PANDORA ANNUAL REPORT 2016

58 • SHAREHOLDER INFORMATION

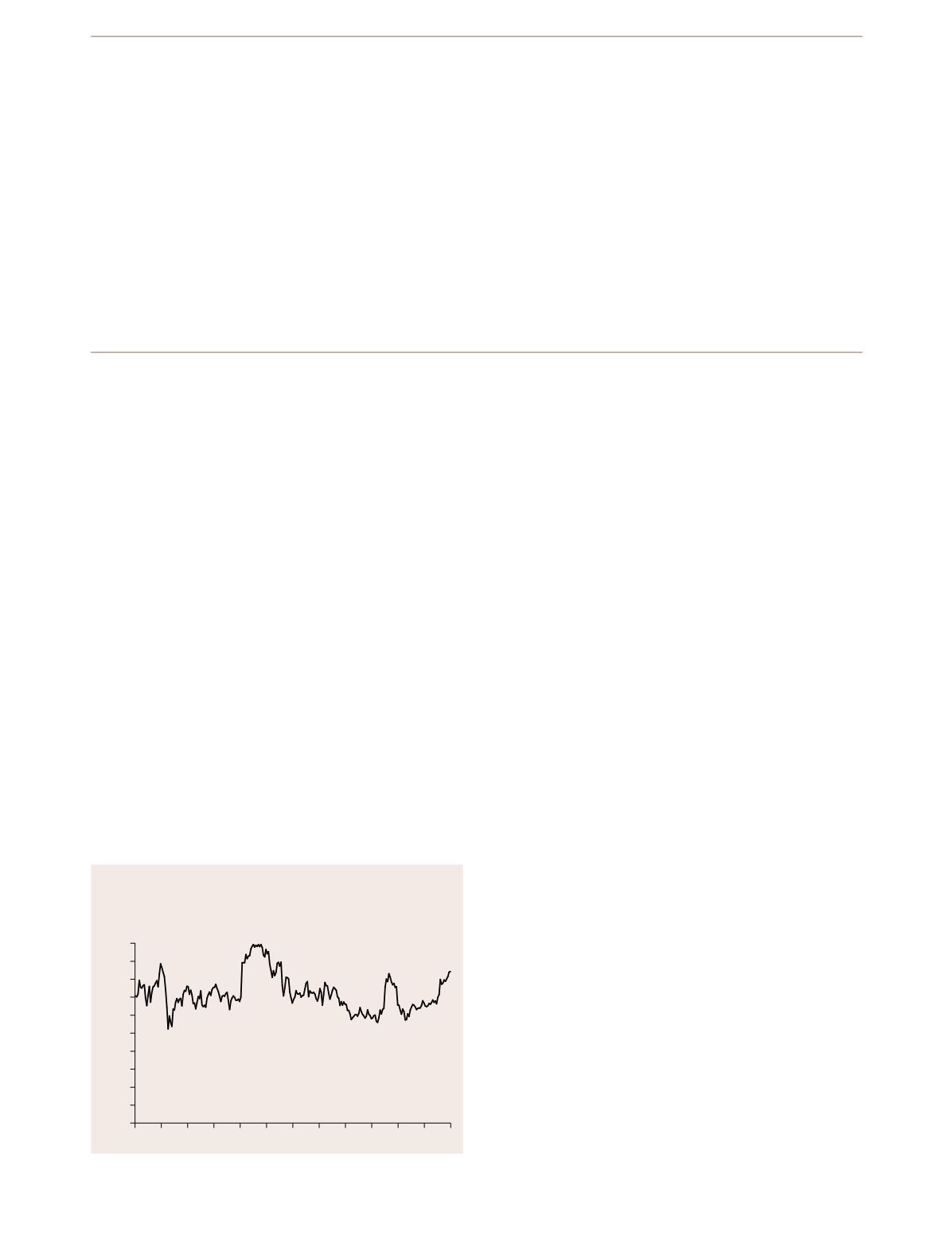

SHARE PRICE DEVELOPMENT 2016

Feb

Jan

Mar Apr May Jun Jul Aug Sep Oct Nov Dec

500

600

700

800

900

1,000

DKK

PANDORA shares have been listed on the Nasdaq OMX

Copenhagen stock exchange since 5 October 2010.

PANDORA is included in the blue chip index OMX C20.

In 2016, the lowest closing price was DKK 764 on 9

February 2016 and the highest closing price was DKK 999.5

on 24 May 2016. At the end of 2016, the share price was

DKK 924, corresponding to an increase of 6% compared

with the end of 2015. By comparison, OMX C20 decreased

13% during the year, while OMX C20 CAP decreased 2%.

Around 125 million PANDORA shares were traded in

2016 with an average trading volume of around 497,000

shares per day.

CAPITAL STRUCTURE AND CASH ALLOCATION

PANDORA’s capital structure is aimed at providing sufficient

financial flexibility to pursue the Company’s strategic goals,

while maintaining a stable financial structure based on a

conservative balance sheet.

Consequently, PANDORA targets a net interest-bearing debt

to EBITDA ratio of 0-1. PANDORA will aim to keep the interest-

bearing debt level at the lower end of the target interval, while

the range allows for financial flexibility throughout the year.

PANDORA’s financial gearing ratio may temporarily exceed the

targeted range in case of larger acquisitions.

Net interest-bearing debt to EBITDA was 0.3x as of 31

December 2016.

PANDORA’s guiding principles for the use of free cash

flow are as follows:

1. Repayment of interest-bearing debt if financial gearing is

outside the Company’s capital structure policy

2. Funding of organic growth opportunities or other value-

creating opportunities, including forward integration

3. Distribution to the Company’s shareholders through

dividend and share buyback programmes aimed at

reducing the Company’s share capital

PANDORA aspires to increase the nominal dividend per

share annually, while returning any additional excess cash

via share buyback programmes.

DIVIDEND

For the financial year 2015, PANDORA paid out ordinary

dividend of DKK 13 per share, corresponding to DKK

1.5 billion in total. From 2017, PANDORA proposes to

supplement the ordinary dividend with three extraordinary

quarterly dividends.

Following a strong financial performance in 2016, the Board

of Directors proposes to return DKK 4.0 billion in dividend in

2017. This includes an ordinary dividend of DKK 9 per share

and additionally three extraordinary quarterly dividends of DKK

9 per share in relation to Q1 2017, Q2 2017 and Q3 2017. In

total, PANDORA will pay out a total of DKK 36 per share in

2017.

SHARE BUYBACK PROGRAMME

In 2016, PANDORA bought back 4,641,992 own shares,

corresponding to 4.0% of the share capital, and at a total

value of DKK 4.0 billion. At the Annual General Meeting,

SHAREHOLDER INFORMATION