8 • PANDORA IN 2016

PANDORA ANNUAL REPORT 2016

Capital expenditure was DKK 1,199 million compared with

DKK 1,109 million in 2015. As in 2015, the level of CAPEX

continued to be impacted by the development of our

crafting facilities in Thailand, investments in our distribution

network, and IT investments.

PANDORA’s tax rate for 2016 was 21.2%, which was in

line with expectations.

DIVIDEND AND SHARE BUYBACK PROGRAMME

For the financial year 2015, PANDORA paid out ordinary

dividend of DKK 13 per share, corresponding to DKK

1.5 billion in total. From 2017, PANDORA proposes to

supplement the ordinary dividend with three extraordinary

quarterly dividends.

Following a strong financial performance in 2016, the Board

of Directors proposes to return DKK 4.0 billion in dividend in

2017. This includes an ordinary dividend of DKK 9 per share

and additionally three extraordinary quarterly dividends of DKK

9 per share in relation to Q1 2017, Q2 2017 and Q3 2017. In

total, PANDORA will pay out a total of DKK 36 per share in

2017.

Furthermore, the Board of Directors of PANDORA has

decided to launch a new share buyback programme in

2017, under which PANDORA expects to buy back own

shares to a maximum consideration of DKK 1.8 billion.

The shares acquired within the programme will be used to

reduce PANDORA’s share capital and to meet obligations

arising from employee share option programmes. The share

buyback programme will run in the period from 7 February

2017 to no later than 6 February 2018.

FINANCIAL PERFORMANCE

PANDORA generated revenue of DKK 20.3 billion in 2016.

This was aided by strong double-digit growth in all four

quarters and, in total, revenue increased by 21% compared

with 2015. This was in line with the renewed guidance

that we communicated in May based on a very strong

performance in the first quarter.

Revenue growth was driven by good performance

across all geographical regions. The Americas increased

revenue by 5%, EMEA by 27% and Asia Pacific by 46%. In

addition, revenue from all product categories experienced

positive growth, driven by new as well as existing products.

Around half of our revenue growth in 2016 can be

attributed to the expansion of our store network, which

included the addition of net 336 new concept stores in

2016. Together with the closing of multibranded stores, this

gave us a stronger and much more branded store network

compared with the beginning of the year.

The level of EBITDA margin exceeded initial

expectations for the year. Earnings before interest, tax,

depreciation and amortisation (EBITDA) was DKK 7.9

billion in 2016, corresponding to an increase of 27%

compared with 2015. Our EBITDA margin for the year was

39.1% compared with 37.1% in 2015.

The improvement of our EBITDA margin was primarily

related to lower realised commodity prices compared with

2015, as well as increasing leverage on costs in our more

developed markets. However, some of the increase was

offset by greater complexity of production as well as our

geographical expansion, primarily in Asia.

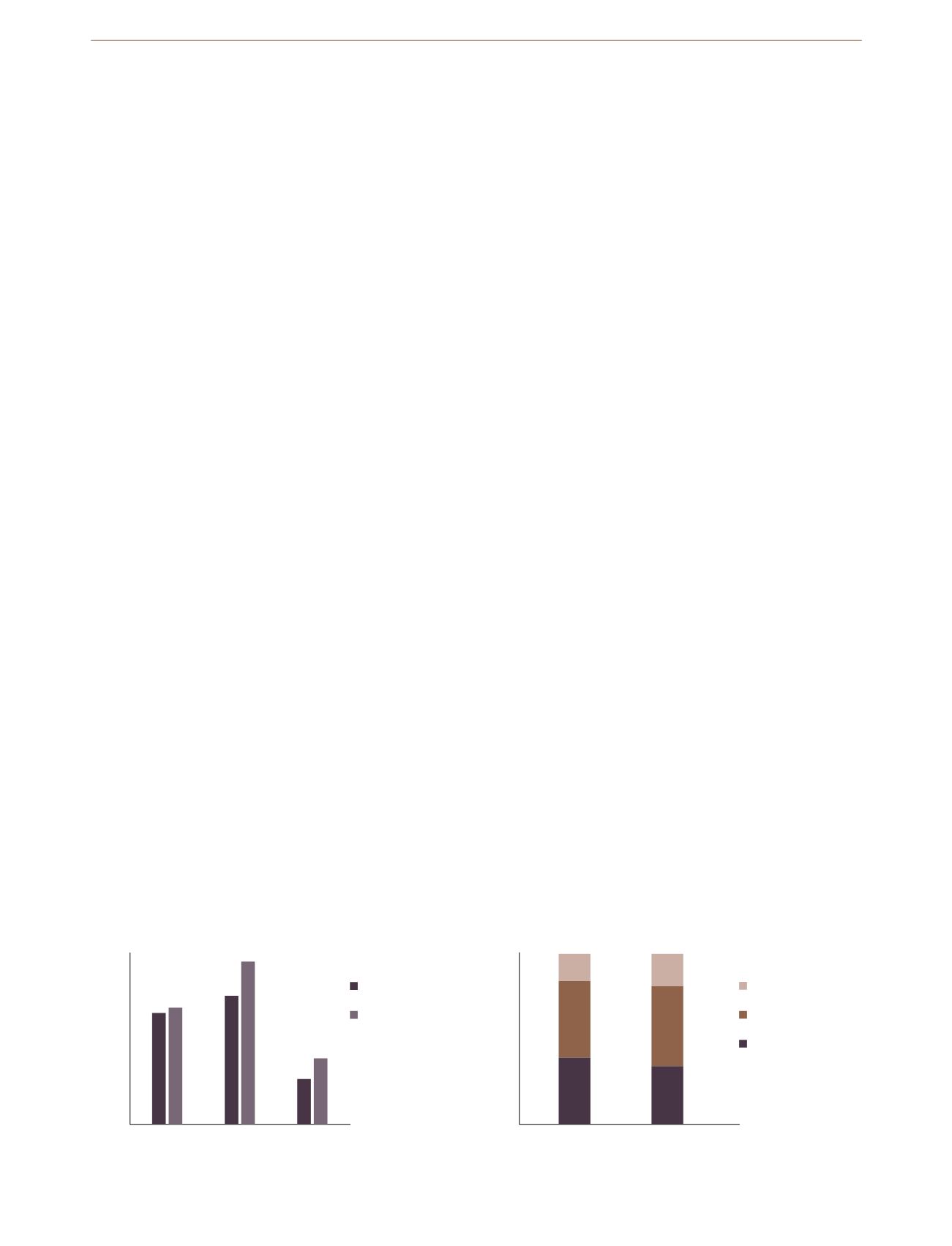

REGIONAL REVENUE

REGIONAL REVENUE SHARE

100

80

60

40

20

0

%

2016

2015

Asia Pacific

EMEA

Americas

34%

47%

19%

39%

45%

16%

DKKm

2015

2016

Asia Pacific

EMEA

Americas

0

2,000

4,000

6,000

8,000

10,000