114• PARENTCOMPANY FINANCIAL STATEMENTS

PANDORAANNUAL REPORT2014

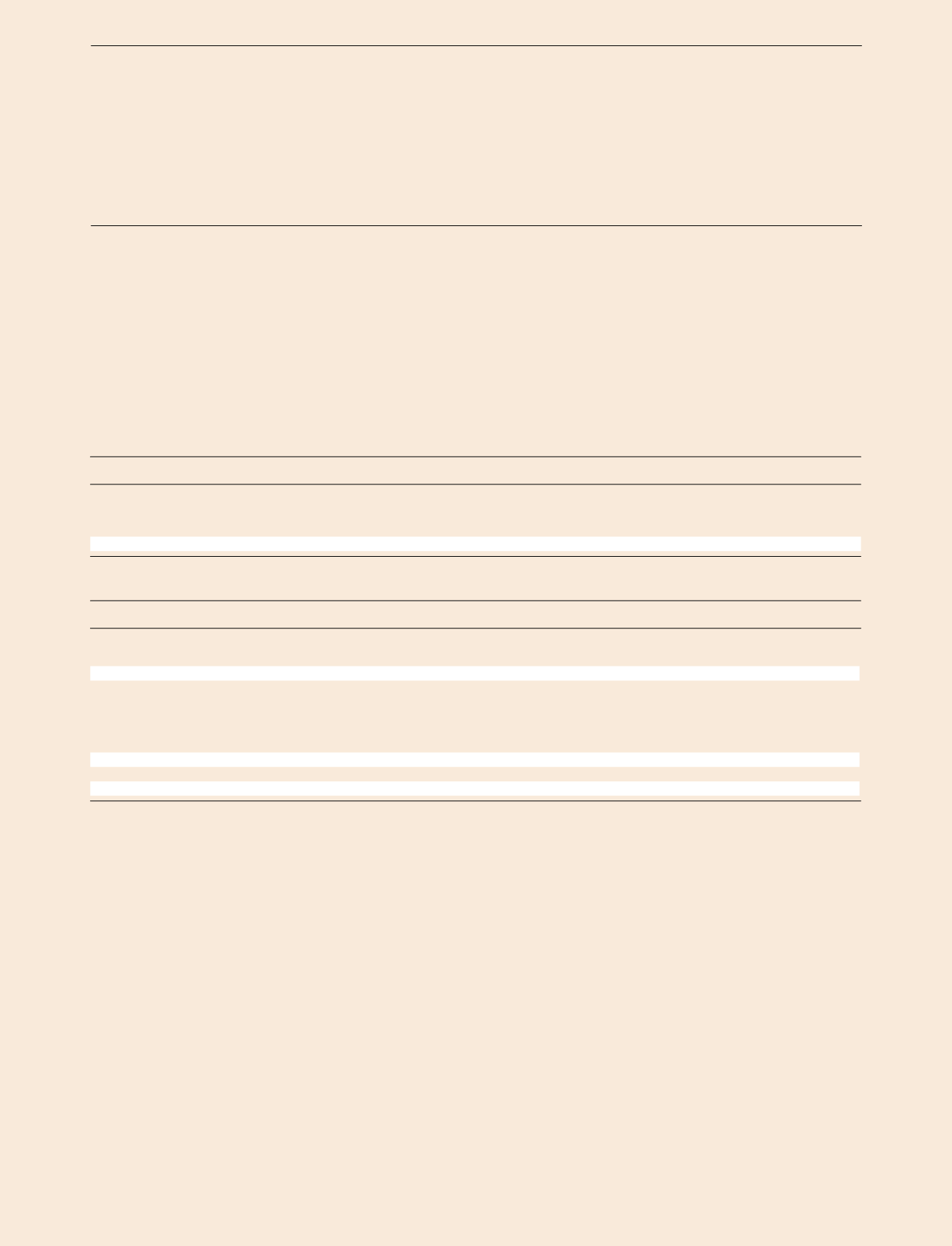

NET FINANCIALS

4.1

4.3

5.1

4.2

NOTES FOR THE

PARENT COMPANY

Finance income

DKKmillion

2014

2013

Finance income from loans and receivablesmeasured at amortised cost:

Interest income from subsidiaries

49

41

Foreign exchange gains

9

425

Total finance income

58

466

Finance costs

DKKmillion

2014

2013

Finance costs fromfinancial assets and liabilities at fair value through the income statement:

Fair value adjustments, financial instruments

50

-

Total finance costs fromfinancial instruments

50

-

Finance costs from financial liabilitiesmeasured at amortised cost:

