NOTES

84•Consolidated financial statements

PANDORAANNUAL REPORT 2014

SECTION 3: INVESTED CAPITAL ANDWORKING CAPITAL ITEMS, CONTINUED

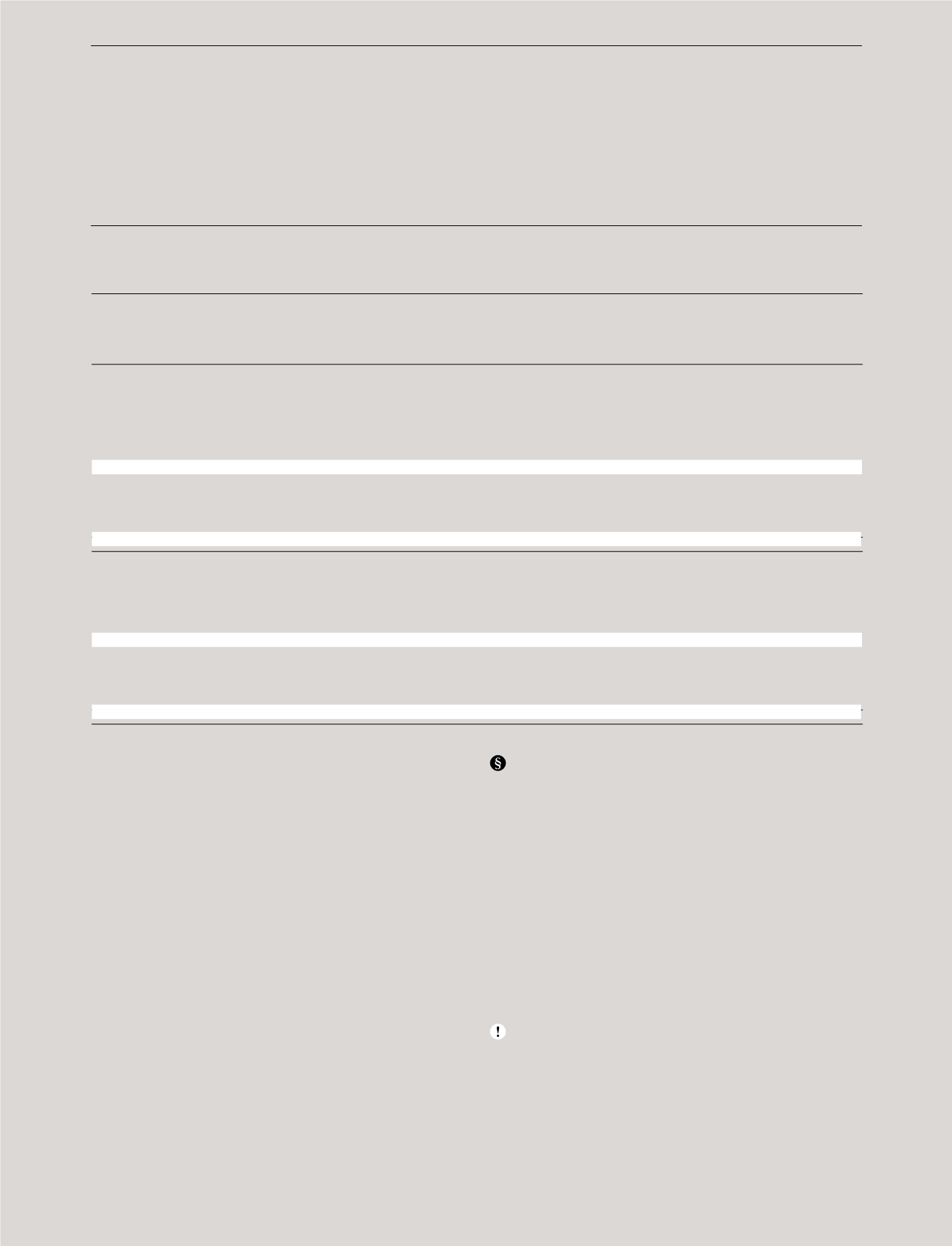

PROVISIONS

Earn-outs,

Sales

acquisition of

return and

non-controlling

warranty

Other

DKKmillion

interests

provisions

provisions

Total

Provisions at 1 January 2014

-

458

48

506

Provisionsmade in 2014

-

774

86

860

Utilised in the year

-

-543

-7

-550

Unused amounts reversed

-

-75

-29

-104

Reclassifications

-

33

-33

-

Exchange rate adjustments

-

23

4

27

Provisions at 31December 2014

-

670

69

739

Provisions are recognised in the consolidated balance sheet:

