NOTES

Consolidated financial statements • 95

SECTION 3: INVESTED CAPITAL AND WORKING CAPITAL ITEMS, CONTINUED

3.1 INTANGIBLE ASSETS, CONTINUED

Other intangible assets

Software is measured at cost and amortised over 3-5 years. Key

money is measured at cost and amortised over the term of the

contract. Contracts that are considered to have an indefinite

term are not amortised, but are tested for impairment.

Impairment

At each reporting date, PANDORA assesses whether there

is any indication that an asset may be impaired. If any such

indication exists, or when annual impairment testing of

an asset is required, PANDORA estimates the recoverable

amount of the asset.

The most significant factors when assessing the potential

need for write-downs are:

• decreasing revenue

• decreasing brand value

• changes to the product mix.

The indicators above should be viewed in the context of

PANDORA’s relatively high margins and low asset base.

The recoverable amount of an asset is the higher of the

fair value of the asset or cash-generating unit (CGU) less

costs to sell and its value in use. The recoverable amount

is determined for the smallest group of assets that are

independent from other assets or groups of assets. Where the

carrying amount of an asset or CGU exceeds its recoverable

amount, the asset is written down to its recoverable amount.

In assessing the value in use, the estimated future cash

flows are discounted to their present value using a pre-tax

discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset.

In determining fair value less costs to sell, an appropriate

valuation model is used.

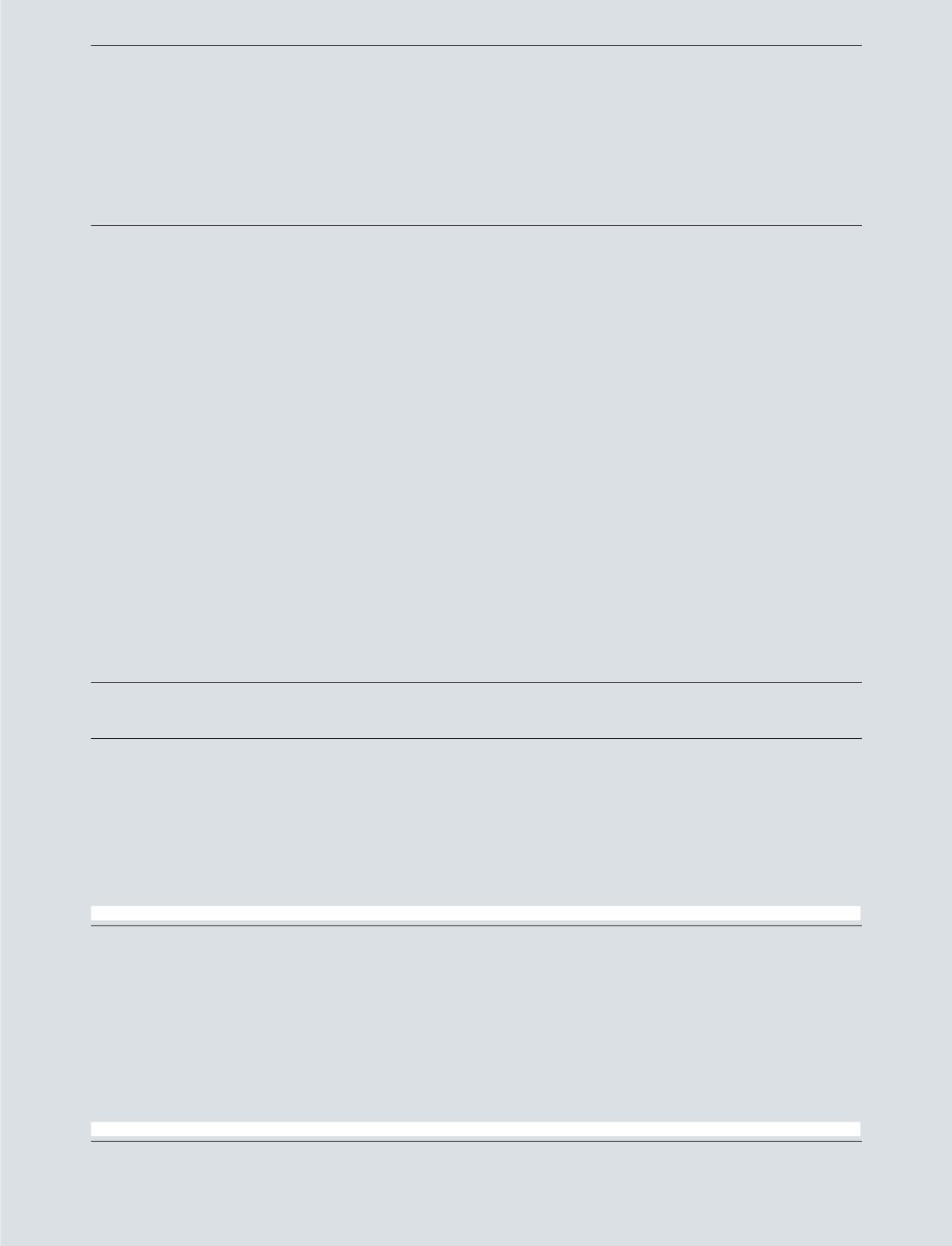

Allocation of intangible assets to CGUs

Other

Distribution

Distribution

intangible

DKK million

Goodwill

Brand

network

rights

assets

Total

2016

US and Caribbean

651

-

-

1,034

44

1,729

Other Americas

41

-

-

-

29

70

Americas

692

-

-

1,034

73

1,799

Northern Europe

930

-

-

13

119

1,062

Other EMEA

176

-

-

-

116

292

EMEA

1,106

-

-

13

235

1,354

Asia

225

-

-

14

6

245

Pacific

497

-

-

-

3

500

Asia Pacific

722

-

-

14

9

745

Group

51

1,057

184

-

576

1,868

Total

2,571

1,057

184

1,061

893

5,766

2015

North America

652

-

-

1,034

41

1,727

South America

22

-

-

-

17

39

Americas

674

-

-

1,034

58

1,766

Western Europe

117

-

-

-

59

176

Central Western Europe

712

-

1

13

161

887

Central Eastern Europe

57

-

-

-

8

65

Distributors & Travel retail

218

-

-

-

3

221

EMEA

1,104

-

1

13

231

1,349

Asia

117

-

-

22

3

142

Pacific

490

-

-

-

3

493

Asia Pacific

607

-

-

22

6

635

Group

39

1,057

215

-

388

1,699

Total

2,424

1,057

216

1,069

683

5,449