PANDORA IN 2016 • 7

represented 19% of Group revenue in 2016. The

accelerated growth in China that began in 2015 continued

in 2016, and we opened net 44 new concept stores in

the country during the year, bringing the total number of

concept stores in China to 97. Furthermore, as part of our

efforts to raise awareness of the PANDORA brand among

Chinese consumers, our products were launched online

on

Tmall.com, a business-to-consumer platform owned by

the Chinese Alibaba Group, in October and we opened

a Chinese eSTORE in December. Thanks to these efforts,

China now represents 4% of Group revenue, a share that

is expected to increase in the coming years. Australia

continued its strong performance. We added net 11 concept

stores to our Australian store network in 2016 and saw

double-digit like-for-like sales-out growth in the country

throughout the year.

EXPANDING PRODUCTION CAPACITY

In 2016, we crafted around 122 million pieces of jewellery,

at our crafting facilities in Thailand. Due to increasing

demand, we have decided to expand our production

capacity through a number of ongoing initiatives. With a

total investment of DKK 1.8 billion, these initiatives will

potentially double our production capacity to more than

200 million pieces a year by the end of 2019.

Our capacity expansion programme includes optimising

our existing crafting facilities in Gemopolis, as well as

building two new crafting facilities – one in Lamphun, near

Chiang Mai, and another in Gemopolis, Bangkok. The first

of these, the facility in Lamphun, was completed in late

2016 and will begin commercial production in early 2017.

Built for around 5,000 employees, the facility is primarily

optimised for rings, earrings and more complex products.

net 1,829 multibranded accounts across the world in 2016.

Of these, more than 200 stores owned by the US jewellery

chain Jared

®

The Galleria Of Jewelry (Jared) and operated by

Signet Jewelers were upgraded to shop-in-shops.

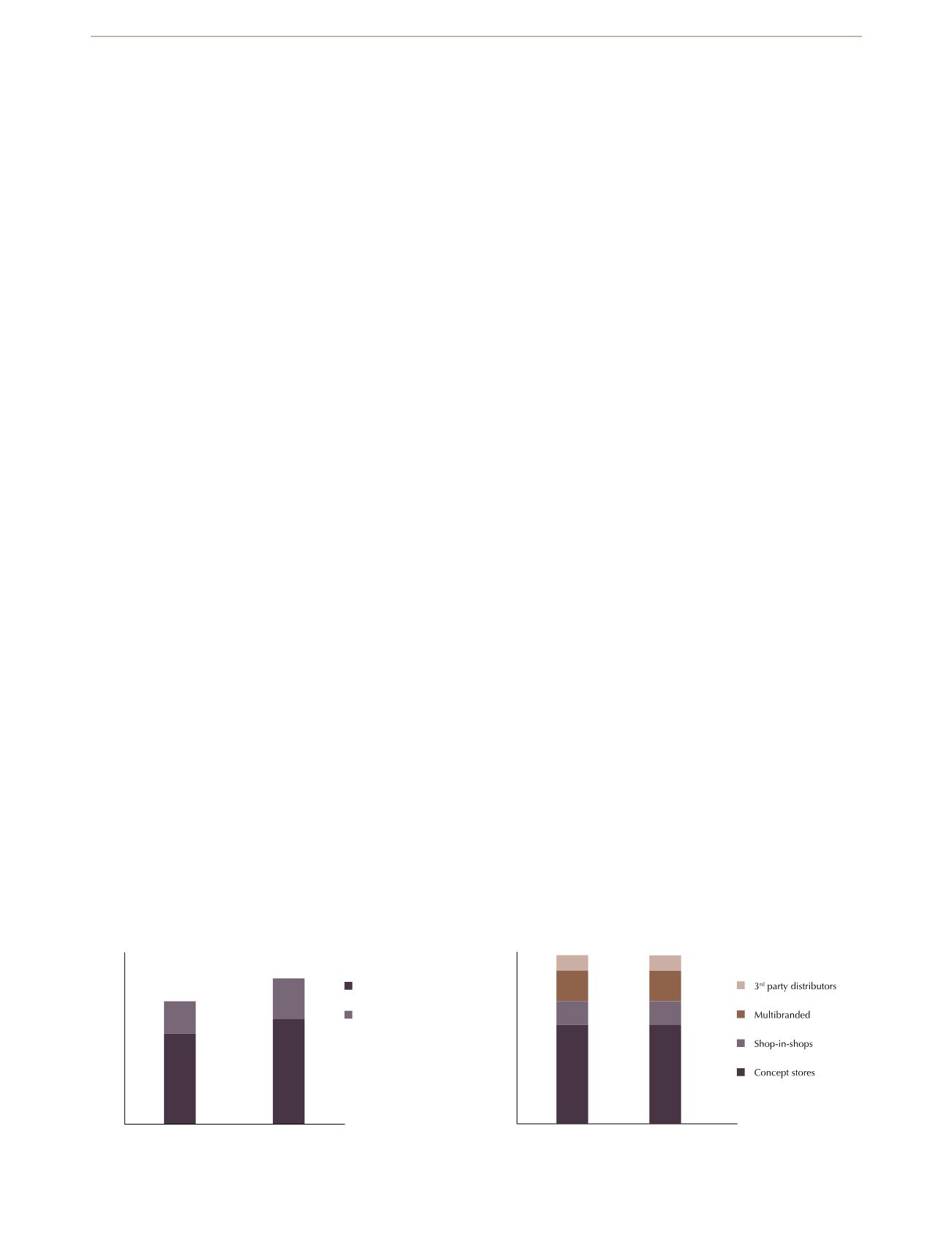

In 2016, branded revenue, which is generated through

our concept stores and shop-in-shops, increased by 30%

compared with 2015 and represented 78% of Group

revenue.

GEOGRAPHICAL EXPANSION

We continued the focus on geographical expansion in both

newer and developed markets in 2016.

In the Americas, a region that delivers 34% of Group

revenue, we opened net 87 new concept stores, including

net 27 new stores in the US, which remains our largest

market. Additionally, we significantly improved the quality

of our store network in the US through Jared’s upgrade of

more than 200 multibranded stores to shop-in-shops, and

a reduction of multibranded stores by more than 50%. In

Latin America, we also continued to expand our network

and added net 53 new concept stores, of which 21 were

located in Brazil.

EMEA represents 47% of Group revenue, and all major

European markets continued to show growth in 2016.

Revenue from Italy and France increased by more than

50% each, driven by increased brand awareness, while

our business in Germany continued to improve as our

store network became increasingly branded. Our business

in the UK also continued to develop positively, and we

experienced limited impact on market performance from

the UK’s decision to leave the EU, with the only significant

effect being the depreciation of the British pound.

Asia Pacific was our fastest-growing region, and

NUMBER OF CONCEPT STORES

BRANDED REVENUE SHARE

0

500

1,000

1,500

2,000

2,500

PANDORA owned

concept stores

Franchisee owned

concept stores

2016

2015

1,540

1,328

598

474

2,138

1,802

100

80

60

40

20

0

%

2016

2015

66%

12%

8%

58%

15%

9%

14%

18%