NOTES

90 • Consolidated financial statements

PANDORA ANNUAL REPORT 2016

SECTION 2: RESULTS FOR THE YEAR, CONTINUED

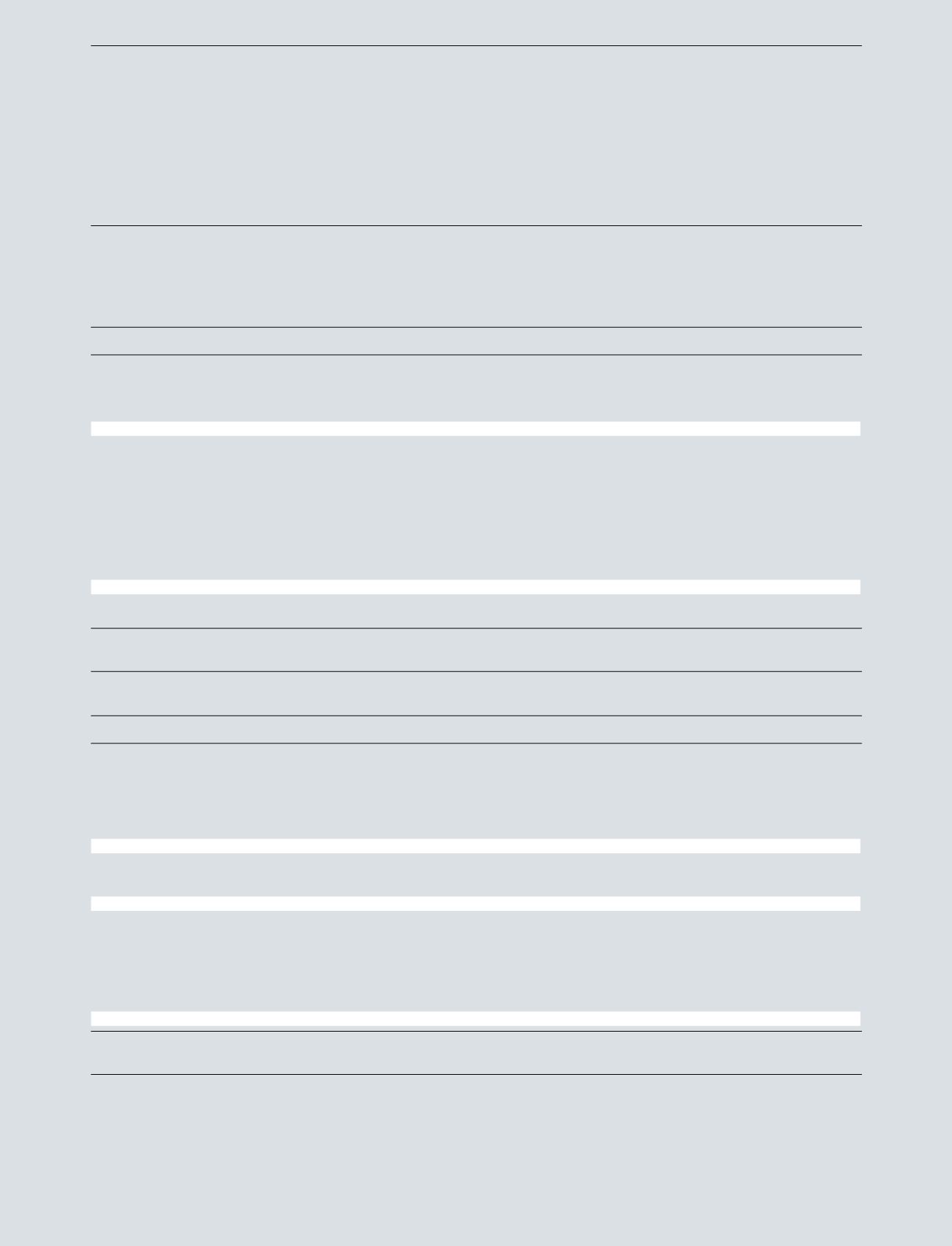

2.5 TAXATION

Income tax expense

DKK million

2016

2015

Current income tax charge

1,692

1,305

Adjustment concerning previous years

1

17

486

Impact of change in tax rates

3

-5

Change in deferred tax

-87

-115

Total income tax expense

1,625

1,671

Tax reconciliation

Profit before tax

7,650

5,345

Corporate tax rate in Denmark, 22% (2015: 23.5%)

1,683

1,256

Tax effect of:

Deviations in foreign subsidiaries’ tax rates compared with tax rate applicable for the Parent Company

77

34

Impact of change in tax rates

3

-5

Non-taxable income and non-deductible expenses

-133

-80

Adjustment concerning previous years

17

486

Adjustments of deferred tax assets, net

-22

-20

Total income tax expense

1,625

1,671

Effective income tax rate

21.2%

31.3%

Tax from other comprehensive income

10

-22

Deferred tax

DKK million

2016

2015

Deferred tax at 1 January

485

-23

Exchange rate adjustments

5

11

Change in deferred tax - recognised in income statement

105

411

Change in deferred tax - recognised in statement of other comprehensive income, hedging instruments

-10

22

Change in deferred tax - recognised in statement of changes in equity, share-based payments

-29

59

Impact of change in tax rates

-3

5

Deferred tax at 31 December

553

485

Deferred tax assets

946

879

Deferred tax liabilities

-393

-394

Deferred tax, net

553

485

Specification of deferred tax

Intangible assets

-627

-615

Property, plant and equipment

-25

31

Current assets

792

570

Non-current assets and liabilities

395

491

Tax loss carry-forwards

18

8

Deferred tax, net

553

485

Unrecognised share of tax loss carry-forwards

72

53

Latent tax liability on undistributed dividends

2

254

244

1

The adjustment concerning previous years in 2015, DKK 486 million comprised DKK 364 million related to the settlement with the Danish tax authorities.

2

The latent tax liability on undistributed dividend relates to a 10% withholding tax on dividend, which will be payable if retained earnings earned before

1 September 2012 are distributed as dividend from PANDORA Production Co. Ltd. to PANDORA A/S. At present, Management does not intend to distribute

this dividend.