NOTES

Consolidated financial statements •79

SECTION 3: INVESTED CAPITAL ANDWORKING CAPITAL ITEMS, CONTINUED

3.1 INTANGIBLEASSETS, CONTINUED

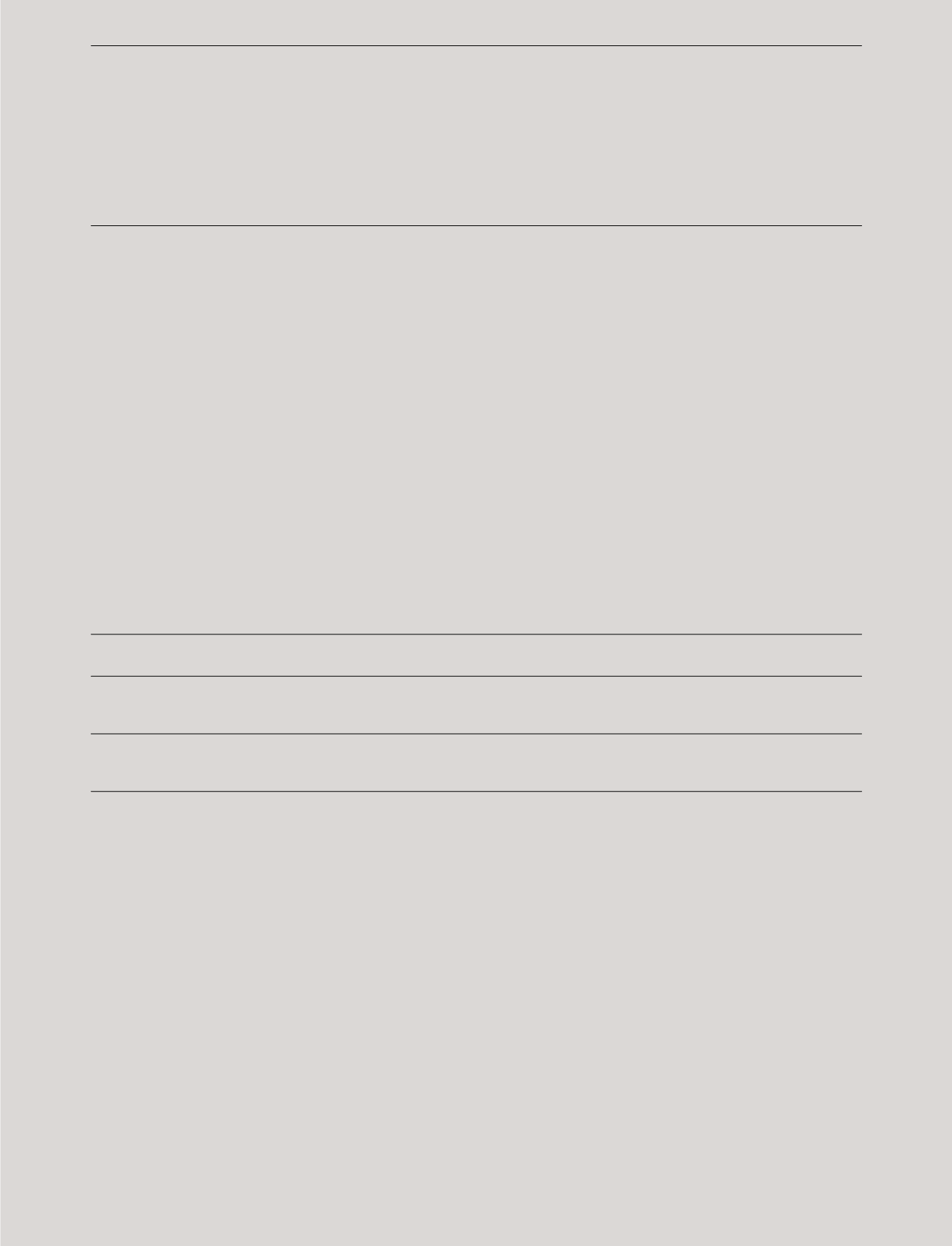

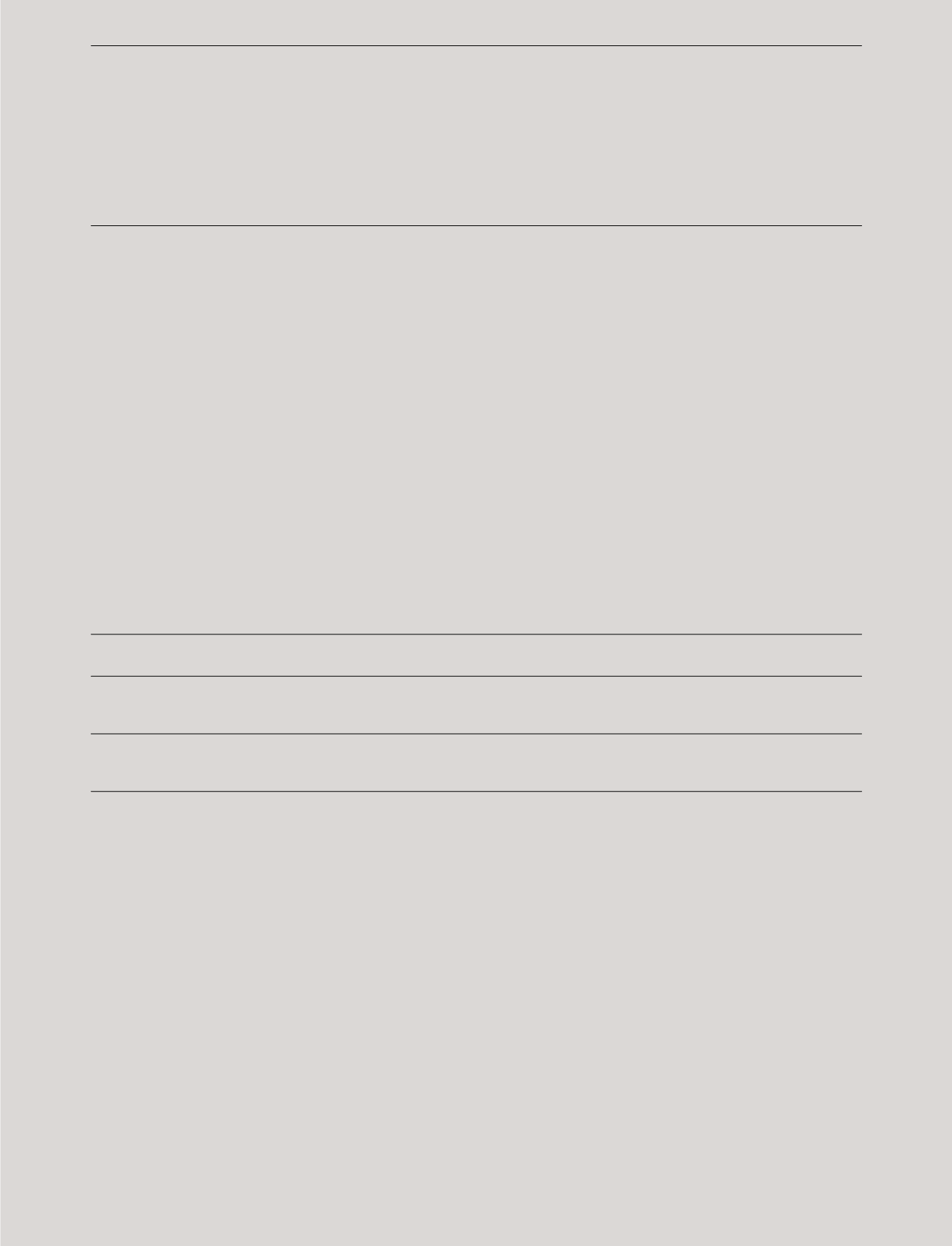

Discount rates and growth rates in terminal period

CentralWestern

Distributors &

Americas

UK

Europe

Australia

travel retail

Group

2014

Discount rate before tax

12.2%

10.8%

14.9%

14.1%

11.8%

12.1%

Growth rate in the terminal period

2.0%

2.0%

2.0%

2.0%

2.0%

2.0%

2013

Discount rate before tax

11.9%

10.9%

12.6%

13.4%

12.7%

12.5%

Growth rate in the terminal period

2.0%

2.0%

2.0%

2.0%

2.0%

2.0%

capital for the industry.The rates have further been adjusted

to reflect themarket assessment of any risk specific to

theCGU.

The EBIT figures used in the impairment test are based

on the budget for next year, prepared and approvedby

Management, and the expectations for the two subsequent

years.The EBITmargin in the budget of the individual CGU

is basedonhistorical experience and expectations to:

• revenue growth considering development in network

(store openings, retail/wholesale share), product mix

andmarket share

• cost of sales based onmetal consumption and average

laggedhedge commodity prices at the time the budget

is prepared

• OPEX development

• currency rates are based on actual rates at the time the

budget is prepared.

The net working capital in the budget for next year,

relative to the revenue of the individual CGUs, is based on

historical experience and ismaintained for the remainder of

the expected lives.Theworking capital is thus increased on

a linear basis as the level of activity increases.

The impairment tests did not show any need for

impairment losses tobe recognised. InManagement’s

opinion, noprobable change in any of the key assumptions

mentioned abovewould cause the carrying amount of the

Groupor CGUs to exceed its recoverable amount.