NOTES

Consolidated financial statements • 101

SECTION 3: INVESTED CAPITAL AND WORKING CAPITAL ITEMS, CONTINUED

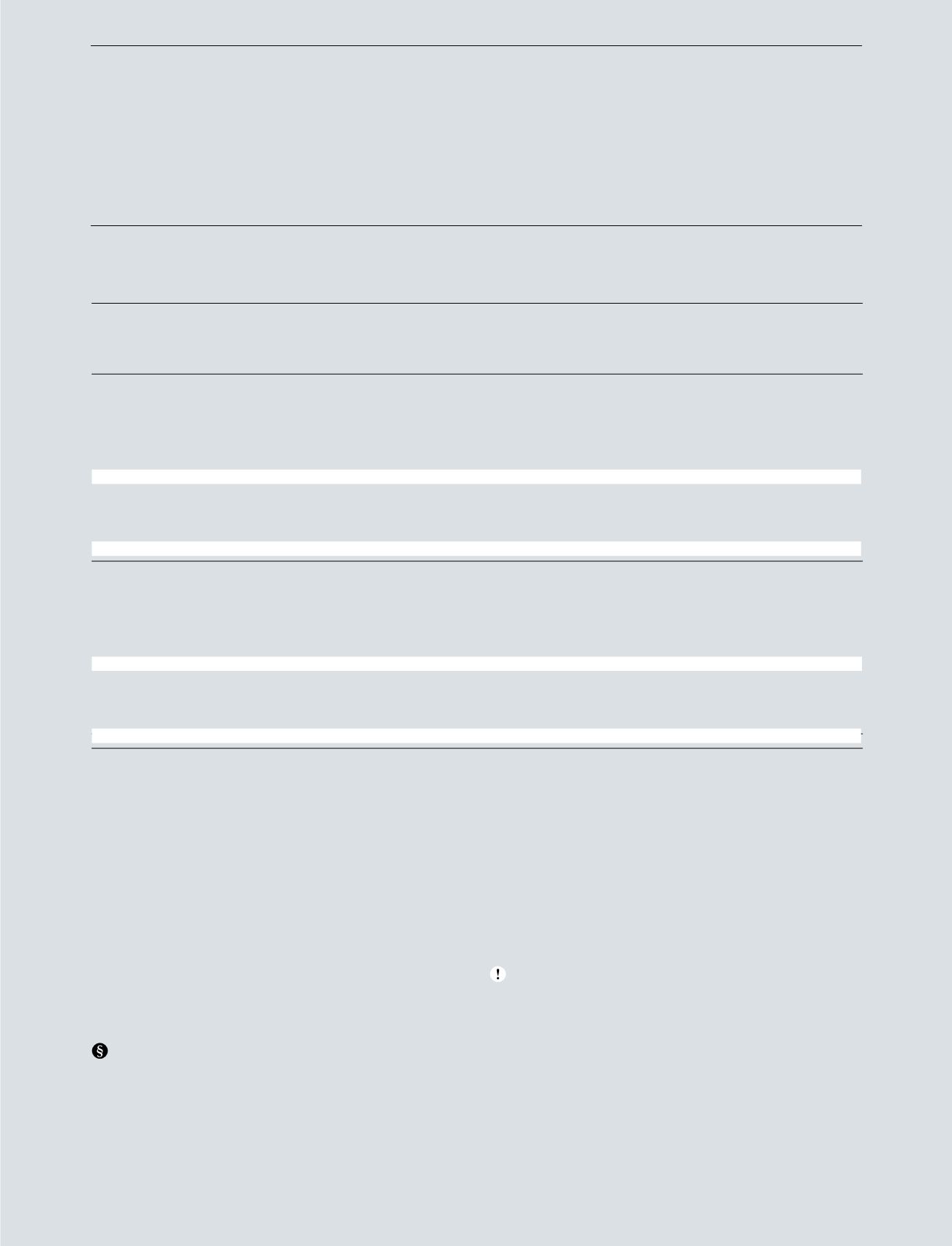

PROVISIONS

Sales

return and

warranty

Other

DKK million

provisions

provisions

Total

2016

Provisions at 1 January

902

166

1,068

Made in the year

813

96

909

Utilised in the year

-749

-33

-782

Unused provisions reversed

-60

-38

-98

Exchange rate adjustments

5

3

8

Provisions at 31 December

911

194

1,105

Provisions are recognised in the consolidated balance sheet as follows:

Current

911

93

1,004

Non-current

-

101

101

Total provisions at 31 December

911

194

1,105

2015

Provisions at 1 January

670

69

739

Made in the year

936

108

1,044

Utilised in the year

-702

-6

-708

Unused provisions reversed

-48

-10

-58

Exchange rate adjustments

46

5

51

Provisions at 31 December

902

166

1,068

Provisions are recognised in the consolidated balance sheet as follows:

Current

902

69

971

Non-current

-

97

97

Total provisions at 31 December

902

166

1,068

3.5

Sales return and warranty provisions

Provision for warranty claims is presented together with sales

returns. This is due to the handling of warranty claims, which

lead to replacements instead of repairs.

PANDORA provides sales return and warranty rights

to customers in most countries. Sales return and warranty

provisions mainly relate to the Americas, DKK 576 million

(2015: DKK 583 million).

Other provisions

Other provisions include provisions for defined pension

plans, obligations to restore leased property as well as other

legal and constructive obligations.

Accounting policies

Provisions are recognised when PANDORA has a present

obligation (legal or constructive) as a result of a past event

and it is probable that an outflow of resources embodying

economic benefits will be required to settle the obligation

and a reliable estimate can be made of the amount of the

obligation. The expense relating to any provision is recognised

in the income statement net of any reimbursement.

A provision for estimated sales returns is recognised when

there is historical experience or when a reasonably accurate

estimate of expected future returns can otherwise be made.

The provision is recognised at the gross margin of the expected

returns. The part of estimated sales returns that is not expected

to be sold is written down to remelt value.

Significant accounting estimates

In most countries, PANDORA has provided return rights

to customers. The provision is to a large extent based on

historical return patterns, and changes in actual return

patterns will therefore impact gross profit at the time of

the return. Provisions are made on a case-by-case basis

when PANDORA expects to take back specific goods for

commercial reasons.