NOTES

Consolidated financial statements • 99

SECTION 3: INVESTED CAPITAL AND WORKING CAPITAL ITEMS, CONTINUED

3.3 INVENTORIES

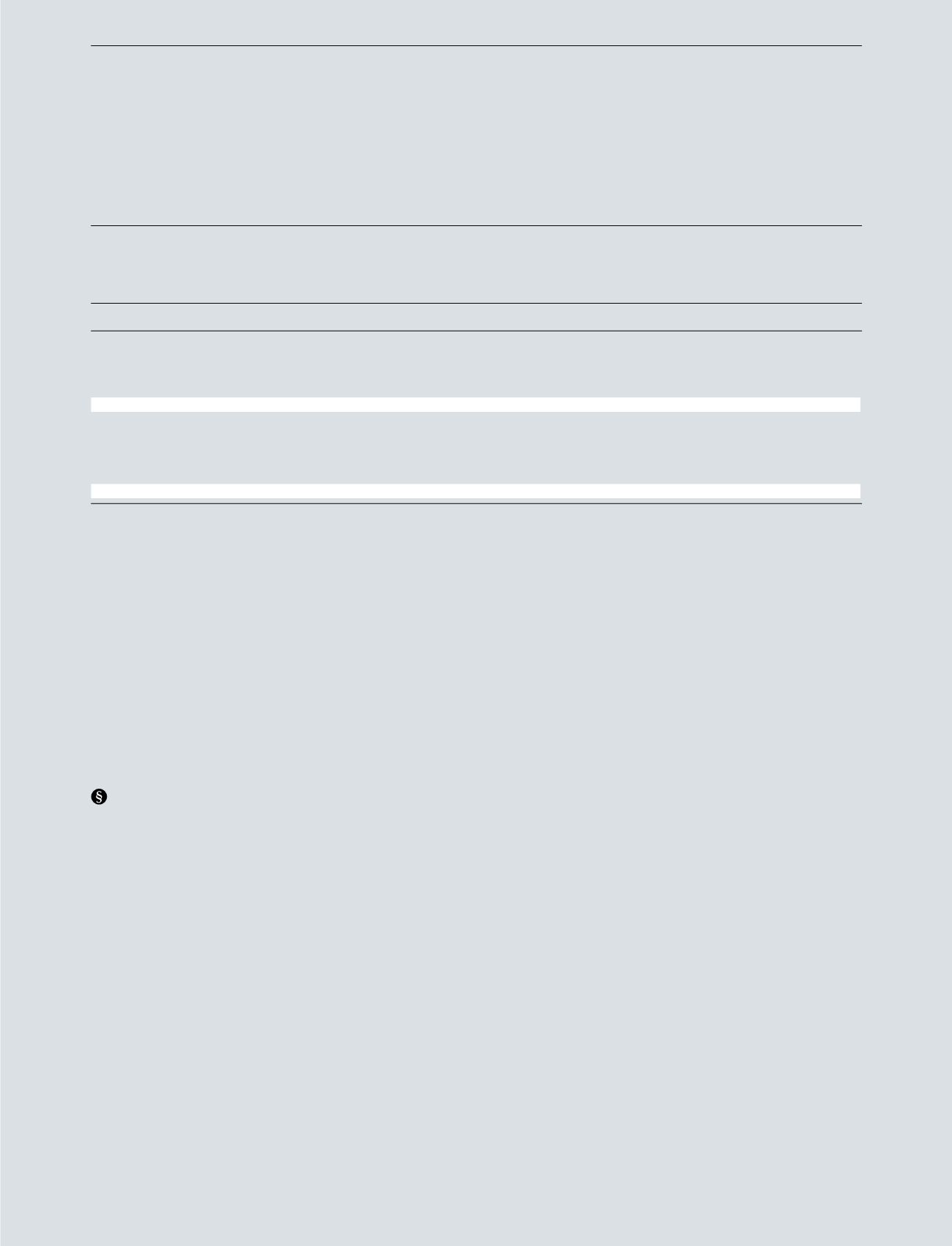

DKK million

2016

2015

Raw materials and consumables

392

469

Work in progress

168

104

Finished goods

1,950

1,582

Point-of-sale materials

219

202

Total inventories at 31 December

2,729

2,357

Inventory write-downs at 1 January

269

246

Write-downs during the year

289

230

Utilised in the year

-235

-185

Reversal of write-downs in the year

-

-22

Inventory write-downs at 31 December

323

269

Write-downs

Write-downs of inventories are recognised in cost of

sales, DKK 179 million (2015: DKK 135 million), and

distribution expenses DKK 110 million (2015: DKK 73

million). Included in the write-downs are remelt costs. This

is PANDORA’s option to re-melt certain products in order

to reduce some of the costs of disposing of either defective

products or products that are not expected to be sold. The

impact from remelt is mainly influenced by the market

price of silver and gold. Remelting of goods (realised and

unrealised) had a negative impact on gross profit of DKK

138 million (2015: DKK 104 million).

Accounting policies

Inventories are valued at the lower of cost and net realisable

value. Costs are accounted for on a first-in, first-out basis

(FIFO). Besides costs for purchases, costs also include

labour and a proportion of production overheads based on

normal operating capacity, but excluding borrowing costs.

Point-of-sale materials comprise purchase costs regarding

equipment, displays and packaging materials etc. and are

also accounted for on a FIFO basis.

Net realisable value

Net realisable value is based on the estimated selling

price less estimated costs of completion and distribution.

Alternatively, if the inventories are not expected to be

sold, net realisable value is based on remelt value of the

reusable raw materials (primarily silver and gold) measured

at the market prices for silver and gold at the reporting

date.

Capitalised production overheads

Capitalised production overheads are calculated using

a standard cost method, which is reviewed regularly

to ensure relevant assumptions concerning capacity

utilisation, lead times and other relevant factors.