102 • Consolidated financial statements

PANDORA ANNUAL REPORT 2016

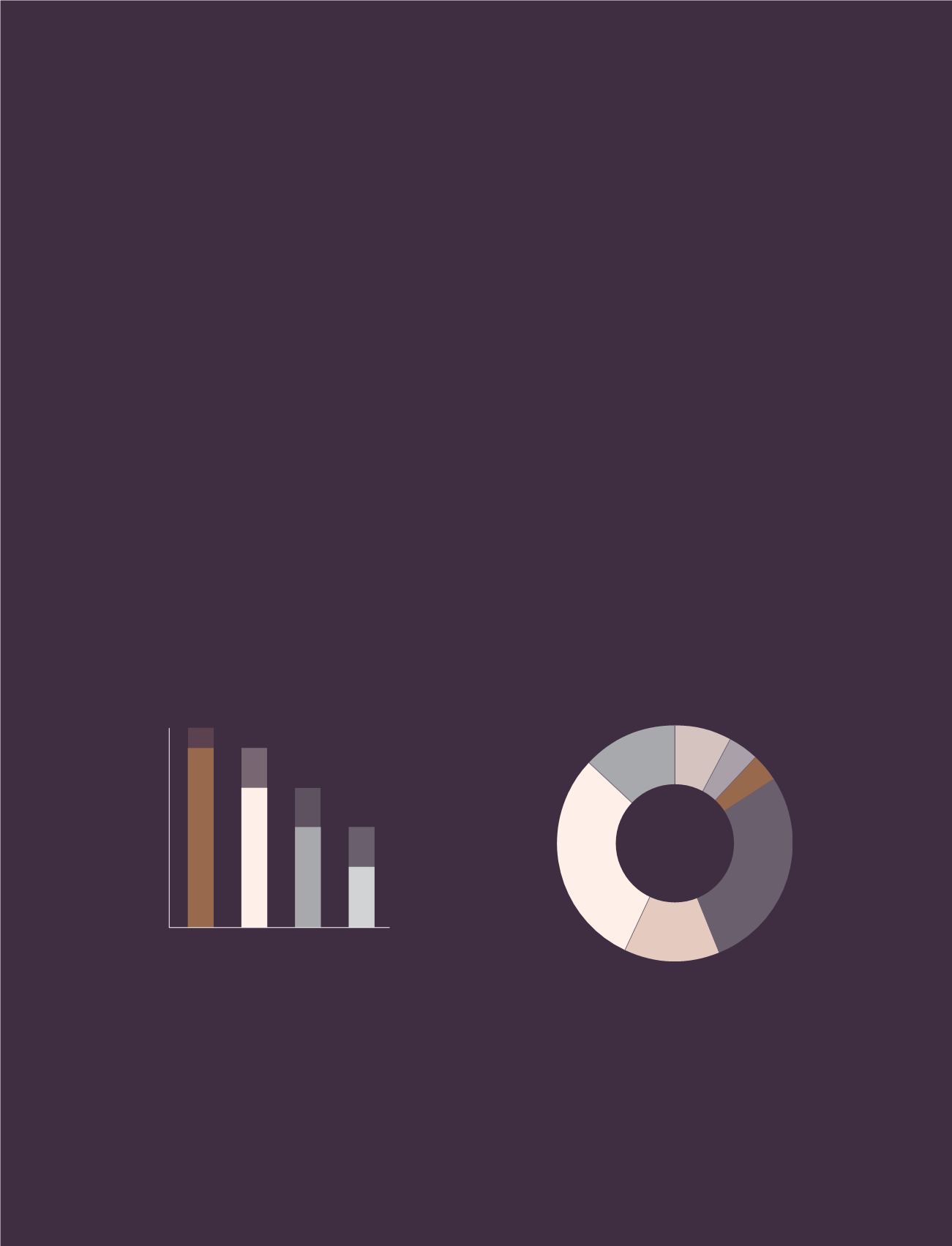

13%

GBP

30%

USD

13%

Other

28%

EUR

4%

CNY

4%

CAD

8%

AUD

1-3 months ahead

4-6 months ahead

7-9 months ahead

10-12 months ahead

100

90

80

70

60

50

40

30

20

10

0

%

90-100%

MIN

.

MAX

.

MIN

.

MAX

.

MIN

.

MAX

.

MIN

.

MAX

.

70-90%

50-70%

30-50%

SECTION 4

CAPITAL STRUCTURE

AND NET FINANCIALS

CASH CONVERSION

TOTAL PAYOUT RATIO

SHARE BUYBACK

4,000

DKK million

72.4%

91.5%

This section includes notes related to PANDORA’s

capital structure and net financials, including financial

risks (see note 4.4). As a consequence of its operations,

investments and financing, PANDORA is exposed to a

number of financial risks that are monitored and man-

aged via PANDORA’s Group Treasury. PANDORA uses

a number of derivative financial instruments to hedge

its exposure to fluctuations in commodity prices and

similar. Derivative financial instruments are described in

note 4.5.

The basis of PANDORA’s capital management is the

NIBD to EBITDA ratio, which Management seeks to

maintain between 0 and 1. At 31 December 2016, the

ratio was 0.3 compared with 0.3 at 31 December 2015.

PANDORA’s ability to keep this low ratio is based on the

high cash conversion. The cash conversion was 72.4% in

2016 compared with 42.1% in 2015.

COMMODITY HEDGE RATIO

REVENUE BREAKDOWN BY CURRENCY