NOTES

Consolidated financial statements •83

SECTION 3: INVESTED CAPITAL ANDWORKING CAPITAL ITEMS, CONTINUED

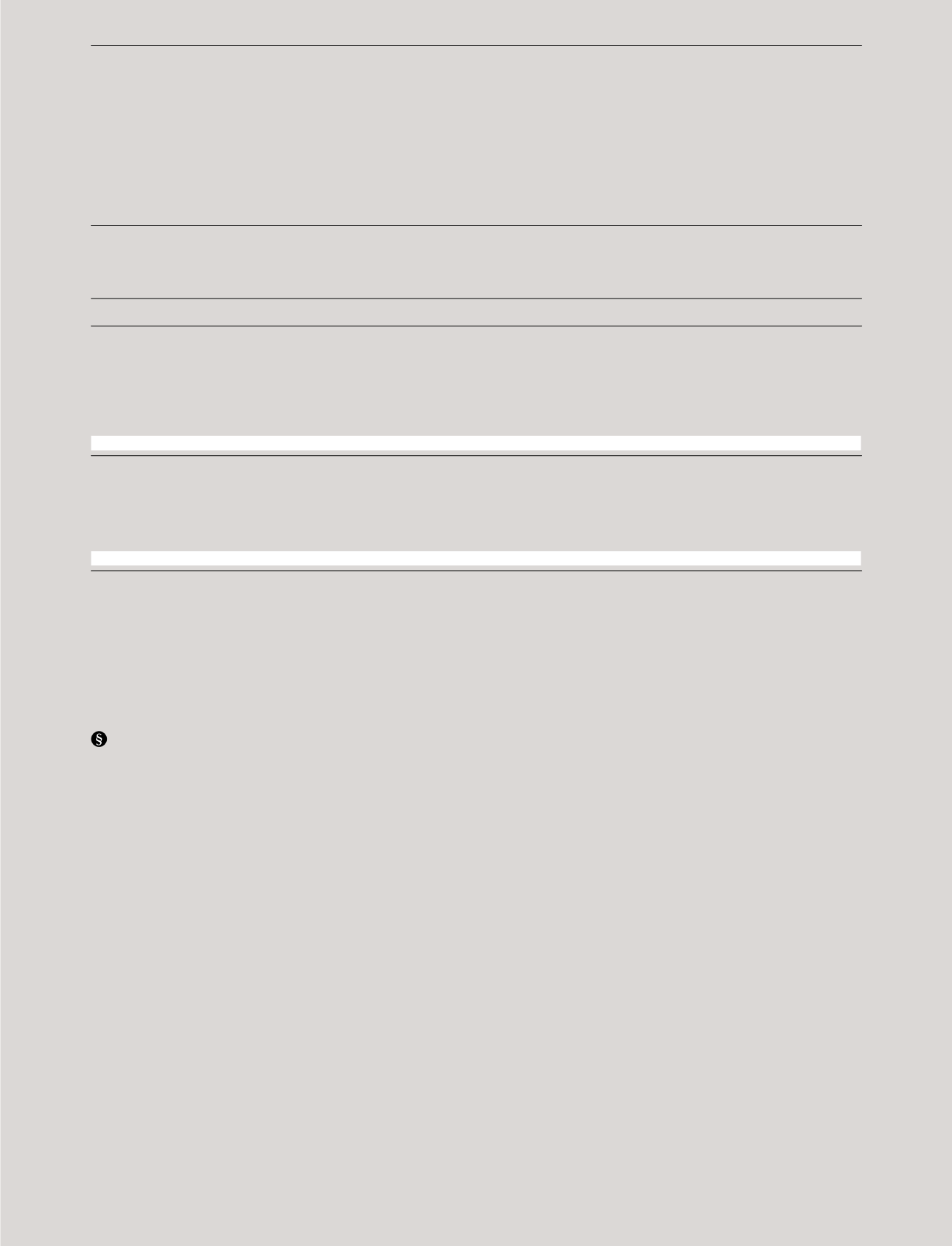

TRADE RECEIVABLES

DKKmillion

2014

2013

Analysis of trade receivables that were past due at 31December

Up to 30days

177

144

Between30 and 60 days

34

58

Between60 and 90days

26

19

Over 90 days

1

21

Total past due

238

242

Not past due

872

653

Total trade receivables at 31December

1,110

895

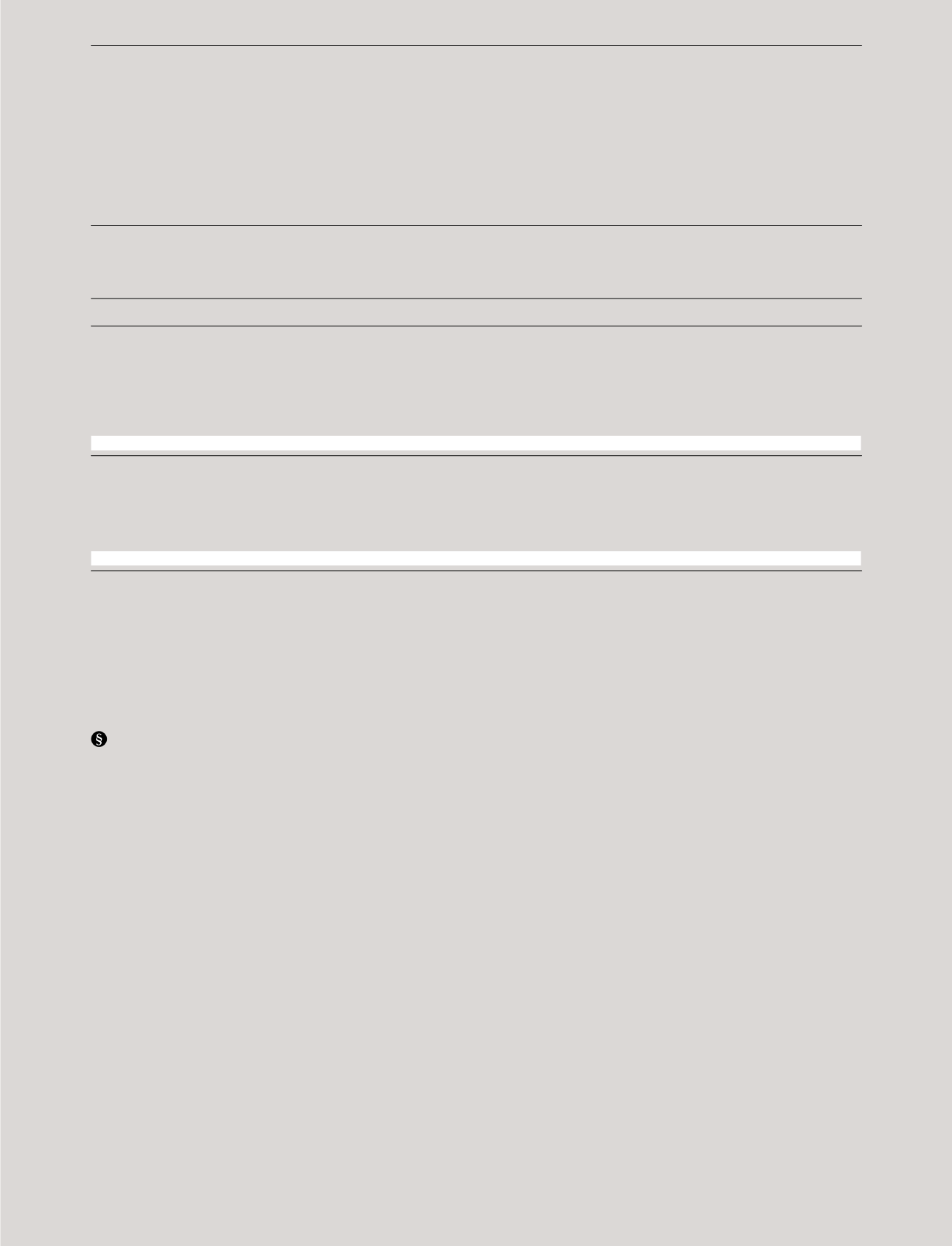

Analysis ofmovements in baddebt provisions

Provisions at 1 January

33

32

Additions

6

6

Utilised

-6

-5

Unused amounts reversed

-9

-1

Exchange rate adjustments

-1

1

Provisions at 31December

23

33

3.4

Trade receivables at 31December 2014 include receivables

at a nominal value of DKK1,133million (2013: DKK 928

million), which have beenwritten down toDKK 1,110

million (2013: DKK 895million).

Historically, PANDORA has not suffered any significant

bad debt losses.

Accounting policies

Receivables are non-derivative financial assetswithfixed

or determinable payments that are not quoted in an active

market. Subsequent to initial recognition, such financial

assets aremeasured at amortised cost using the effective

interest ratemethod, less impairment. Any losses arising

from impairment are recognised in the income statement as

administrative expenses.

Awrite-down for bad or doubtful debts ismade if there

is any indication of impairment of a receivable or a

portfolioof receivables.Thewrite-down is calculated as the

difference between the carrying amount and the present

value of estimated future cash flows associatedwith the

receivable.The discount rate used is the effective interest

rate for the individual receivable or portfolio.