PARENTCOMPANY FINANCIAL STATEMENTS •113

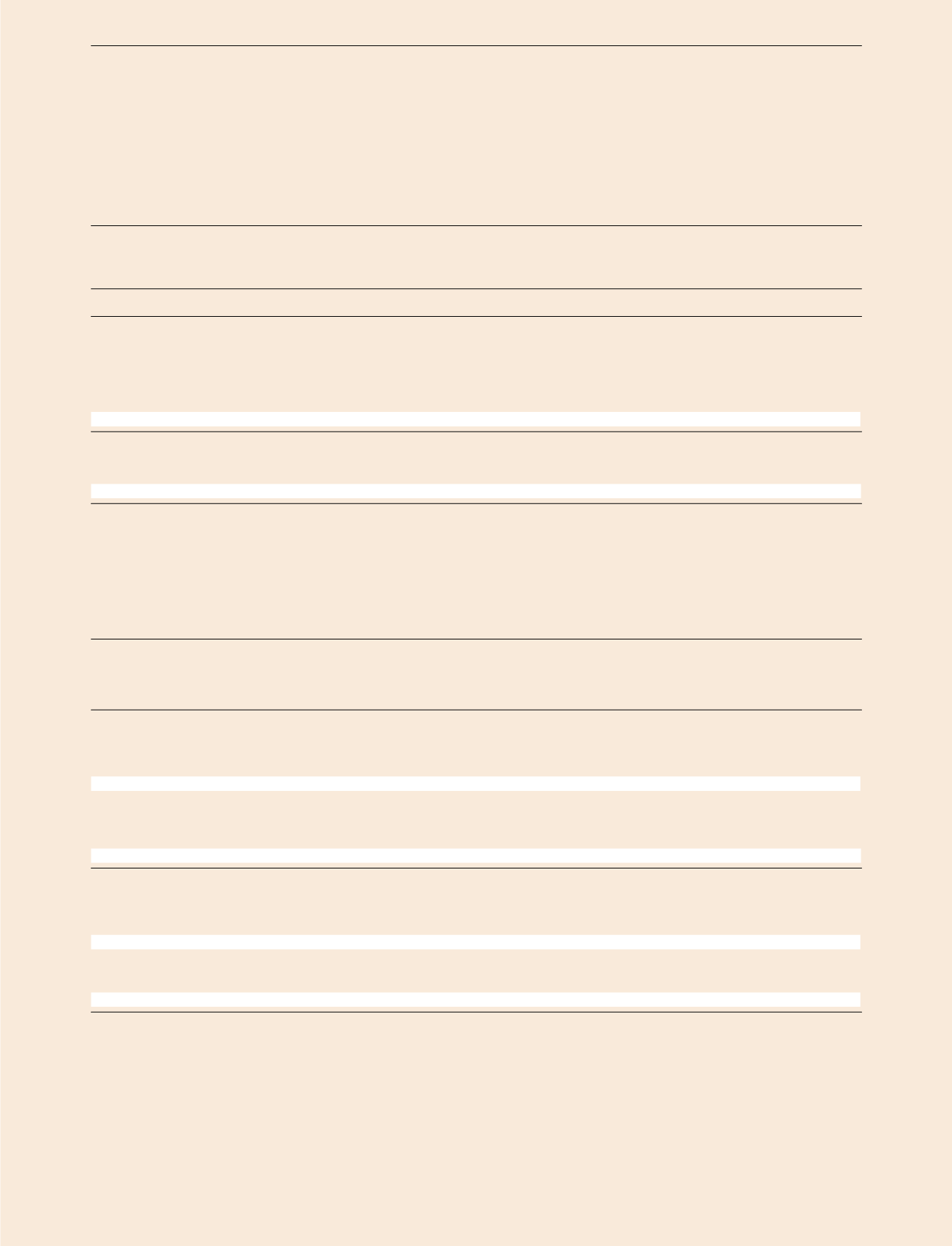

TRADE RECEIVABLES

DKKmillion

2014

2013

Analysis of trade receivables that were past due at 31December

Up to 30 days

-

2

Between 30 and 60days

1

1

Over 90 days

-

-

Total past due

1

3

Not past due

7

7

Total trade receivables at 31December

8

10

Analysis ofmovements in bad debt provisions

Provisions at 1 January

1

1

Additions

3

-

Provisions at 31December

4

1

Trade receivables at 31December 2014 include receivables of nom. DKK12million (2013: DKK11million) that have beenwritten down toDKK 8 million

(2013: DKK 10million). Historically, PANDORAA/S has not suffered any significant bad debt losses.

