NOTES

82•Consolidated financial statements

PANDORAANNUAL REPORT2014

SECTION 3: INVESTED CAPITAL ANDWORKING CAPITAL ITEMS, CONTINUED

3.3 INVENTORIES

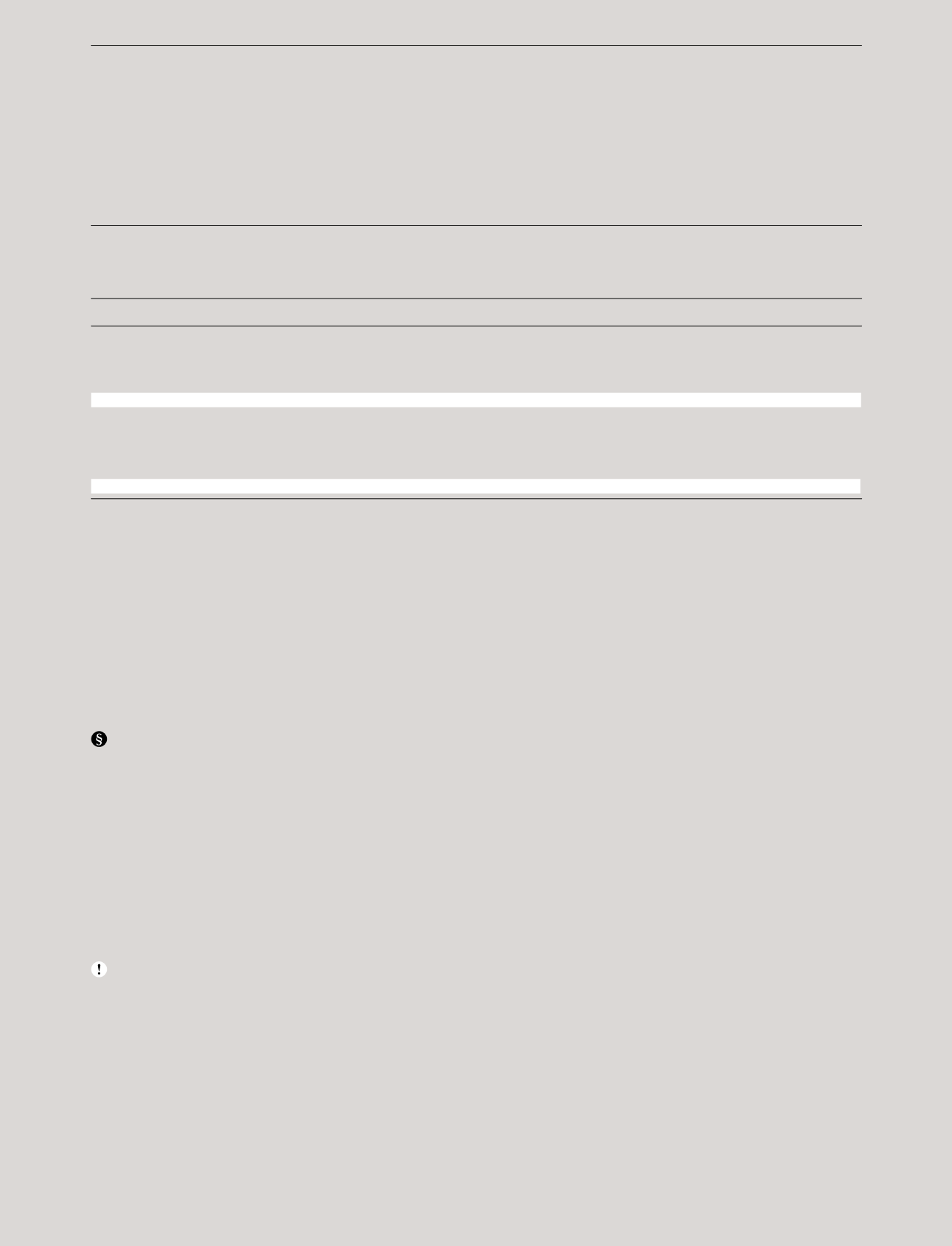

DKKmillion

2014

2013

Rawmaterials and consumables

412

327

Work in progress

71

78

Finished goods

1,054

948

Point of salematerials

147

137

Total inventories at 31December

1,684

1,490

Inventorywrite-downs at 1 January

300

208

Write-downs during the year

227

265

Utilised in the year

-264

-168

Reversal of write-downs in the year

-17

-5

Inventorywrite-downs at 31December

246

300

Thewrite-downs of inventories are recognised inCost of salesDKK 130million (2013: DKK 209million), andDistribution expensesDKK80million

(2013: DKK 51million).

Inventories at 31December 2014 include inventories at

a nominal value of DKK1,930million (2013: DKK 1,790

million), which have beenwritten down toDKK1,684

million (2013: DKK1,490million).

Silver and gold prices decreased in 2014, leading to losses

on re-melting of goods, with a negative impact on gross

profit of DKK136million (2013: DKK 189million).

Accounting policies

Inventories are valued at the lower of cost andnet realisable

value. Costs incurred in bringing each product to its present

location and condition are accounted for as follows:

• rawmaterials – purchase costs on a first-in, first-out

basis

• finished goods andwork in progress – cost of direct

materials and labour and a proportion of production

overheads based on normal operating capacity, but

excluding borrowing costs.

Significant accounting estimates

Net realisable value

Net realisable value is the re-melt value or the estimated

selling price less estimated costs of completion and

distribution.The re-melt value is based on theweight of

silver and gold in the products and themarket prices for

silver and gold on the reporting date. Future changes in the

market prices of silver or goldwill result in changes in the

re-melt value.

PANDORAdivides inventories into four categories:

introduction, released-for-sale, phasing-out and

discontinued.Group SupplyChainmonitors the sales-out

of all products and, based on sales ratios, some products

may be regarded as slow-moving and thus assigned to

the categories phasing-out or discontinued.The part of

discontinued inventory that is not expected to be sold is

written down to re-melt value. Inventories in the phasing-

out category canbe sold onnormal terms or transferred

to the discontinued category, and the amount expected to

be transferred to discontinued is thereforewrittendown as

described above.

Sales forecasts are used to assesswhichproducts in

the released-for-sale category need to bewritten down.

Inventories exceeding estimateddemand for the next 12

months arewritten down.

Historically, PANDORA has not made any significant

write-downs as a result of damaged goods.

Capitalisedproduction overheads

Capitalisedproduction overheads are calculated using

a standard cost method, which is reviewed regularly

to ensure relevant assumptions concerning capacity

utilisation, lead times andother relevant factors.The

carrying amount of capitalised productionoverheads

wasDKK39million at 31December 2014 (2013: DKK

24million).