Foreign exchange losses

83

303

Interest on loans and borrowings

7

1

Other finance costs

63

21

Total finance costs from loans and borrowings

153

325

Total finance costs

203

325

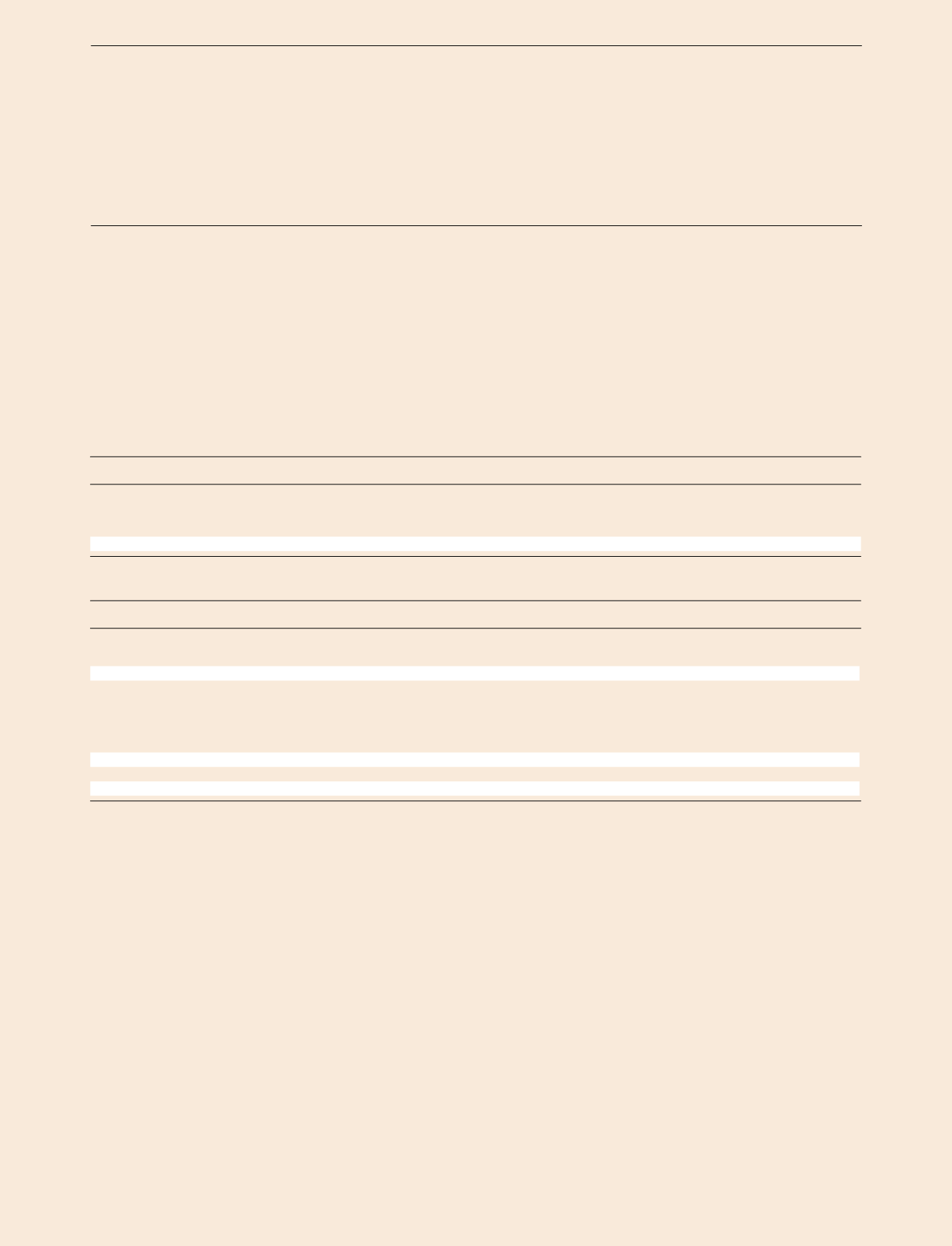

CONTINGENT LIABILITIES

Contingent liabilities

PANDORAA/S is a party to a number of minor legal

proceedings, which are not expected to affect future

earnings.

PANDORAA/S has issued letters of support and letters

of guarantee in favour of creditors of certain subsidiaries.

TheCompany is jointly taxedwithDanish subsidiaries.

TheCompany is jointly and severally liablewith other

jointly taxedDanish companieswithin theGroup for

income tax andwithholding taxes due on or after 1 July

2012 in the joint taxation.

On behalf of PANDORAA/S, a bank guarantee of EUR

37million has been provided.

Contractual obligations

PANDORAA/S is a party to a number of long-term

purchase, sales and supply contracts entered into in the

course of theCompany’s ordinary business. In addition

to the lease commitments disclosedbelow, contractual

obligations amount toDKK206million (2013: DKK 72

million). Apart from the liabilities already recognised in the

balance sheet, theCompany does not expect to incur any

significant financial losses as a result of these contracts.

Other obligations

PANDORAA/S’s other financial obligationsmainly relate to

leases for office premises and operating equipment.

FINANCIAL INSTRUMENTS

Reference ismade tonote 4.5 to the consolidatedfinancial

statements.

SHARECAPITAL

Reference ismade tonote 4.1 to the consolidatedfinancial

statements.