NOTES

72•Consolidated financial statements

PANDORAANNUAL REPORT2014

SECTION 2: RESULTS FOR THE YEAR, CONTINUED

2.4 SHARE-BASED PAYMENTSAND EMPLOYEE SHARES, CONTINUED

Accounting policies

Key employees of PANDORA receive remuneration in

the form of share-based payment transactions, whereby

employees render services as consideration for equity

instruments (‘equity-settled transactions’).

Equity-settled transactions

The cost of equity-settled transactionswith employees is

measured by reference to the fair value at the date onwhich

they are granted.The calculated fair values are based on the

Black-Scholesmodel formeasuring share options.The cost

of equity-settled transactions is recognised together with a

corresponding increase in equity over the period inwhich

the performance and/or service conditions are fulfilled.

The cumulative expense recognised for equity-settled

transactions at each reporting date until the vesting date

reflects the extent towhich the vesting period has expired

and PANDORA’s best estimate of the number of equity

instruments that will ultimately vest.The income statement

expense or credit for a period represents themovement in

cumulative expenses recognised at the beginning and end

of that period.

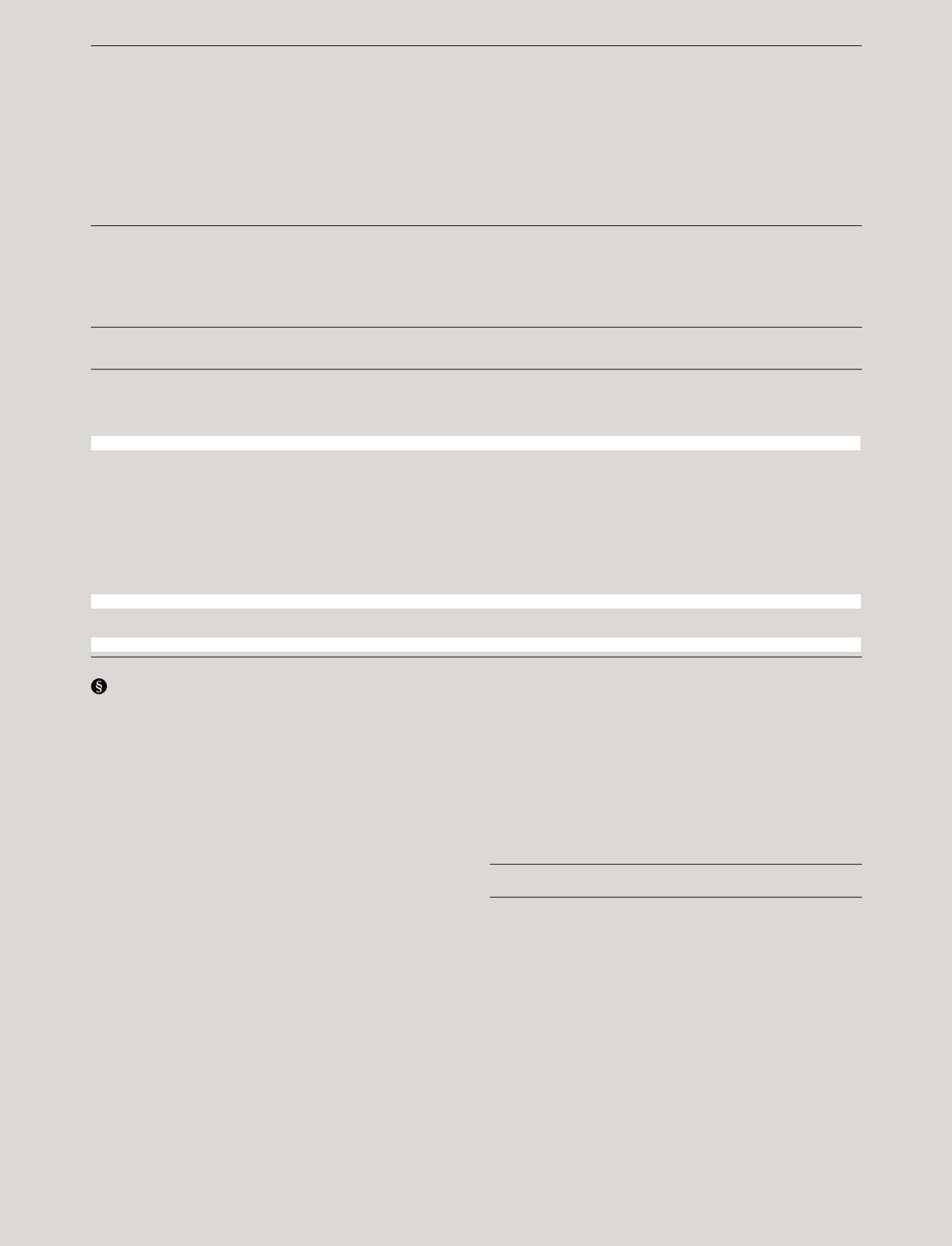

Purchase of

Sale

2012

shares

of shares

2013

Executive Board

Allan Leighton

12,380

-

-

12,380

StenDaugaard

10,785

-

-10,785

-

HenrikHolmark

