NOTES

Consolidated financial statements •91

SECTION 4: CAPITAL STRUCTURE AND NET FINANCIALS, CONTINUED

FINANCIAL INSTRUMENTS

4.5

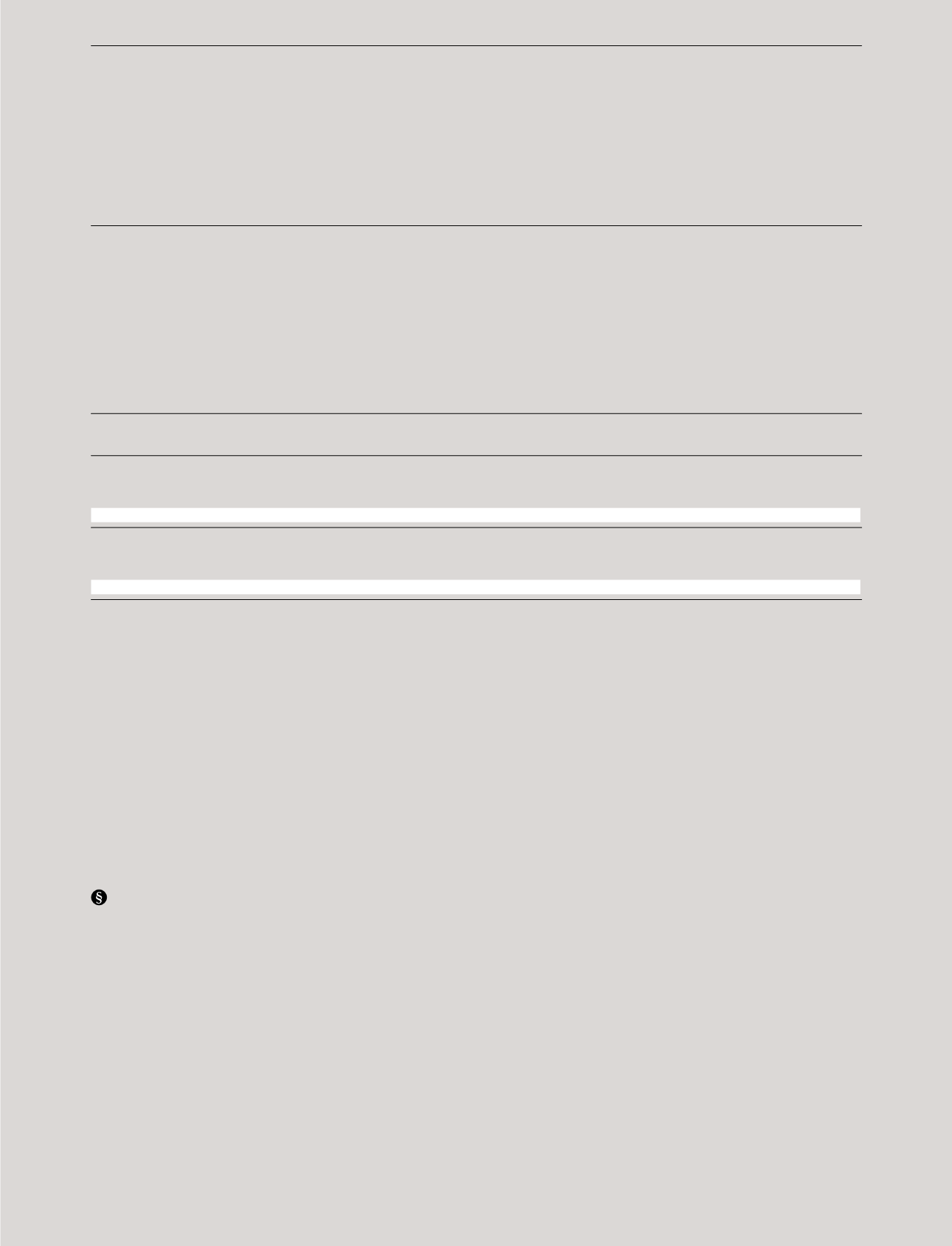

Carrying

Hedge

DKKmillion

Assets

Liabilities

amount

reserve

2014

Commodities

9

-133

-124

-122

Foreign exchange

90

-135

-45

-34

Total financial instruments

99

-268

-169

-156

2013

Commodities

-

-127

-127

-127

Foreign exchange

-

-21

-21

-16

Total financial instruments

-

-148

-148

-143

Financial assets and liabilities aremeasured at cost with the

exception of financial instruments (forward contracts etc.),

which aremeasured at fair value.

PANDORA uses a number of financial instruments to

hedge its exposure to fluctuations in commodity prices,

Classification according to the fair value hierarchy

The fair value at 31December 2014 and2013of

PANDORA’s financial instrumentswasmeasured in

accordancewith level 2 in the fair valuehierarchy (IFRS7).

Level 2 is basedonnon-quotedprices, observable either

directly (i.e. as prices) or indirectly (i.e. derived fromprices).

PANDORAuses third-party valuation specialists toquote

prices for theunrealisedfinancial instruments.The value

of unrealised silver and gold instruments are tested against

theprices observable at LBMA (LondonBullionMarket

Association).The valueof unrealised foreign exchange

instruments are tested against observable foreign exchange

forward rates.

Accounting policies

Financial instruments are initially recognised at fair

value at thedateonwhich a contract is entered into and

are subsequentlymeasured at fair value. For financial

instruments not traded in an activemarket, the fair value

is determinedusing appropriate valuationmethods. Such

methodsmay include comparisonwith recent arm’s length

market transactions, reference to the current fair value

of another instrument that is substantially the sameor

discounted cashflow analysis.

exchange rates and interest rates. Financial instruments

include forward commodity contracts, forward currency

contracts and interest rate swaps.

PANDORA has designated certainfinancial instruments

as cash flow hedges as definedunder IAS 39. Hedge

accounting is classified as cashflow hedgewhenhedging

variability in cashflow is attributable to a highly probable

forecast transaction. PANDORAuses a range of 80% to

125% for hedge effectiveness and any relationshipwhich

has effectiveness outside this range is deemed to be

ineffective andhedge accounting is suspended. PANDORA

designates and documents all hedging relationships

between commodity contracts and transactions.

Financial instruments that qualify for cash

flowhedge accounting

The effective portionof the unrealised gainor loss on

all hedging instruments is recognised directly as other

comprehensive income in the equity hedging reserve.The

ineffective portion is recognised innet financials.

The effective part of the realised gain or loss on a com-

modity hedging transaction is recognised inGroup invento-

rieswhereas the ineffective part is realised in net financials.

The realised gain or loss on all forward exchange contracts

is recognised in net financials.