NOTES

106 • Consolidated financial statements

PANDORA ANNUAL REPORT 2016

SECTION 4: CAPITAL STRUCTURE AND NET FINANCIALS, CONTINUED

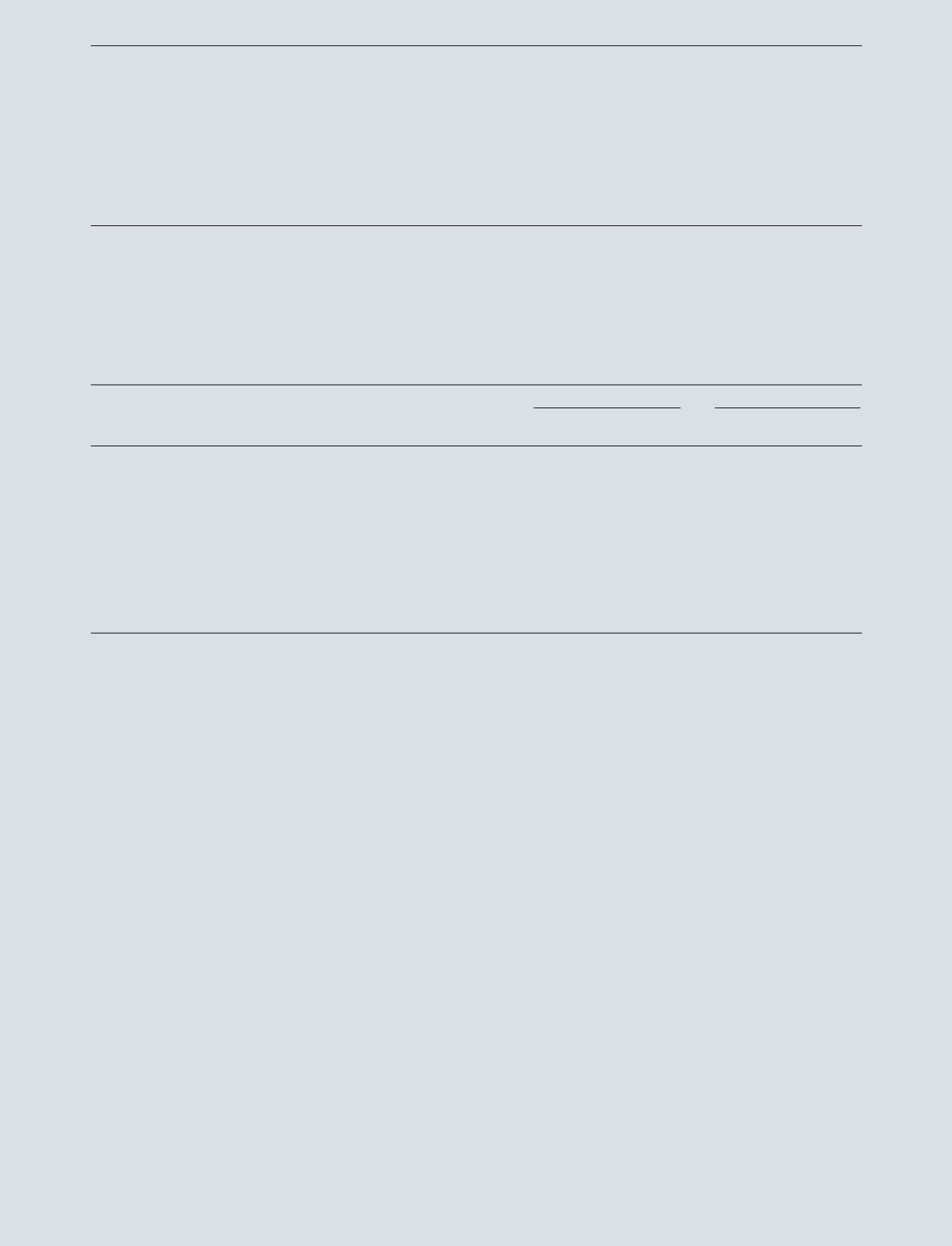

Analysis of assets and liabilities

31 December 2016

31 December 2015

Change in

Profit (loss)

Profit (loss)

DKK million

exchange rate

before tax

Equity

before tax

Equity

USD

-10%

-0

68

38

103

USD

+10%

0

-68

-38

-103

CAD

-10%

-13

33

2

49

CAD

+10%

13

-33

-2

-49

AUD

-10%

18

94

4

64

AUD

+10%

-18

-94

-4

-64

GBP

-10%

53

223

15

150

GBP

+10%

-53

-223

-15 -150

EUR

-1%

0

-3

-9

-10

EUR

+1%

-0

3

9

10

THB

-10%

12

-266

-11

-197

THB

+10%

-12

266

11

197

The movements in the income statement arise from monetary items (cash, borrowings, receivables and payables) where the functional currency of the entity differs

from the currency that the monetary items are denominated in. The movements in equity arise from monetary items and hedging instruments where the functional

currency of the entity differs from the currency that the hedging instruments or monetary items are denominated in.

Below is an illustration of the impact in DKK million on the

net profit and changes in equity resulting from a change in

the Group’s primary foreign currencies after the effect of

hedge accounting.

FINANCIAL RISKS, CONTINUED

4.4

Credit risk

Credit risk is primarily related to trade receivables, cash and

unrealised gains on financial contracts. The maximum credit

risk related to financial assets corresponds to the carrying

amounts recognised in the consolidated balance sheet.

It is PANDORA’s policy for subsidiaries to be responsible

for credit evaluation and credit risk on their trade receivables.

In case of deviation from standard agreements, Group Treasury

and/or the CFO must approve any significant transactions

related to direct distributors and local key customers.

Note 3.4 includes an overview of the credit risk related to

trade receivables. Rating of trade receivables is not materially

different either by type of customer or geographic placement.

The risk of further impairment is considered limited.

Credit risks related to PANDORA’s other financial

assets mainly include cash and unrealised gains on

financial contracts. The credit risk is related to default of the

counterparty with a maximum exposure corresponding to

the carrying amount of the assets. It is PANDORA’s policy for

Group Treasury to monitor and manage these credit risks.

Liquidity risk

Liquidity risk is the risk that PANDORA will have insufficient

funds to meet its liabilities when due.

The aim of liquidity management is to maintain optimal

cash resources to fund PANDORA’s commitments at

all times, to minimise interest and bank costs and to

avoid financial distress. Group Treasury is responsible

for monitoring and managing PANDORA’s total liquidity

position. PANDORA currently does use cash pools, and

in addition intercompany loans exist between PANDORA

A/S and its subsidiaries. Whenever possible, liquidity is

accumulated in PANDORA A/S.

PANDORA’s cash resources comprise cash and

unutilised committed and uncommitted credit facilities. It is

Management’s opinion that the cash resources of the Group

and the Parent Company are adequate. It is PANDORA’s

policy to ensure adequate cash resources in case of

unforeseen cash fluctuations.

PANDORA has committed revolving credit facilities of

7,500 million. DKK 1,000 million are committed until June

2019 and DKK 6,500 million are committed until June 2021.

Furthermore, PANDORA has minor local uncommitted

credit facilities to ensure efficient and flexible local liquidity

management. These credits are facilitated by Group Treasury.