NOTES

100 • Consolidated financial statements

PANDORA ANNUAL REPORT 2016

SECTION 3: INVESTED CAPITAL AND WORKING CAPITAL ITEMS, CONTINUED

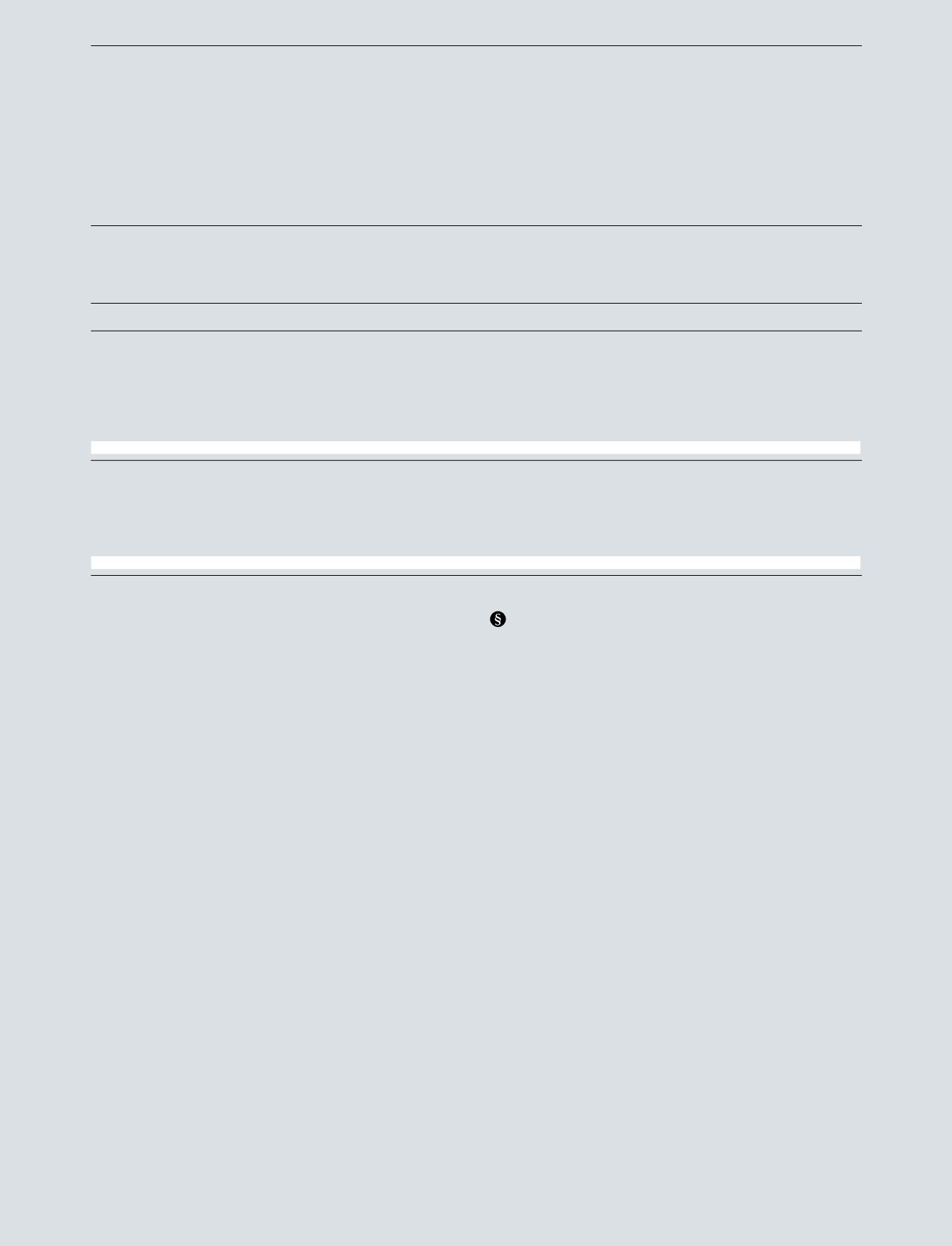

TRADE RECEIVABLES

DKK million

2016

2015

Analysis of trade receivables at 31 December

Not past due

1,394

1,033

Up to 30 days

211

193

Between 30 and 60 days

41

85

Between 60 and 90 days

19

47

Over 90 days

8

2

Total past due, not impaired

279

327

Total trade receivables at 31 December

1,673

1,360

Analysis of movements in bad debt write-downs

Write-downs at 1 January

24

23

Additions

50

10

Utilised

-3

-5

Unused amounts reversed

-22

-5

Exchange rate adjustments

-1

1

Write-downs at 31 December

48

24

3.4

PANDORAs customers comprise distributors, franchisees

and consumers. While consumers pay cash, management

monitors payment patterns of the other groups of customers

and estimate the need for a write-down. Credit ratings of

customers and market specific development are taken into

account in order to assess the need for further impairment.

Historically PANDORA has not suffered any significant

losses.

Accounting policies

Trade receivables are initially recognised at fair value and

subsequently at amortised cost using the effective interest

rate method, less impairment. Any losses arising from write-

down are recognised in the income statement as sales costs.

A write-down for bad or doubtful debts is made if

there is any indication of impairment of a receivable or a

portfolio of receivables. The write-down is calculated as the

difference between the carrying amount and the present

value of estimated future cash flows associated with the

receivable. The discount rate used is the effective interest

rate for the individual receivable or portfolio of receivables

at the time of recognition.