NOTES

Consolidated financial statements •81

SECTION 3: INVESTED CAPITAL ANDWORKING CAPITAL ITEMS, CONTINUED

3.2 PROPERTY, PLANTAND EQUIPMENT, CONTINUED

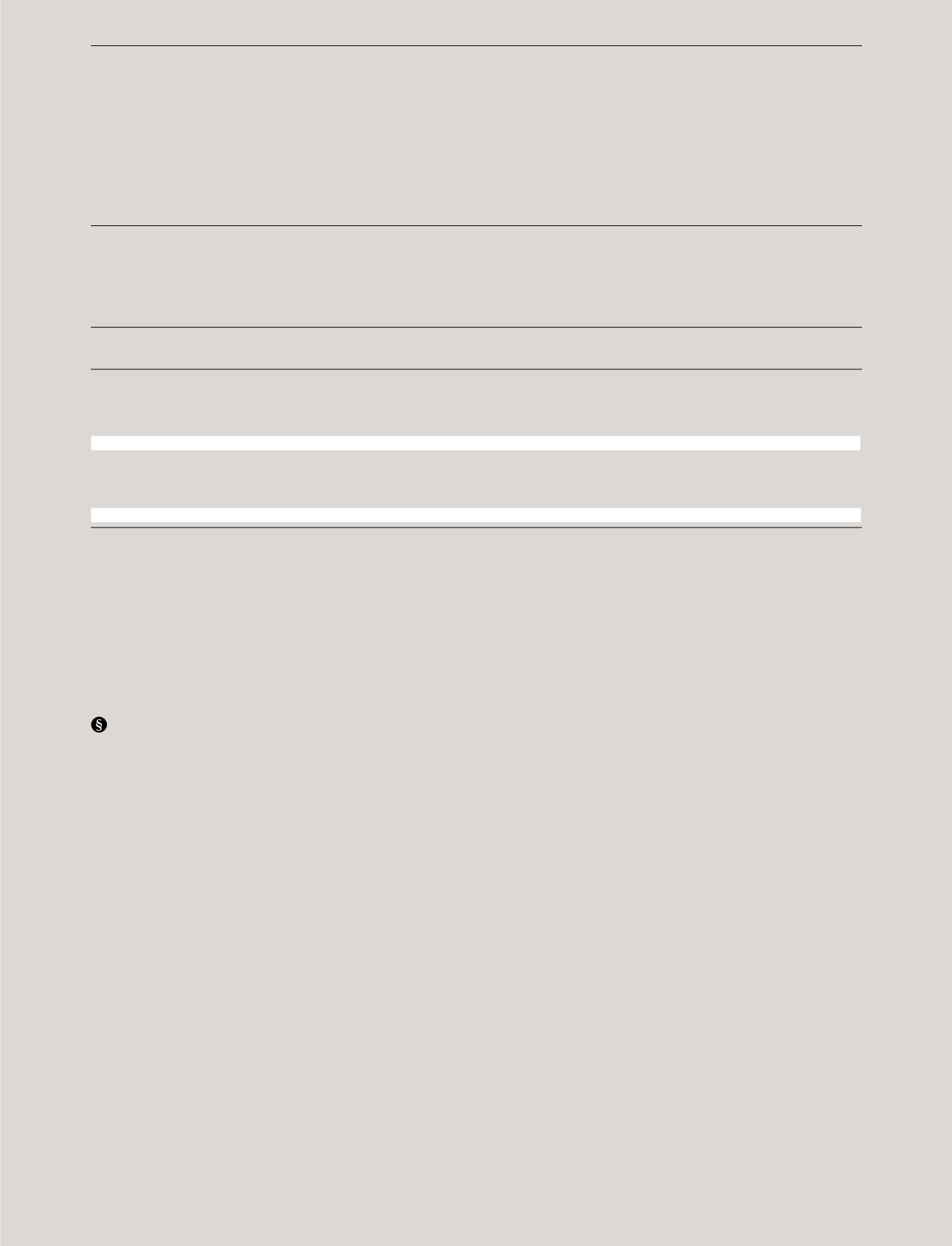

Operating leases

Land and

Plant and

DKKmillion

buildings

equipment

Total

Futureminimum lease payments on existing contracts at 31December

Within 1 year

303

23

326

Between 1- 5 years

826

27

853

After 5 years

371

1

372

Total 2014

1,500

51

1,551

Within 1 year

182

50

232

Between 1- 5 years

417

15

432

After 5 years

128

-

128

Total 2013

727

65

792

PANDORA has a large number of individually insignificant

leases.The leases aremainly for stores, offices and copy

machines etc.The increase in commitments in 2014 is

mainly related tonew owned and operated concept stores,

including the stores acquired fromUS jeweller Hannoush,

and the lease for a newDanish headquarters fromApril

2016.

Accounting policies

Property, plant and equipment is stated at cost, net of

accumulated depreciation and/or any accumulated

impairment losses. Depreciation is calculatedon a straight-

line basis over the estimateduseful life of the asset.

Leases

Thedeterminationofwhether an arrangement is, or

contains, a lease is basedon the substance of the

arrangement at the inception date: whether fulfilment of

the arrangement is dependent on the use of a specific asset

or the arrangement conveys a right touse the asset.

Operating lease payments are recognised as expenses

in the income statement on a straight-line basis over the

lease term.