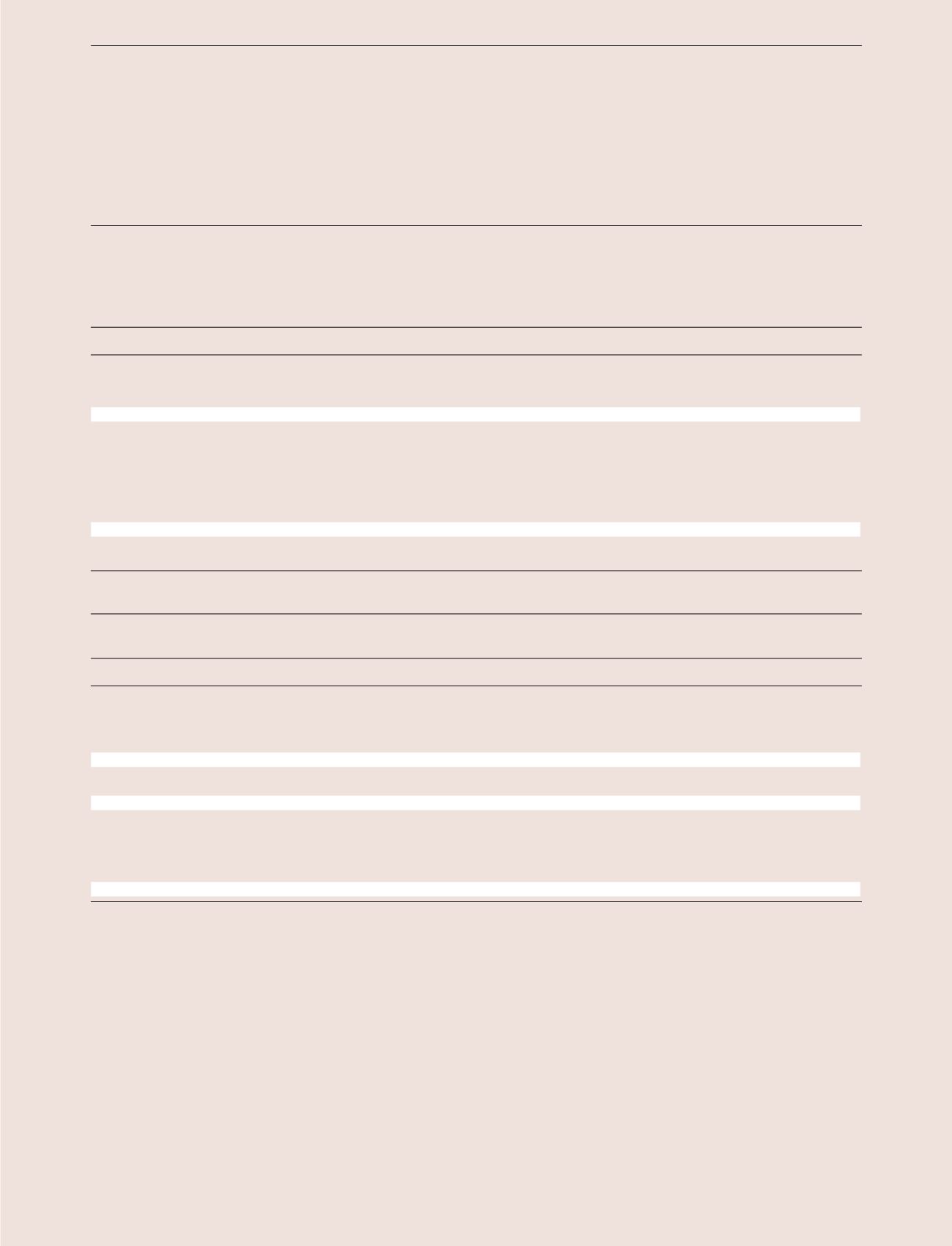

PARENT COMPANY FINANCIAL STATEMENTS • 127

NOTES FOR THE

PARENT COMPANY

TAXATION

2.3

Income tax expense

DKK million

2016

2015

Current income tax charge

1,127

937

Adjustment concerning previous years

-4

569

Change in deferred tax

-15

-33

Total income tax expense

1,108

1,473

Tax reconciliation:

Profit before tax

5,950

5,161

Corporate tax rate in Denmark, 22% (2015: 23.5%)

1,309

1,213

Tax effect of:

Non-taxable income and non-deductible expenses

-197

-309

Adjustment concerning previous years

-4

569

Total income tax expense

1,108

1,473

Effective income tax rate

18.6%

28.5%

Tax from other comprehensive income

15

4

Deferred tax

DKK million

2016

2015

Deferred tax at 1 January

-283

-361

Change in deferred tax - recognised in income statement

17

23

Change in deferred tax - recognised in statement of other comprehensive income, hedging instruments

-15

-4

Change in deferred tax - recognised in statement of changes in equity, share-based payments

-29

59

Deferred tax at 31 December

-310

-283

Deferred tax liabilities

-310

-283

Deferred tax, net

-310

-283

Specification of deferred tax

Intangible assets

-595

-561

Property, plant and equipment

10

32

Other assets and liabilities

275

246

Deferred tax, net

-310

-283

Refer to note 2.5 to the consolidated financial statements for further information.