NOTES

86•Consolidated financial statements

PANDORAANNUAL REPORT2014

SECTION 4: CAPITAL STRUCTURE AND NET FINANCIALS, CONTINUED

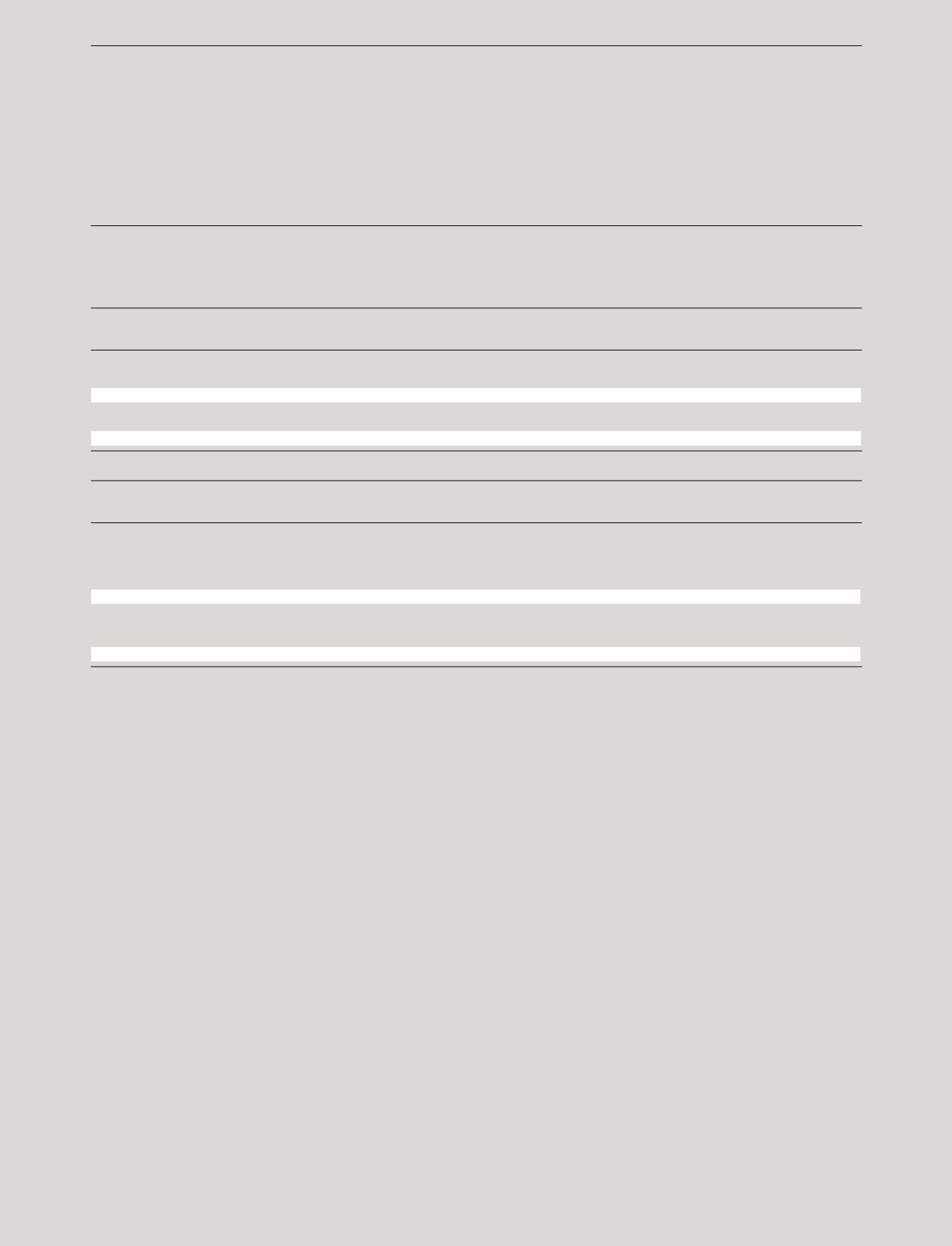

4.1 SHARECAPITAL

Shares

Nominal

Share capital

(number)

value (DKK)

