NOTES

94•Consolidated financial statements

PANDORAANNUAL REPORT2014

BUSINESSCOMBINATIONS

5.1

Acquisitions in2014

Acquisitionof a net total of 22 concept stores from

Hannoush

On 22 September 2014, PANDORA acquired 27 stores

fromUS jeweller Hannoush in a business combination.

With the acquisition of the 27 stores PANDORAwill

execute its strategy to refresh its network in theNortheast

region of theUS.

Thepurchase considerationwasDKK162million and

was paid in cash.Therewerenoother significant terms or

payments related to the acquisition.The transaction costs,

DKK1million, havebeen recognised as administrative

expenses inprofit or loss for 2014.

Fiveof the acquired stores locatedoutside theNortheast

regionwere re-sold to an existing franchiseeon22

September 2014.The saledidnot have any effect onprofit or

loss.Thenet cash effect from theHannoush acquisitionwas

anoutflowofDKK143million.

Assets acquired and liabilities assumedmainly comprise

inventories, equipment andobligations to restore the leased

premises. Inventories havebeenmeasured atmarket value

basedon the saleabilityof the individual items.

Goodwill from the acquisition amounted toDKK81

million (excluding goodwill ofDKK6million related to

thefive stores thatwere re-sold), and is attributable to the

expected synergies from an increasedpresence in the region,

including the effect from a refreshednetwork.Noneof the

goodwill recognised is deductible for income taxpurposes.

The22 stores contributed approximatelyDKK95million

in revenue andDKK22million innet profit since the

acquisitionon22 September 2014. If the stores hadbeen

acquiredon1 January2014, revenue andnet profitwould

havebeenDKK115million andDKK4millionhigher

respectively.

Other business combinations in 2014

PANDORA acquired concept stores in theUK, Germany

and theNetherlands in2014.Thesewere accounted for as

business combinations. Assets acquiredmainly consist of

keymoney and other assets relating to the stores. Of the

purchase price, DKK6millionwas allocated to goodwill.

None of the goodwill recognised is deductible for income

tax purposes.

The impact on revenue and net profit for 2014 from

the acquired storeswas insignificant. If the stores had

been owned from the beginning of the year, the impact

on PANDORA’s revenue and net profit would have been

equally insignificant.

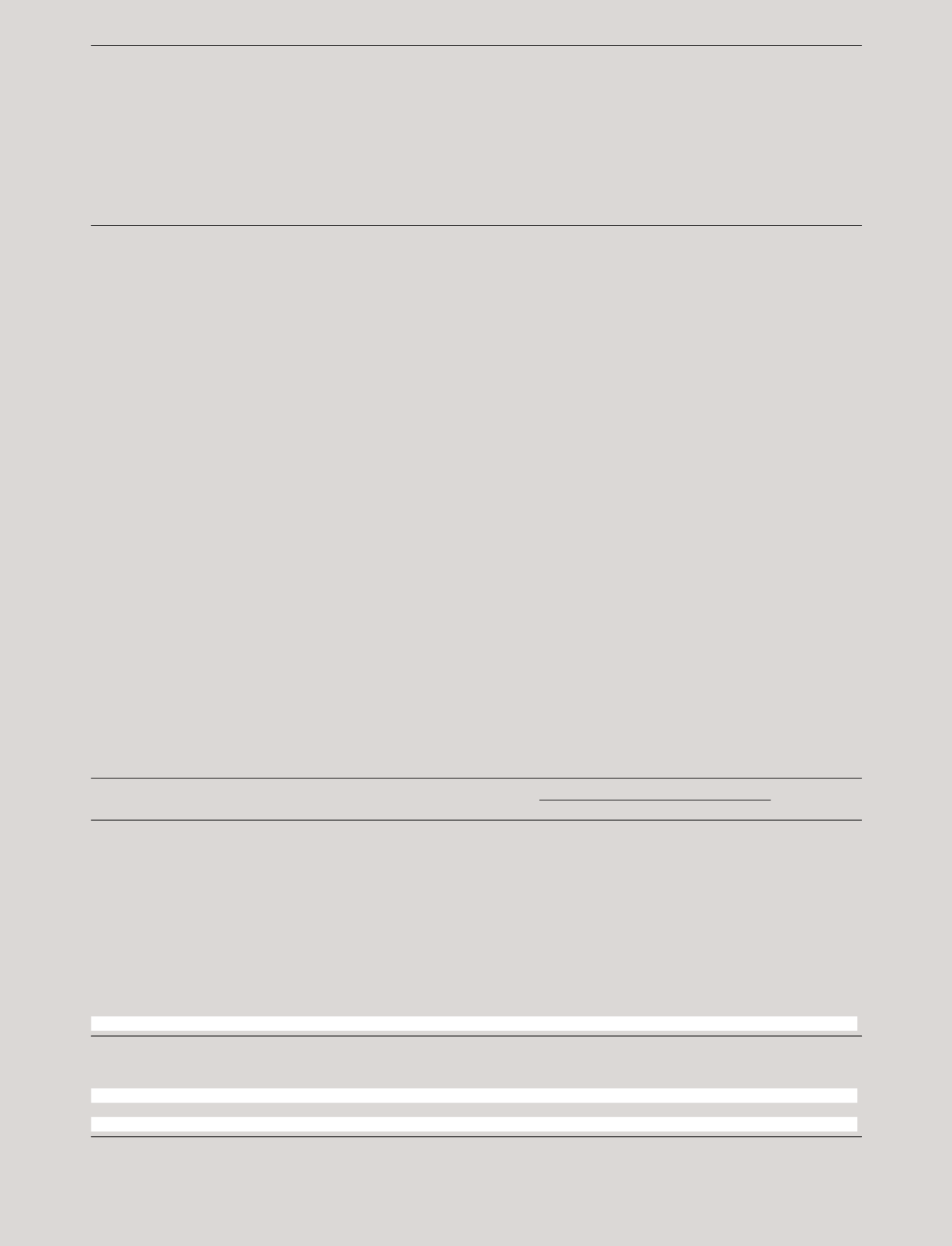

2014

2013

DKKmillion

Hannoush

Other

Total

Brazil

Other intangible assets

-

1

1

13

Property, plant and equipment

4

5

9

9

Receivables

2

-

2

3

Inventories

77

-

77

12

Other current assets

-

-

-

4

Assets acquired

83

6

89

41

Non-current liabilities

3

-

3

5

Payables

3

-

3

18

Other non-current liabilities

2

-

2

5

Deferred tax

-

-

-

3

Liabilities assumed

8

-

8

31

Total identifiable net assets acquired

75

6

81

10

Goodwill arising from acquisition

87

6

93

30

Purchase consideration

162

12

174

40

Cashmovements on acquisition:

Purchase consideration transferred

162

12

174

40

Deferred payment

-

-

-

-2

Net cashflows on acquisition

162

12

174

38

Cash flow sale of businesses

1

19

-

19

-

Net cashflow from business combinations

143

12

155

38

1

The sale of businesses includedmainly inventories, DKK 12million, assets related to stores, DKK1million, and goodwill, DKK 6million.

SECTION 5: OTHER DISCLOSURES, CONTINUED