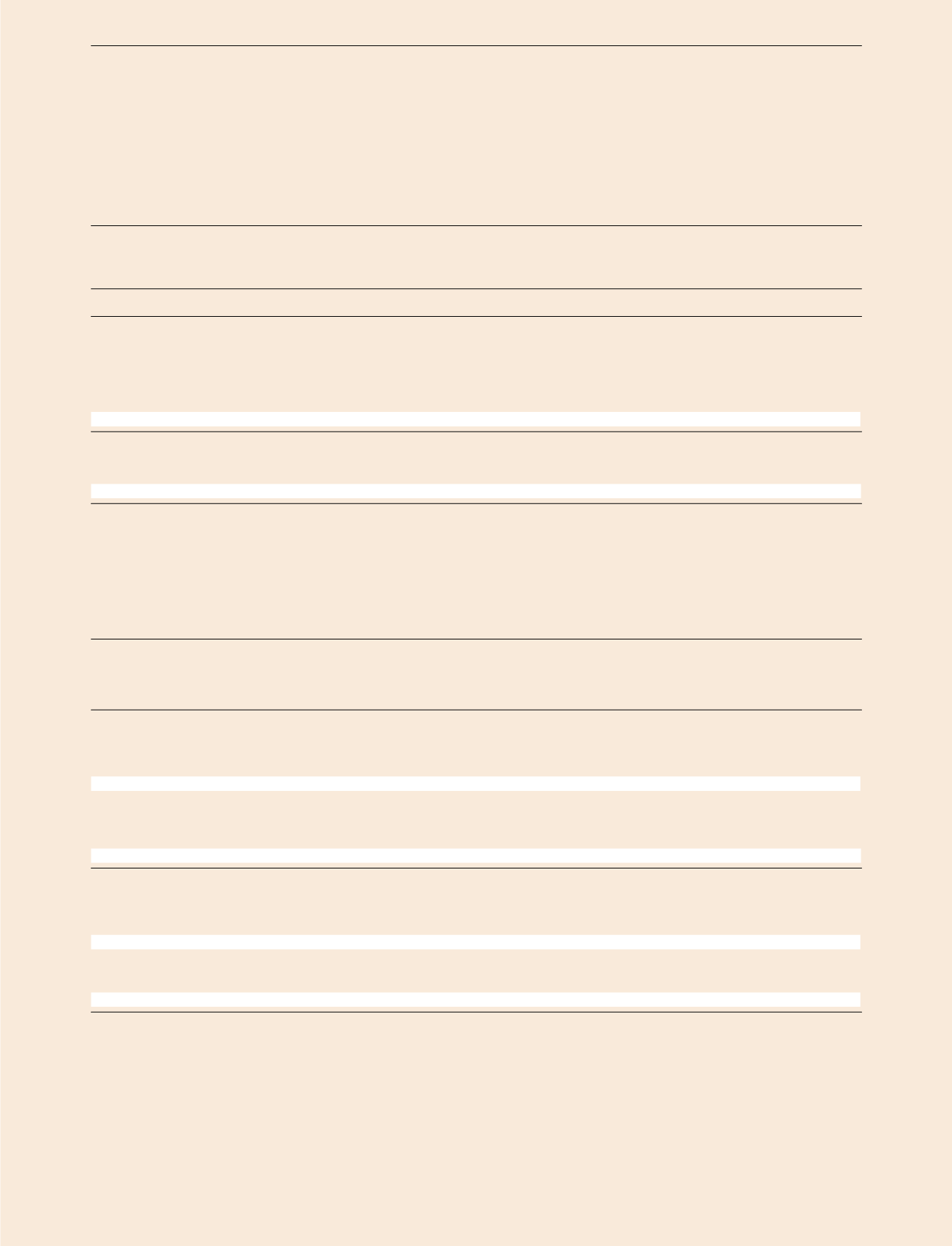

PROVISIONS

3.5

3.6

Earn-out,

acquisition of

Sales

non-controlling

return

Other

DKKmillion

interests

provisions

provisions

Total

Provisions at 1 January 2014

-

126

-

126

Provisionsmade in2014

-

139

15

154

Utilised in the year

-

-110

-

-110

Unused amounts reversed

-

-14

-

-14

Provisions at 31December 2014

-

141

15

156

Provisions are recognised in the balance sheet:

Current

-

141

-

141

Non-current

-

-

15

15

Total provisions at 31December 2014

-

141

15

156

Provisions at 1 January 2013

-

153

10

163

Provisionsmade in2013

-

126

-

126

Utilised in the year

-

-153

-

-153

Unused amounts reversed

-

-

-10

-10

Provisions at 31December 2013

-

126

-

126

Provisions are recognised in the balance sheet:

Current

-

126

-

126

Total provisions at 31December 2013

-

126

-

126

NOTES FOR THE

PARENT COMPANY

Earn-out, acquisitionof non-controlling interests

Theearn-out payment provision relates to theacquisitionof thenon-controlling

interests inPANDORA JewelryCentralWesternEuropeA/S.

Sales returnprovisions

Provisions regarding returns of products fromcustomers arebasedonhistorical

returnpercentages.Where the returnprices are reducedover time, this has been

taken intoaccount in thecalculationof theprovisions.

From time to time, theParent Company takes back inventory from

subsidiaries, primarily related todiscontinued items andexcess inventory.

Inventory is takenbackat original sales prices invoiced to the subsidiaries.The

provision represents expected losses in theParent Company related toexpected

returns from subsidiaries of discontinuedproducts included in inventories

at subsidiaries at year end.This does not impact PANDORA’s consolidated

financial statements.

Other provisions

Other provisions includeaprovision for onerous contracts due to the future

relocationof PANDORA’s office inDenmark,whichmay lead toaperiodof rent

payments for anempty location.