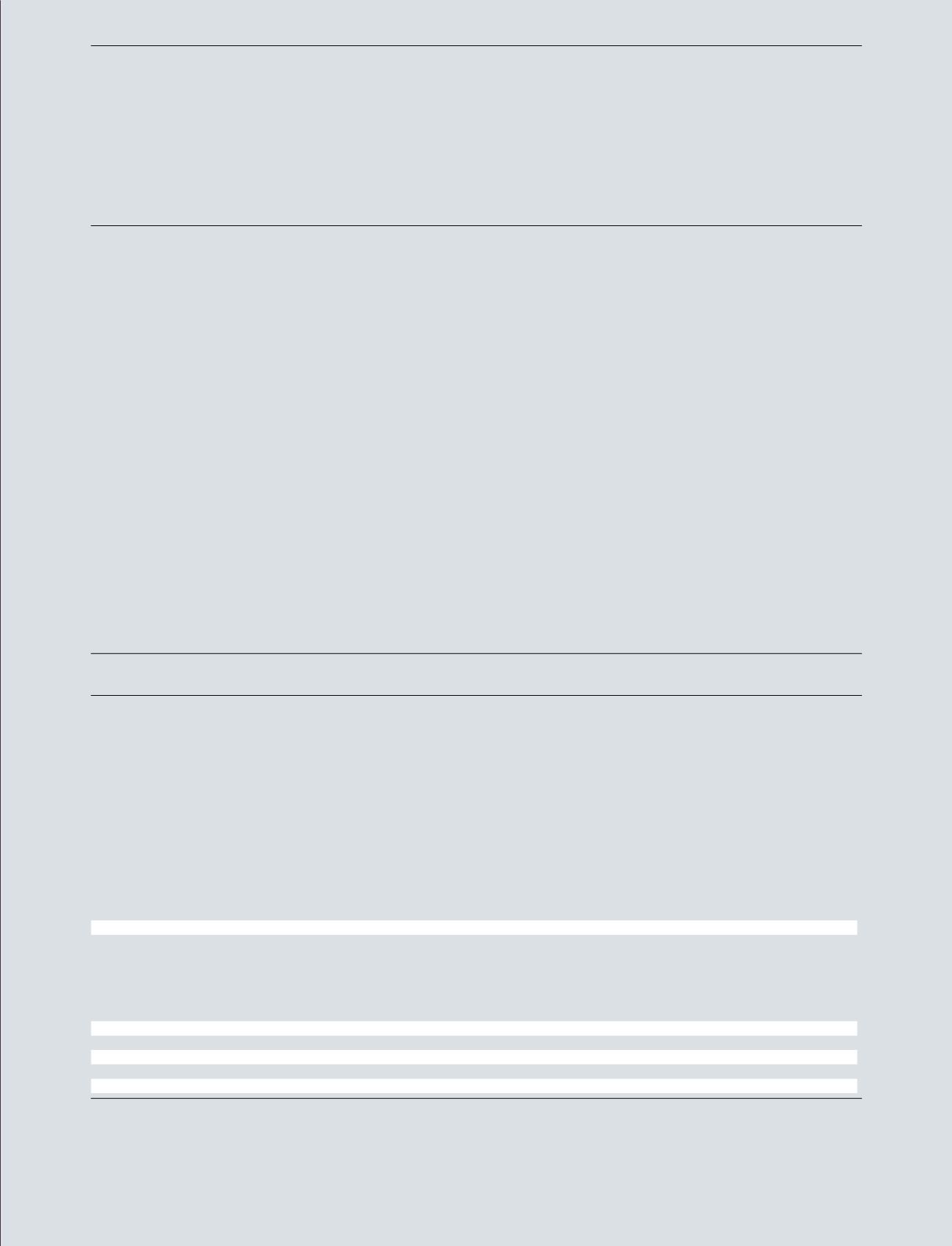

BUSINESS COMBINATIONS

5.1

2016

2015

DKK million

Total

Total

Other intangible assets

-

69

Property, plant and equipment

6

23

Other non-current receivables

9

12

Receivables

4

30

Inventories

61

141

Cash

1

21

Assets acquired

81

296

Non-current liabilities

2

5

Payables

6

40

Other non-current liabilities

-

7

Liabilities assumed

8

52

Total identifiable net assets acquired

73

244

Goodwill arising on acquisitions

115

281

Purchase consideration

188

525

Cash movements on acquisitions:

Prepaid, previous year

1

-7

-

Consideration transferred regarding previous years

2

29

-

Deferred payment (including earn-out)

-

-222

Cash acquired

-1

-21

Net cash flows on acquisitions for the year

209

282

Prepayments, acquisitions

3

1

7

Net cash flows on acquisitions

210

289

Cash flow from sale of businesses

4

-

-29

Net cash flows from business combinations

210

260

1

Prepayments 2015 relate to the acquisitions in Singapore, Macau and the Philippines on 1 January 2016. The amount paid was DKK 7 million.

2

The consideration transferred in 2016 was the final payment for the transfer of assets regarding the acquisition in China in 2015, DKK 29 million.

3

Prepayments 2016 relate to the acquisition of a store in Australia on 4 January 2017. The amount paid was DKK 1 million.

4

Sale of businesses in 2015 includes mainly inventories, DKK 18 million and goodwill, DKK 9 million.

SECTION 5: OTHER DISCLOSURES, CONTINUED

Acquisitions in 2016

On 1 January 2016, PANDORA acquired the PANDORA

store network in Singapore and Macau from Norbreeze

Group (Norbreeze). The distribution agreements with

Norbreeze for distributing PANDORA jewellery in

Singapore, Macau and the Philippines expired on 31

December 2015. Distribution in the Philippines continues

under a new agreement with the existing distributor,

whereas distribution in Singapore and Macau remains with

PANDORA. On 1 January 2016, PANDORA established

a local office in Singapore for the Singapore operation,

whereas Macau and the Philippines are operated out of

PANDORA’s office in Hong Kong.

According to the purchase price allocation, the

purchase price of DKK 167 million was primarily related to

non-current assets and inventories related to the acquired

stores. Goodwill was DKK 102 million mainly related to

the opportunity to enter Singapore and Macau directly and

to add 15 PANDORA concept stores and 5 shop-in-shops

located in these two markets to PANDORA’s retail chain.

In 2016, purchase consideration in the amount of DKK

160 million has been transferred to Norbreeze. DKK 7

million was prepaid in 2015. Transaction costs of DKK 3

million have been recognised in the income statement as

administrative expenses. None of the goodwill recognised is

deductible for income tax purposes.

On 6 July 2016, PANDORA acquired four concept

stores in London, UK, in a business combination. The

purchase amount was DKK 21 million. Assets acquired

mainly consist of inventories and other assets and liabilities

relating to the stores. Of the purchase price DKK 13 million

was allocated to goodwill. Transaction cost was DKK 1

million. None of the goodwill recognised is deductible for

income tax purposes.