NOTES

Consolidated financial statements •85

SECTION 4

CAPITAL S RUCTURE

ANDNET FINANCIALS

CASHCONVERSION

TOTALPAYOUTRATIO

SHAREBUYBACK

2,400

DKKmillion

124.9%

112.7%

This section includes notes related toPANDORA’s

capital structure andnet financials, including financial

risks (see note 4.4). As a consequenceof its operations,

investments and financing, PANDORA is exposed to a

number of financial risks that aremonitored andman-

aged via PANDORA’sGroupTreasury. PANDORAuses a

number of financial instruments tohedge its exposure to

fluctuations in commodity prices and similar. Financial

instruments aredescribed innote 4.5.

Thebasis of PANDORA’s capitalmanagement is the

NIBD/EBITDA ratio,whichManagement seeks tomain-

tainbetween 0 and 1. At 31December 2014, the ratio

was -0.3. PANDORA’s ability to keep this low ratio is

basedon the high cash conversion. The cash conversion

was 124.9% in 2014 comparedwith 88.1% in 2013.

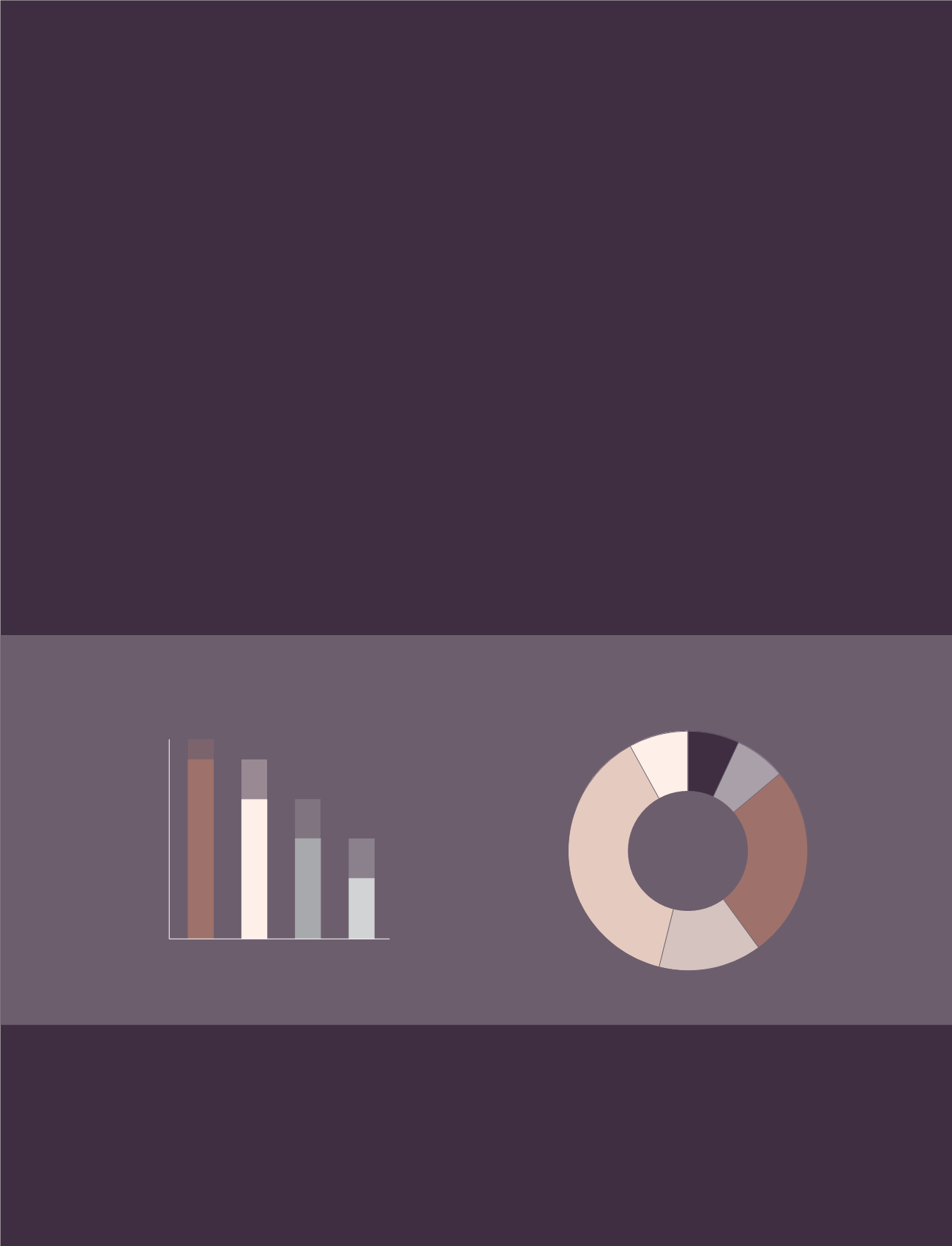

14%

GBP

38%

USD

8%

Other

26%

EUR

7%

CAD

7%

AUD

1-3months ahead

4-6months ahead

7-9months ahead

9-12months ahead

100

90

80

70

60

50

40

30

20

10

0

%

90-100%

MIN

.

MAX

.

MIN

.

MAX

.

MIN

.

MAX

.

MIN

.

MAX

.

70-90%

50-70%

30-50%

COMMODITYHEDGERATIO

REVENUEBREAKDOWNBYCURRENCY