NOTES

Consolidated financial statements •89

SECTION 4: CAPITAL STRUCTURE AND NET FINANCIALS, CONTINUED

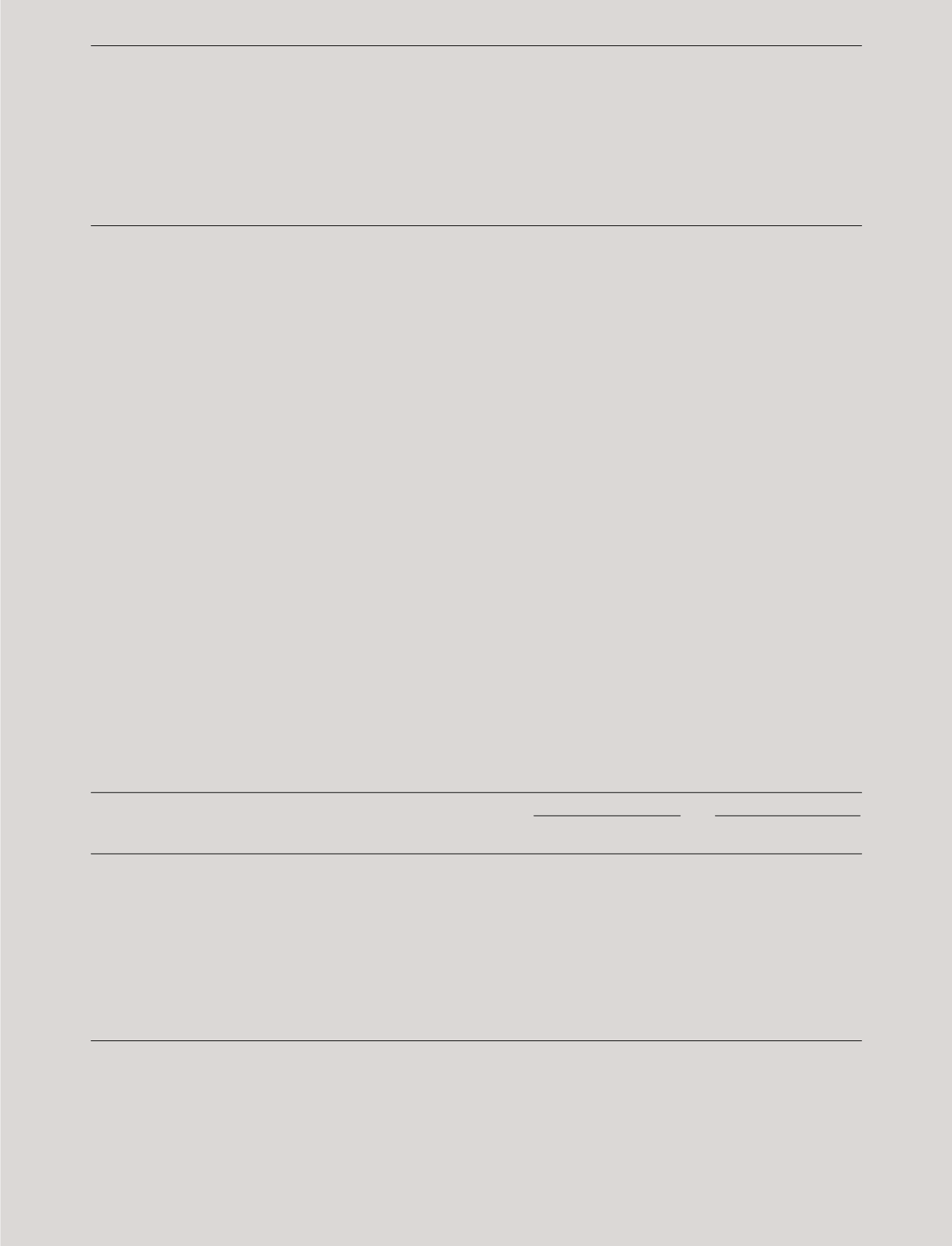

Analysis of assets and liabilities

31December 2014

31December 2013

Change in

Profit (loss)

Profit (loss)

DKKmillion

exchange rate

before tax

Equity

before tax

Equity

USD

-10%

156

305

171

59

USD

+10%

-156

-305

-171

-59

CAD

-10%

1

39

-

32

CAD

+10%

-1

-39

-

-32

AUD

-10%

4

37

4

6

AUD

+10%

-4

-37

-4

-6

GBP

-10%

15

104

11

21

GBP

+10%

-15

-104

-11

-21

EUR

-1%

-11

-11

-12

-7

EUR

+1%

11

11

12

7

THB

-10%

-

-154

-

-93

THB

+10%

-

154

-

93

Themovements in the income statement arise frommonetary items (cash, borrowings, receivables andpayables)where the functional currencyof the entity is

different to the currency that themonetary items aredenominated in.Themovements in equity arise frommonetary items andhedging instrumentswhere the func-

tional currencyof the entity is different to the currency that thehedging instruments ormonetary items aredenominated in.

Foreign currency risk

PANDORA’s presentation currency isDKK, but the

majority of PANDORA’s activities and investments are in

other currencies. Consequently, there is a substantial risk

of exchange rate fluctuations having a negative impact

on PANDORA’s reported cash flows, profit (loss) and/or

financial position inDKK.

Themajority of PANDORA’s revenue is inUSD,

CAD, AUD, GBP and EUR. A drop in the strength of

these currencies against DKKwill result in a decline in

the translated future cash flows. A substantial portion of

PANDORA’s costs are related to rawmaterials purchased

from suppliers that price their products inUSD. PANDORA

also purchases rawmaterials and pays other costs in

THB. Exchange rate increaseswill result in a decline

in the translated value of future cash flows. PANDORA

finances themajority of its subsidiaries’ needs for cash via

intercompany loans denominated in the local currency of

the individual subsidiary. Adrop in the strength of these

currencies against DKKwill result in a foreign exchange

loss in the Parent Company. PANDORA owns foreign

subsidiarieswhere the translation of equity intoDKK

is influenced by exchange rate fluctuations. Declining

exchange rateswill result in a foreign exchange loss in the

Group’s equity.

Exchange rate fluctuationsmay lead to a decrease

in revenue and an increase in costs and thus declining

margins. In addition, exchange rate fluctuations affect the

translated value of the profit or loss of foreign subsidiaries

and the translation of foreign currency assets and liabilities.

It is PANDORA’s policy to hedge foreign currency risks

related to the risk of declining net cash flows resulting

from exchange rate fluctuations. PANDORA basically does

not hedge balance sheet items or ownership interests in

foreign subsidiaries. It is PANDORA’s policy for itsGroup

Treasury to hedge 100% of the risk 1-3months forward,

80% of the risk 4-6months forward, 60% of the risk 7-9

months forward and40% of the risk 10-12months forward,

based on a rolling 12-month liquidity budget. Foreign

currency hedging is updated at the end of eachquarter or in

connectionwith revised12-month rolling cash forecasts.

Below is an illustration of the impact inDKKmillion on

the net profit and changes in equity resulting from a change

in theGroup’s primary foreign currencies after the effect of

hedge accounting.

FINANCIAL RISKS, CONTINUED

4.4