NOTES

Consolidated financial statements • 97

SECTION 3: INVESTED CAPITAL AND WORKING CAPITAL ITEMS, CONTINUED

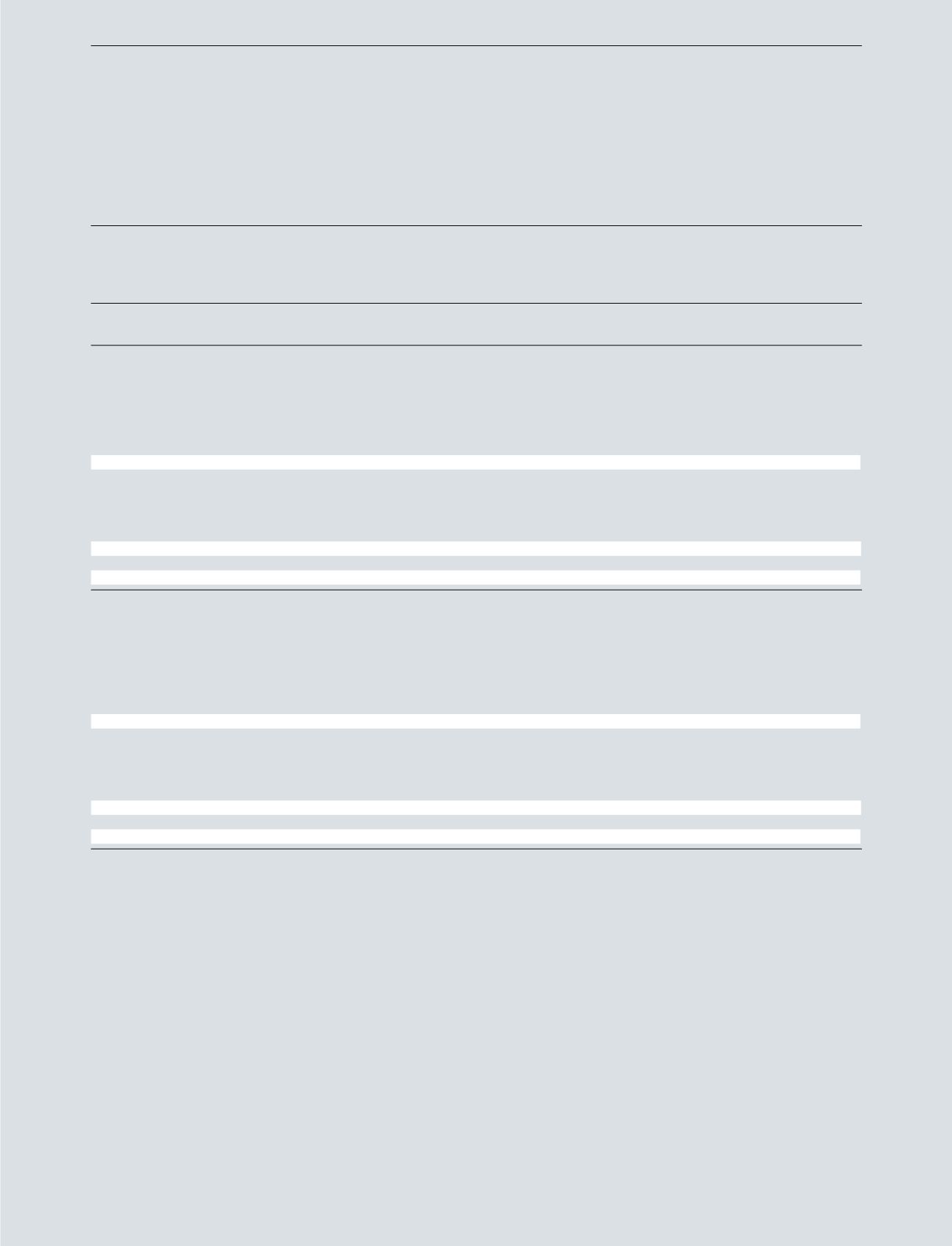

PROPERTY, PLANT AND EQUIPMENT

Land and

Plant and

Assets under

DKK million

buildings

equipment

construction

Total

2016

Cost at 1 January

420

1,266

124

1,810

Acquisition of subsidiaries and activities

-

6

-

6

Additions

32

267

529

828

Disposals

-46

-120

-

-166

Transfers

304

298

-602

-

Exchange rate adjustments

22

30

8

60

Cost at 31 December

732

1,747

59

2,538

Depreciation and impairment losses at 1 January

96

477

-

573

Depreciation for the year

19

295

-

314

Disposals

-34

-94

-

-128

Exchange rate adjustments

3

9

-

12

Depreciation and impairment losses at 31 December

84

687

-

771

Carrying amount at 31 December

648

1,060

59

1,767

2015

Cost at 1 January

342

686

78

1,106

Acquisition of subsidiaries and activities

-

23

-

23

Additions

69

353

284

706

Disposals

-5

-36

-3

-44

Transfers

9

233

-242

-

Exchange rate adjustments

5

7

7

19

Cost at 31 December

420

1,266

124

1,810

Depreciation and impairment losses at 1 January

81

314

-

395

Depreciation for the year

16

185

-

201

Disposals

-2

-28

-

-30

Exchange rate adjustments

1

6

-

7

Depreciation and impairment losses at 31 December

96

477

-

573

Carrying amount at 31 December

324

789

124

1,237

PANDORA has pledged assets relating to land and buildings in the amount of DKK 155 million (2015: DKK 147 million) as collateral for tax surcharges in Thai-

land. It is expected that the pledge will be revoked in 2017.

3.2