Current

-

670

8

678

Non-current

-

-

61

61

Total provisions at 31December 2014

-

670

69

739

Provisions at 1 January 2013

-

416

54

470

Provisionsmade in2013

-

492

35

527

Utilised in the year

-

-423

-7

-430

Unused amounts reversed

-

-20

-34

-54

Exchange rate adjustments

-

-7

-

-7

Provisions at 31December 2013

-

458

48

506

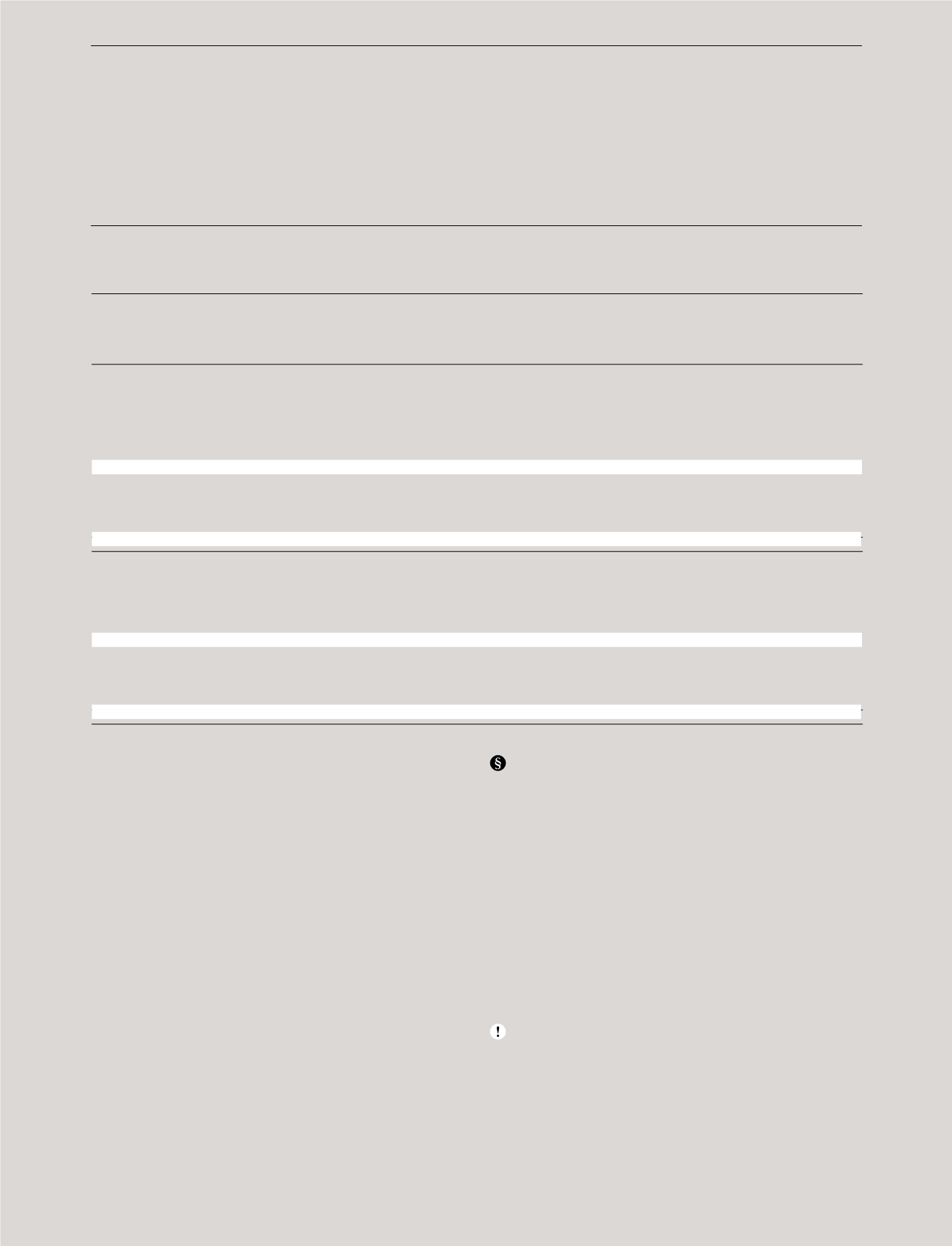

Provisions are recognised in the consolidated balance sheet:

Current

-

458

13

471

Non-current

-

-

35

35

Total provisions at 31December 2013

-

458

48

506

3.5

Sales return andwarrantyprovisions

In2014, provisions forwarranty claimswere reclassified so

that they arenowpresented togetherwith returnprovisions.

This is due to a change in thehandlingofwarranty claims,

whichnowmainly lead to replacements insteadof repairs.

PANDORAonlyprovides return rights to customers

in some countries. Sales returnprovisions in2014mainly

related to theAmericas,DKK460million (2013:DKK

353million).

Other provisions

Other provisions include aprovision for onerous contracts

due to the future relocationof PANDORA’s office in

Denmarkwhichmay lead to aperiodof rent payments for an

empty location.

Earn-outs, acquisitionof non-controlling interests

The earn-out payment provisionDKK0million (2013:DKK

0million) relates to the acquisitionof thenon-controlling

interests inPANDORA JewelryCentralWestern EuropeA/S.

Accountingpolicies

Provisions are recognisedwhenPANDORAhas apresent

obligation (legal or constructive) as a result of apast event and

it is probable that anoutflowof resources embodyingeconomic

benefitswill be required to settle theobligationanda reliable

estimatecanbemadeof theamount of theobligation.The

expense relating toanyprovision is recognised in the income

statement net of any reimbursement.

Aprovision for estimated sales returns is recognisedwhen

there is historical experienceorwhena reasonablyaccurate

estimateof expected future returns canotherwisebemade.The

provision is recognisedat thegrossmarginon theexpected

returns.

Significant accountingestimates

In somecountries, PANDORAhas provided return rights

tocustomers.Theprovision is toa largeextent basedon

historical returnpatterns andchanges in future returnpatterns

may therefore result inchanges compared to theprovision

recognised. Provisions arealsomadeonacasebycasebasis

whenPANDORAexpects to takeback specificgoods for

commercial reasons.