426,825

-

-137,241

289,584

Total number of shares

449,990

-

-148,026

301,964

Board of Directors

MarcelloBottoli

29,461

-

-

29,461

Allan Leighton

12,380

-

-

12,380

Christian Frigast

59,636

1,368,149

-641,269

786,516

TorbenBallegaard Sørensen

192,670

-

-179,996

12,674

AndreaAlvey

6,107

-

-

6,107

NikolajVejlsgaard

57,630

837,158

-393,333

501,455

RonicaWang

4,070

-

-

4,070

Anders Boyer-Søgaard

-

4,121

-

4,121

Total number of shares

361,954

2,209,428

-1,214,598

1,356,784

Allan Leighton transferred to Executive Board

-12,380

-

-

-12,380

Total number of shares

349,574

2,209,428

-1,214,598

1,344,404

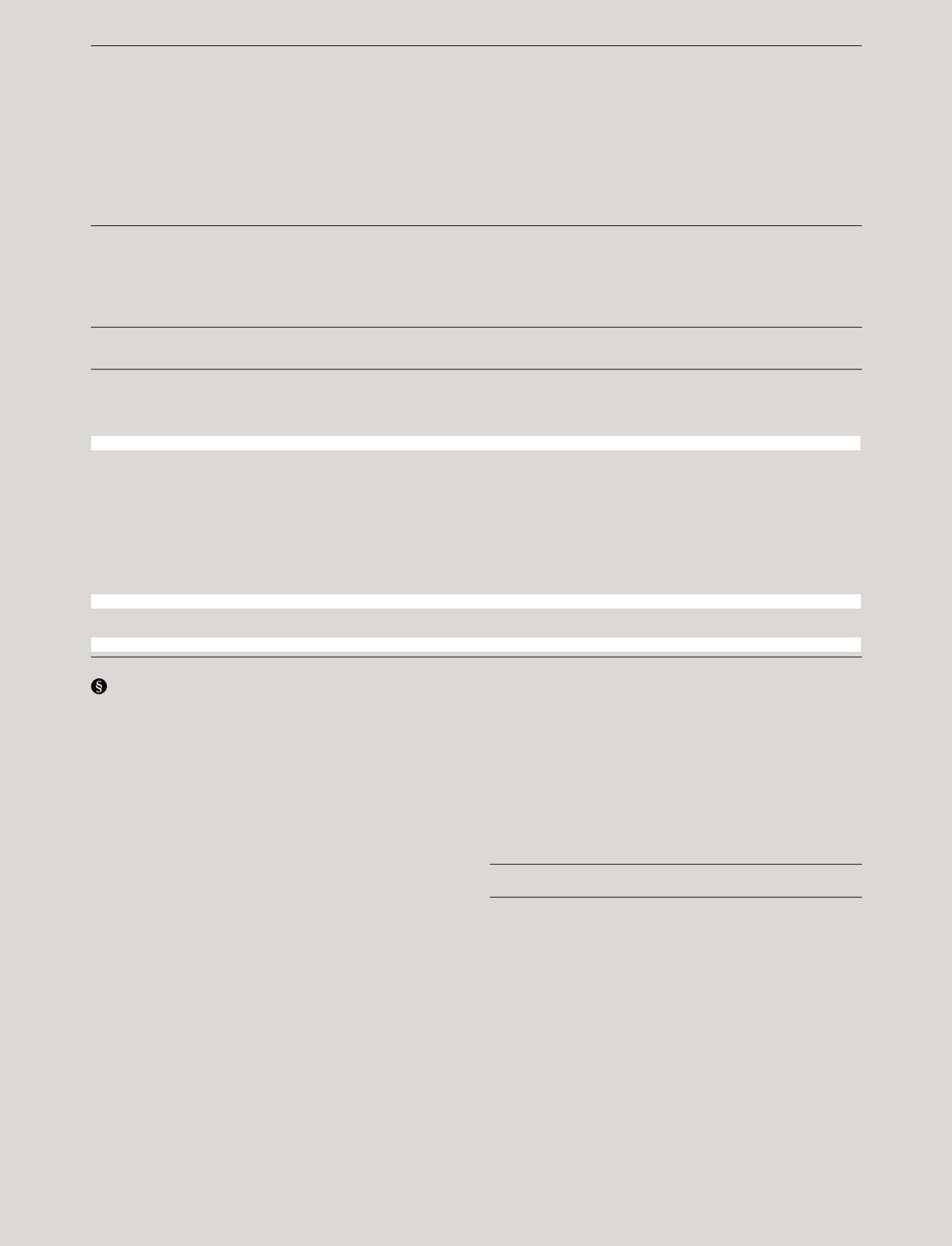

Assumptions

Assumptions concerning the calculationof fair value at date

of grant:

Given that the exercise price for one option equals 1%

of themarket price of one share at grant date, the fair value

of one option almost equals themarket value of one share

at grant date.The assumptions listed below therefore have

a very limited impact on the estimated fair value of the

options granted.

Exercise

Expected Risk-free Dividend

Year of grant

price volatility interest rate per share

20143-year

2.99

46% 0.47% 6.50

2013 1-year

2.10

48% 0.09% 5.50

2013 3-year

1.25

48% 0.16% 5.50

20123-year

0.52

100% 1.34% 5.50

For the above programmes, volatility is based on historical

volatility of the PANDORA share based on the preceding

two years.