NOTES

104 • Consolidated financial statements

PANDORA ANNUAL REPORT 2016

SECTION 4: CAPITAL STRUCTURE AND NET FINANCIALS, CONTINUED

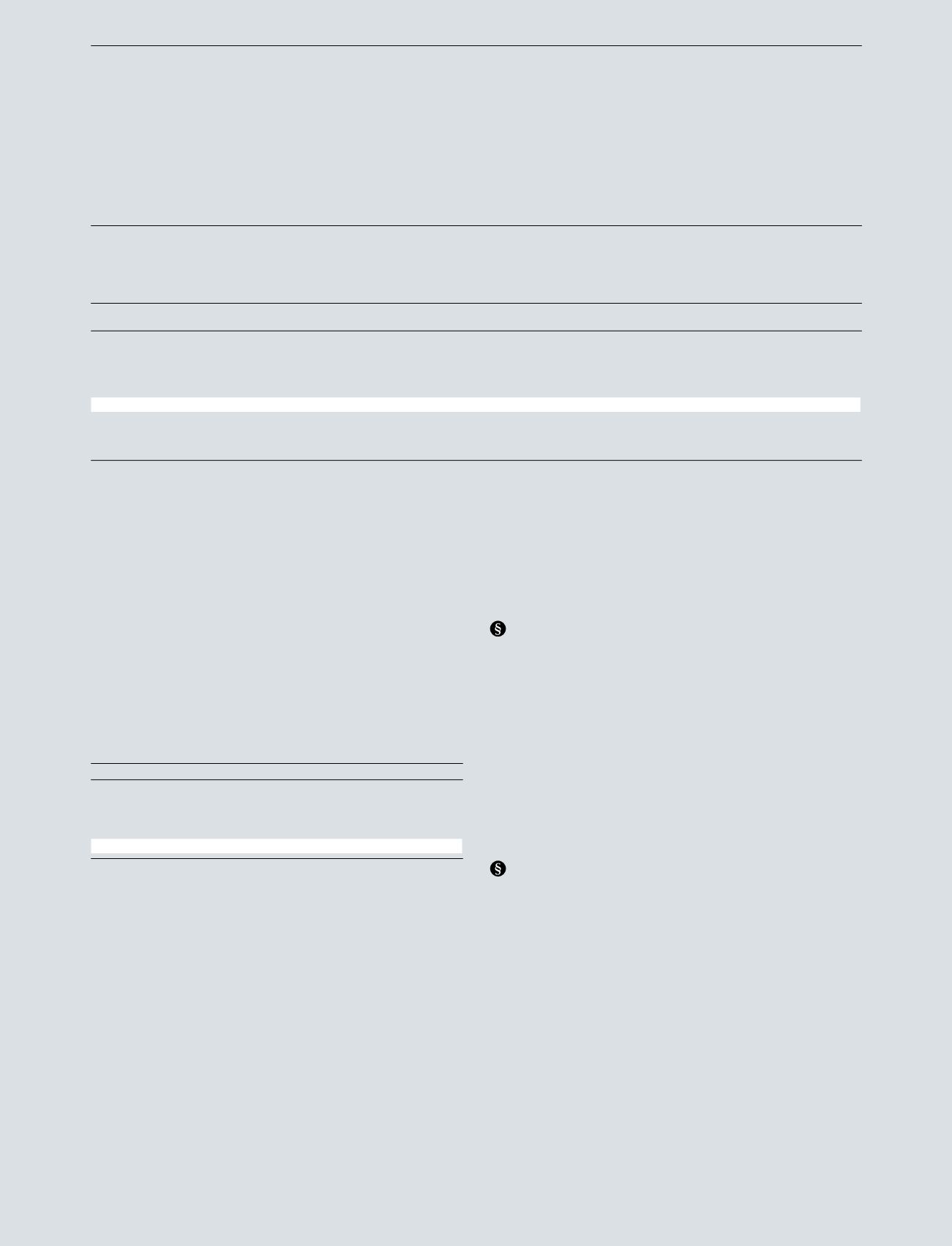

4.2 EARNINGS PER SHARE AND DIVIDEND

2016

2015

Profit attributable to equity holders, DKK million

6,025

3,674

Weighted average number of ordinary shares

114,162,672 118,981,186

Effect of share options

581,252

823,567

Weighted average number of ordinary shares adjusted for the effect of dilution

114,743,924 119,804,753

Basic earnings per share, DKK

52.8

30.9

Diluted earnings per share, DKK

52.5

30.7

There have been no transactions between the reporting date and the date of completion of the Annual Report involving shares that would have significantly

changed the number of shares or potential shares in PANDORA A/S.

Dividend

At the end of 2016, proposed dividend (not yet declared)

was DKK 9.00 per share (2015: DKK 13.00 per share),

corresponding to DKK 1,007 million. Declared dividend of

DKK 13.00 per share, corresponding to DKK 1,511 million

in 2015, was paid to the shareholders in 2016. No dividend

was paid on treasury shares.

Dividend paid has had no effect on the Group’s tax

expense for the year.

Distributable reserves

When calculating the amount available for distribution of

dividend, treasury shares are deducted from distributable

reserves.

Accounting policies

Dividend proposed is recognised as a liability at the date

of the adoption at the Annual General Meeting (declaration

date). Extraordinary dividend is recognised as a liability at the

declaration date.

4.3 NET INTEREST-BEARING DEBT

DKK million

2016

2015

Loans and borrowings, non-current

3,008

2,350

Other liabilities, non-current¹

334

203

Loans and borrowings, current

3

257

Cash

-897

-889

Net interest-bearing debt

2,448

1,921

1

Put options to acquire non-controlling interests have been reclassified to be

included in net interest-bearing debt (NIBD). Consequently NIBD and NIBD

to EBITDA have been recalculated for 2015.

Capital management

The principal objectives of PANDORA’s capital management

are to ensure shareholders a competitive return on their

investment and to ensure that PANDORA will be able to meet

all the commitments set out in the loan agreements with the

banks. The basis of PANDORA’s capital management is the

NIBD to EBITDA ratio. It is the policy of the Group that this

ratio should be between 0 and 1 on a 12-month rolling basis.

At 31 December 2016, the NIBD to EBITDA ratio was 0.3

(2015: 0.3).

In June and November 2016, PANDORA added an

additional DKK 2,500 million in committed credit facilities.

Total committed credit facilities amount to DKK 7,500

million (2015: DKK 5,000 million). DKK 1,000 million

are committed until June 2019 and DKK 6,500 million are

committed until June 2021.

Accounting policies

Subsequent to initial recognition, interest-bearing loans and

borrowings are measured at amortised cost using the effective

interest rate method. Gains and losses are recognised in the

income statement when the liabilities are derecognised as

well as through the effective interest rate method. Amortised

cost is calculated by taking into account any discount or

premium at inception, and fees and other costs.

PANDORA has entered into put options with non-

controlling interests of certain Group entities. The put

option gives the non-controlling shareholder the right to sell

its non-controlling interest to PANDORA at a predefined

exercise price, which is based on the revenue realised.

Financial liabilities relating to the acquisition of non-

controlling interests is measured at fair value as if the put

options have been exercised already. The value is determined