PANDORA IN 2016 • 9

FINANCIAL GUIDANCE

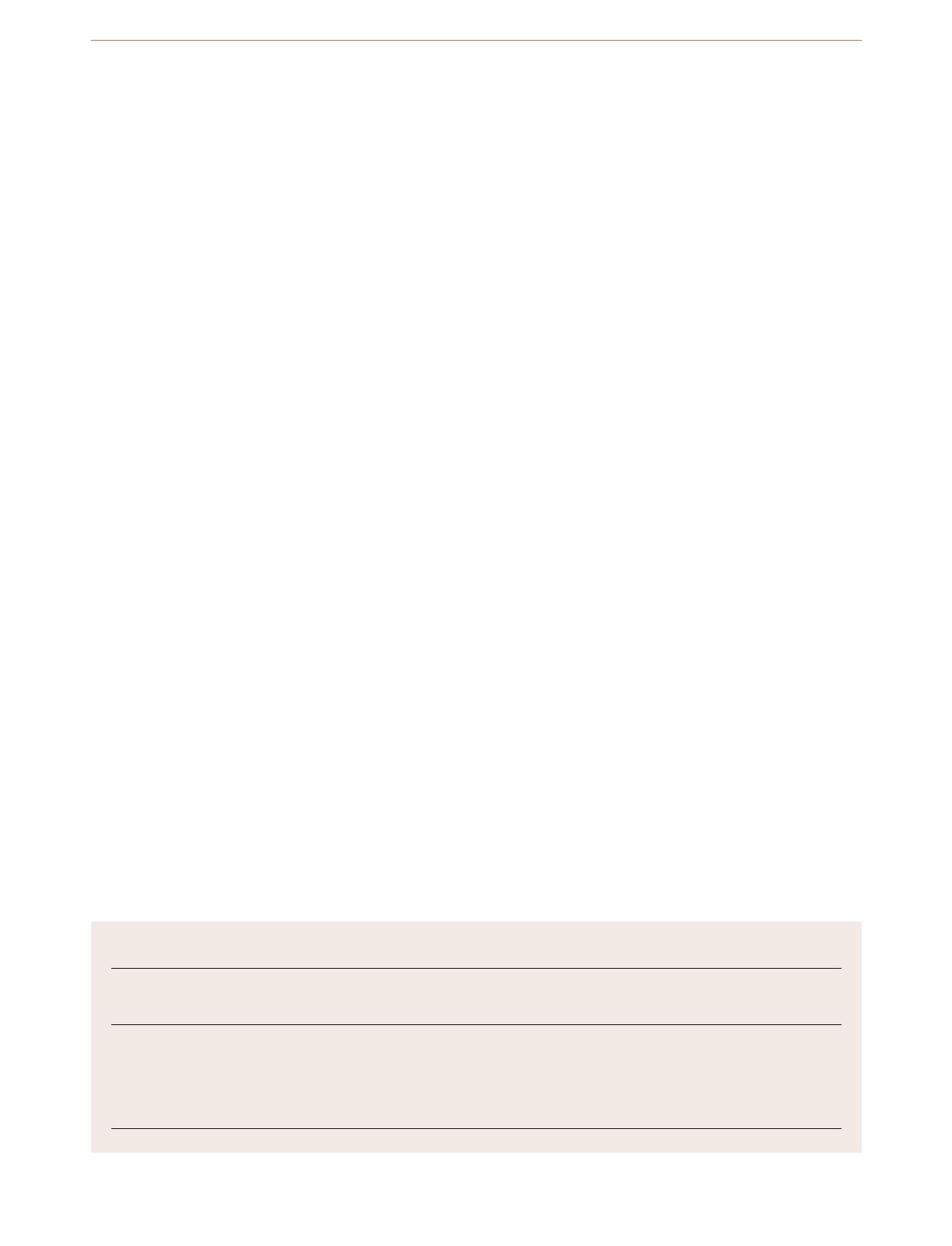

FY 2016

FY 2016

FY 2016

FY 2016

FY 2017

FY 2016

Guidance

Guidance

Guidance

Guidance

FY 2015

Guidance

Actual

(Nov. 2016)

(Aug. 2016)

(May 2016)

(Feb. 2016)

Actual

Revenue, DKK billion

23-24

20.3

>20

>20

>20

>19

16.7

EBITDA margin

Approx. 38%

39.1% Approx. 39%

>38%

>38%

>37%

37.1%

CAPEX, DKK billion

Around 5%

1.2

Approx. 1.2

Approx. 1.2

Approx. 1.0

Approx. 1.0

1.1

of revenue

Effective tax rate

Approx. 21%

21.2% Approx. 21% Approx. 21% Approx. 21% Approx. 21%

31.3%

FINANCIAL GUIDANCE 2017

In 2017, PANDORA will continue to drive growth in

existing stores, and expand the store network in newer as

well as in more developed markets. Revenue is expected to

be in the range of DKK 23-24 billion, with existing stores

expected to contribute roughly half of the growth, and

expansion of the store network contributing the remaining

half. PANDORA currently expects only single digit

revenue growth in the first quarter of 2017, due to timing of

shipments and a very strong performance in the first quarter

of 2016. Assuming current exchange rates, PANDORA

expects a full year tailwind effect from currencies on

revenue of around 1 percentage point compared with 2016.

The EBITDA margin in 2017 is expected to be around

38%. For 2017, the EBITDA margin is anticipated to be

negatively impacted by around 0-1 percentage points from

higher commodity prices. Furthermore, assuming current

exchange rates, PANDORA expects a full year headwind

effect from currencies on the EBITDA margin of around 1

percentage point compared with 2016. The EBITDA margin

is expected to be significantly lower in the first half of 2017

compared to the second half.

CAPEX for the year is expected to be around 5%

of revenue. The expected level of investments includes

expansion of the crafting facilities in Thailand, investments

in PANDORA’s distribution network, as well as IT

investments.

The effective tax rate for 2017 is expected to be around

21%, unchanged compared to 2016.

In 2017, PANDORA plans to continue to expand the store

network and expects to add more than 275 new concept

stores during the year of which roughly 50% are expected

to be opened in EMEA, 25% in Americas and 25% in Asia

Pacific. PANDORA expects around half of the concept store

openings to be PANDORA owned stores, which is in line

with the Company’s intentions to increase the owned and

operated retail footprint.

Expectations are based on the foreign exchange rates at

the day of announcement.

EVENTS AFTER THE REPORTING PERIOD

On 27 January 2017, PANDORA signed a letter of intent

with Pan India Charms & Jewellery Private Limited (Pan India)

about distribution of PANDORA jewellery in India. Under

the terms of the distribution agreement, Pan India will be

granted exclusive distribution rights for PANDORA jewellery

in India, in which PANDORA currently has no distribution.

The agreement is subject to certain conditions to be fulfilled.

Through its distribution partner, PANDORA will

establish branded sales distribution focusing on concept

stores and shop-in-shops, initially in Delhi, Mumbai and

Bangalore, consistent with PANDORA’s overall strategy to

focus on expanding the global branded network. The initial

expectation is to open around 50 concept stores in India

over a three year period, with around five stores expected to

be opened in 2017. The first opening is planned for the first

quarter of 2017.