FINANCIAL HIGHLIGHTS

DKK million

2016

2015

2014

2013

2012

Consolidated income statement

Revenue

20,281 16,737 11,942

9,010

6,652

Gross profit

15,223 12,193

8,423 5,999

4,429

Earnings before interest, tax, depreciation and amortisation (EBITDA)

7,922 6,214 4,294 2,881

1,658

Operating profit (EBIT)

7,404 5,814 4,072

2,681

1,475

Net financials

246

-469

-200

61

4

Net profit for the year

6,025 3,674 3,098

2,220

1,202

Consolidated balance sheet

Total assets

15,085 13,311 10,556

9,275

8,414

Invested capital

9,396 8,255 6,080 5,976

5,900

Operating working capital

2,780 2,388 1,990 1,846 2,039

Net interest-bearing debt (NIBD)

1

2,448 1,921 -1,121

-637

-183

Equity

6,794 6,139 7,032

6,462

6,038

Consolidated cash flow statement

Net increase/decrease in cash

5

-245

431

361

165

Free cash flow

5,358 2,449 3,868

1,956

1,151

Cash conversion, %

72.4% 42.1% 95.0% 73.0% 78.0%

Growth ratios

Revenue growth, %

21% 40% 33% 35% 0%

Gross profit growth, %

25% 45% 40% 35% -9%

EBITDA growth, %

27% 45% 49% 74% -27%

EBIT growth, %

27% 43% 52% 82% -28%

Net profit growth, %

64% 19% 40% 85% -41%

Margins

Gross margin, %

75.1% 72.9% 70.5% 66.6% 66.6%

EBITDA margin, %

39.1% 37.1% 36.0% 32.0% 24.9%

EBIT margin, %

36.5% 34.7% 34.1% 29.8% 22.2%

Other ratios

Effective tax rate, %

21.2% 31.3% 20.0% 19.0% 18.7%

Equity ratio, %

45.0% 46.1% 66.6% 69.7% 71.8%

NIBD to EBITDA, x

0.3

0.3

-0.3

-0.2

-0.1

Return on invested capital (ROIC), %

78.8% 70.4% 67.0% 44.9% 25.0%

Share information

Dividend per share

2

, DKK

9.00 13.00

9.00

6.50

5.50

Total payout ratio (incl. share buyback), %

91.5% 135.8% 104.1%

63.7%

59.5%

Earnings per share, basic, DKK

52.8

30.9

25.0

17.2

9.2

Earnings per share, diluted, DKK

52.5

30.7

24.7

17.0

9.2

Share price at year-end, DKK

924.0 872.0 504.5 294.0

124.5

Other key figures

Capital expenditure (CAPEX), DKK million

1,199 1,109

455

490

276

Capital expenditure, tangible assets (CAPEX), DKK million

828

706

297

182

167

Store network, total number of points of sale

8,131 9,271 9,906 10,279 10,374

Store network, total number of concept stores

2,138 1,802 1,410 1,100

895

Average number of full-time employees

17,770 13,971 9,957

6,910

5,753

1

For 2015, NIBD and consequently NIBD to EBITDA were recalculated due to reclassifications. Refer to note 4.3.

2

Dividend proposed per share for 2016.

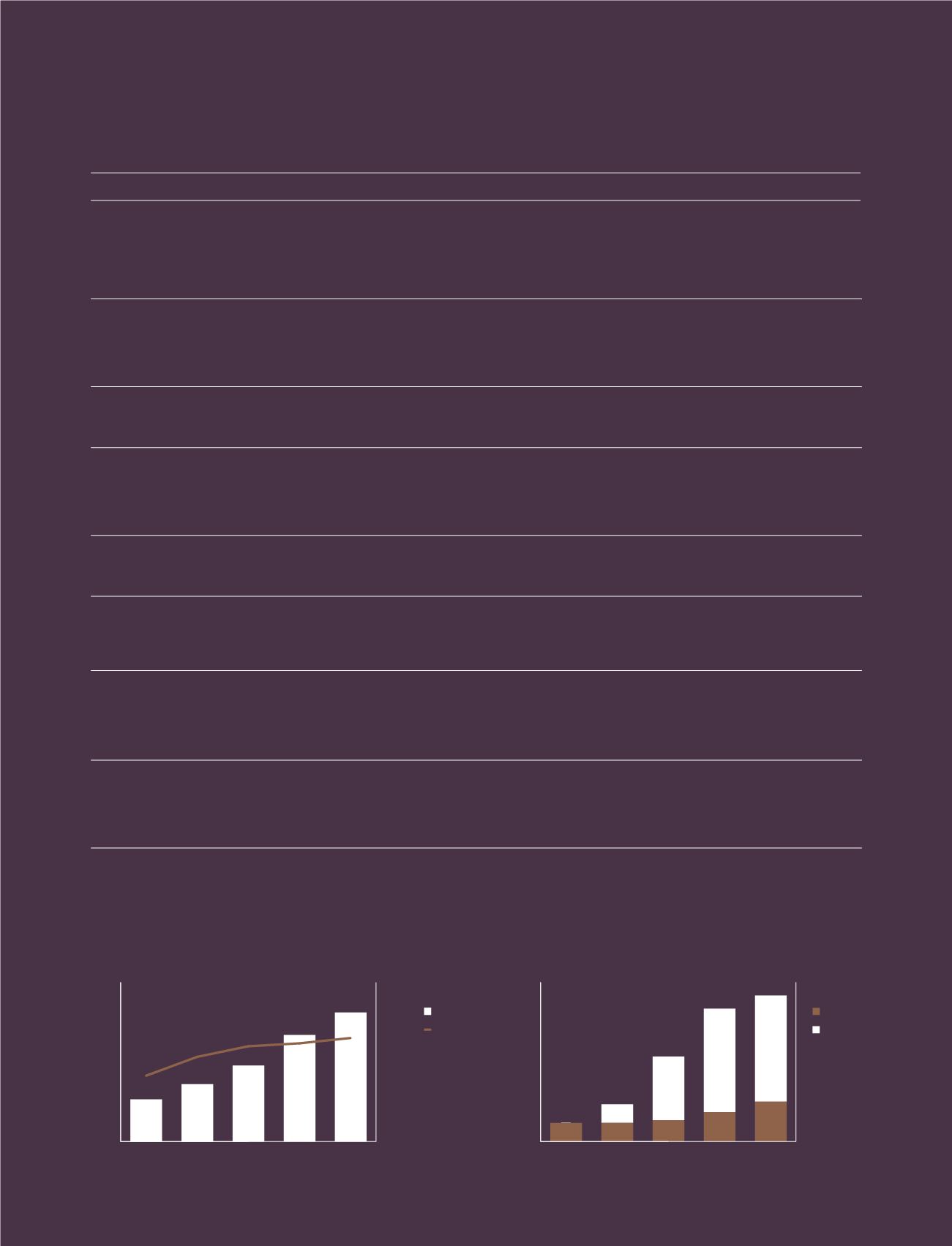

REVENUE AND EBITDA MARGIN

DIVIDEND AND SHARE BUYBACK

0

5,000

10,000

15,000

25,000

20,000

Revenue

0%

20%

40%

60%

DKKm

EBITDA

margin

2016

2015

2014

2013

2012

Share

buyback

Dividend

1.4

0.7

0.7

0.7

0.7

3.2

2.4

0.8

1.1

3.9

4.0

1.5

5.0

5.5

2016

2015

2014

2013

2012

0

2.0

1.0

3.0

5.0

4.0

6.0

DKKbn