Balance at 1 January 2014

130,143,258

130,143,258

Reduction of share capital

-2,027,438

-2,027,438

Balance at 31December 2014

128,115,820

128,115,820

Balance at 1 January 2013

130,143,258

130,143,258

Balance at 31December 2013

130,143,258

130,143,258

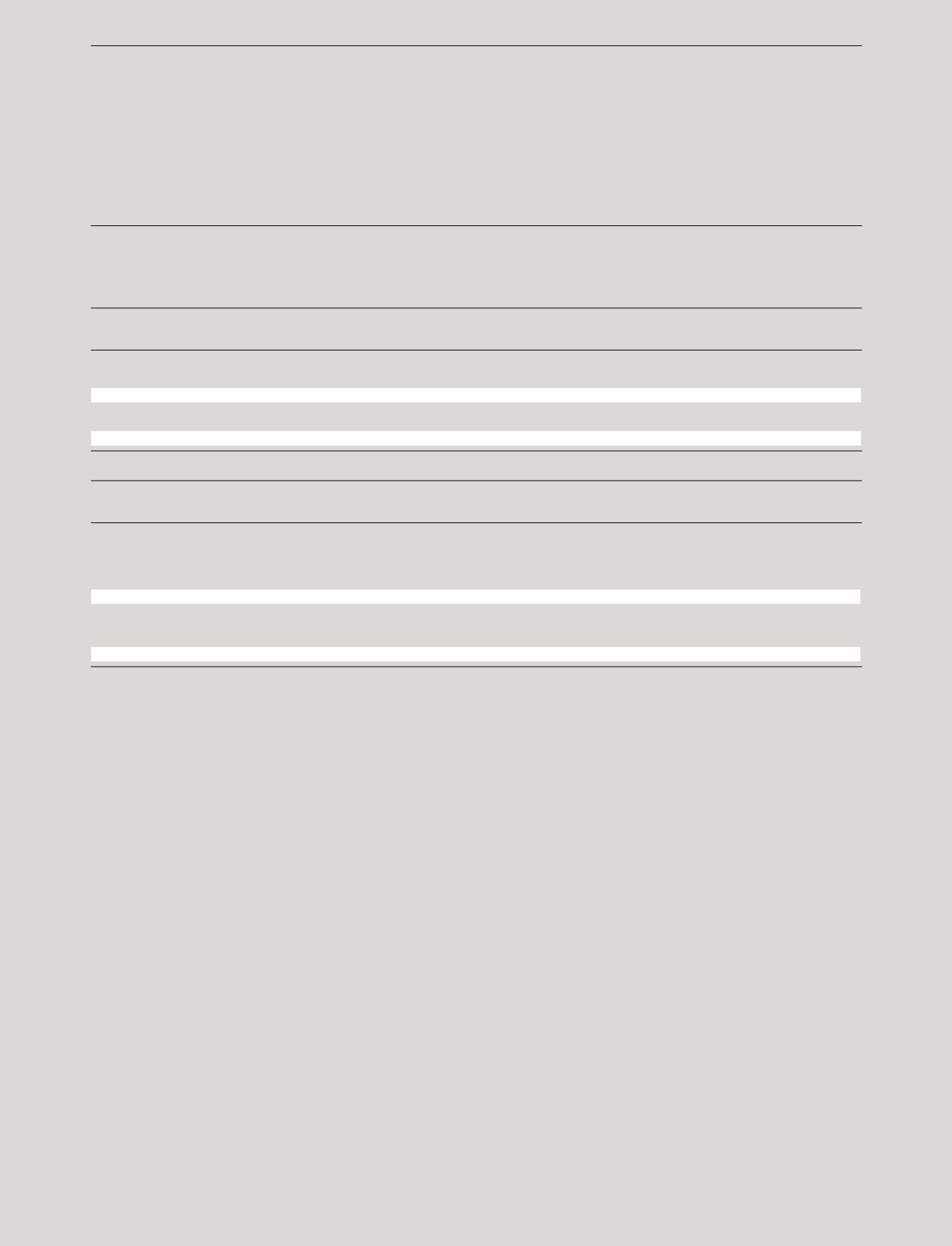

Shares

Nominal

Purchase

Treasury shares

(number)

value (DKK)

price

% of shares

Balance at 1 January 2014

3,539,023

3,539,023

738,413,909

2.7%

Used to settle share options

-170,784

-170,784

-35,861,172

-0.1%

Reduction of share capital

-2,027,438

-2,027,438

-423,023,083

-1.6%

Acquisitionof treasury shares

5,875,257

5,875,257

2,399,991,096

4.6%

Balance at 31December 2014

7,216,058

7,216,058 2,679,520,750

5.6%

Balance at 1 January 2013

182,925

182,925

38,414,250

0.1%

Acquisitionof treasury shares

3,356,098

3,356,098

699,999,659

2.6%

Balance at 31December 2013

3,539,023

3,539,023

738,413,909

2.7%

At 31December 2014, the share capital comprised

128,115,820 shareswith a par value of DKK 1. No shares

have special rights.

In 2014, PANDORA launched a share buyback

programme under which PANDORA expected to buy

back own shares of DKK2,400million or amaximum of

9,475,303 shares.

In 2014, PANDORA bought 5,875,257 treasury shares

equal to a purchase price of DKK 2,399,991,096.

Treasury shares

All treasury shares are owned by PANDORAA/S.Treasury

shares includes hedges for share-based incentive plans and

restricted stock grants to the Boardof Directors and key

employees.