NOTES

78•Consolidated financial statements

PANDORAANNUAL REPORT2014

SECTION 3: INVESTED CAPITAL ANDWORKING CAPITAL ITEMS, CONTINUED

3.1 INTANGIBLEASSETS, CONTINUED

rights are considered to have an indefinite useful life.

Other acquireddistribution rights aremeasuredbased

on theMulti-period Excess Earningsmodel and amortised

over their useful lives.

Other intangible assets

Software ismeasured at cost and amortisedover three years.

Significant accounting estimates

At each reporting date, PANDORA assesseswhether there

is any indication that an asset may be impaired. If any

indication exists, or when annual impairment testing of

an asset is required, PANDORA estimates the recoverable

amount of the asset.

The recoverable amount of an asset is the higher of the

fair value of the asset or cash-generating unit (CGU) less

costs to sell and its value in use.The recoverable amount

is determined for the individual asset, unless the asset does

not generate cash flows that are independent of those from

other assets or groups of assets.Where the carrying amount

of an asset or CGU exceeds its recoverable amount, the

asset is considered impaired and iswritten down to its

recoverable amount.

In assessing the value in use, the estimated future cash

flows are discounted to their present value using a pre-tax

discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset.

Indetermining fair value less costs to sell, an appropriate

valuationmodel is used.

Goodwill and distribution rights are allocated to five

CGUs: Americas, UK, CentralWestern Europe, Australia

anddistributors & travel retail.The recoverable amount has

beenbased on a calculation of the value in use using cash

flow estimates basedonbudgets and expectations for the

next three years.The long-term growth rate in the terminal

periodhas been set to equal the expected long-term rate of

inflation of 2.0% (2013: 2.0%).

The brand is applied and supported globally in all of

theGroup’s entities.Through common strategy and product

development at Group level andmarketing in the individual

sales entities, the brand ismaintained and preserved.

Therefore, the brand is tested for impairment at Group level.

The calculations of the recoverable amounts of the

CGUs or groups of CGUs are basedon the following key

assumptions:

Discount rates reflect the current market assessment of

the risks specific to eachCGU.TheGroup discount rates

have been estimatedbased on aweighted average cost of

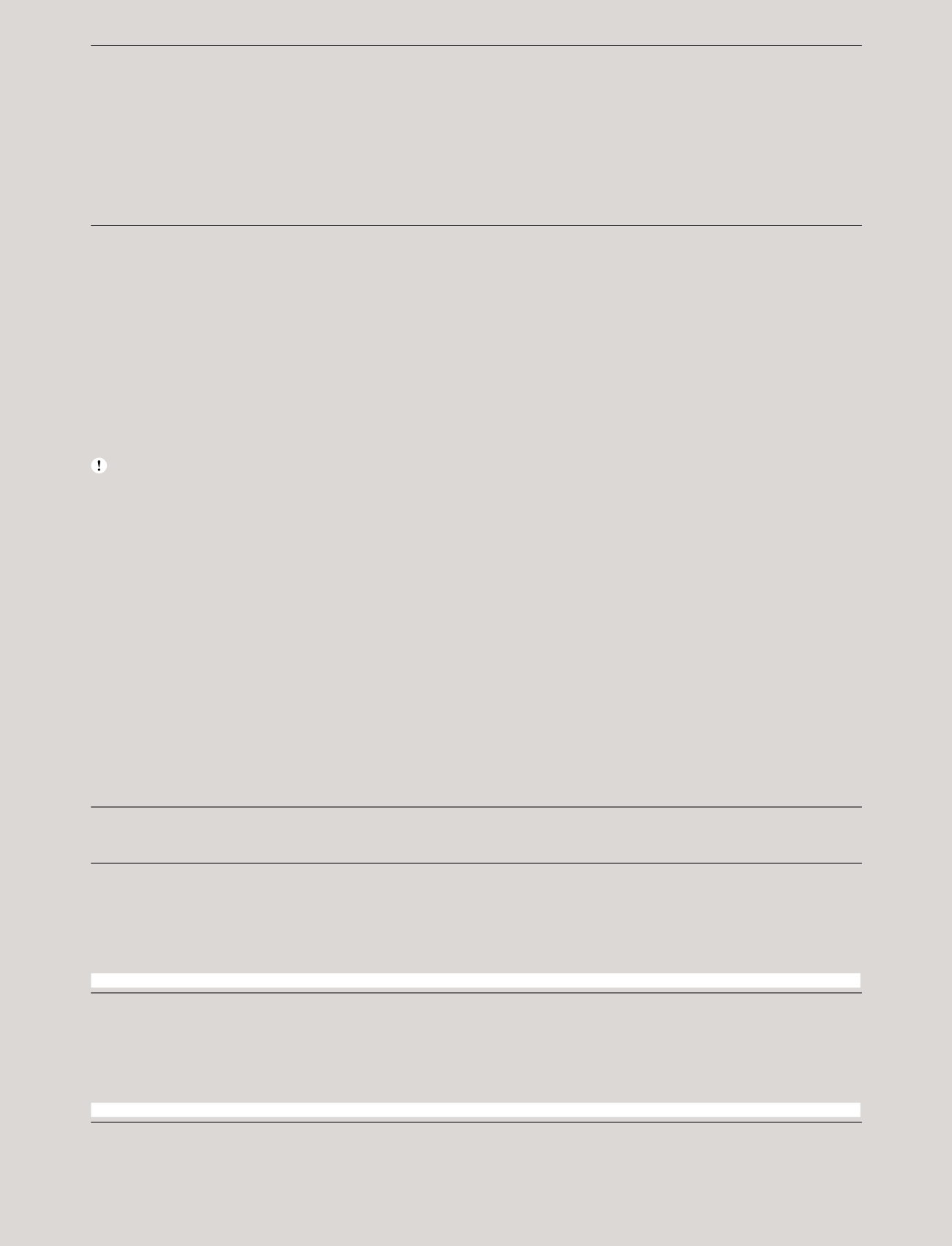

Allocation of intangible assets onCGUs

Other

Distribution

Distribution

intangible

DKKmillion

Goodwill

Brand

network

rights

assets

Total

2014

Americas

605

-

-

1,034

46

1,685

UK

43

-

-

-

-

43

CentralWestern Europe

705

-

-

13

16

734

Australia

482

-

-

-

6

488

Distributors & travel retail

207

-

-

-

13

220

Group

38

1,053

268

-

330

1,689

Total

2,080

1,053

268

1,047

411

4,859

2013

Americas

448

-

-

1,034

22

1,504

UK

36

-

-

-

-

36

CentralWestern Europe

700

-

-

8

18

726

Australia

461

-

-

-

12

473

Distributors & travel retail

226

-

-

-

4

230

Group

33

1,053

300

-

262

1,648

Total

1,904

1,053

300

1,042

318

4,617