NOTES

Consolidated financial statements •73

SECTION 2: RESULTS FOR THE YEAR, CONTINUED

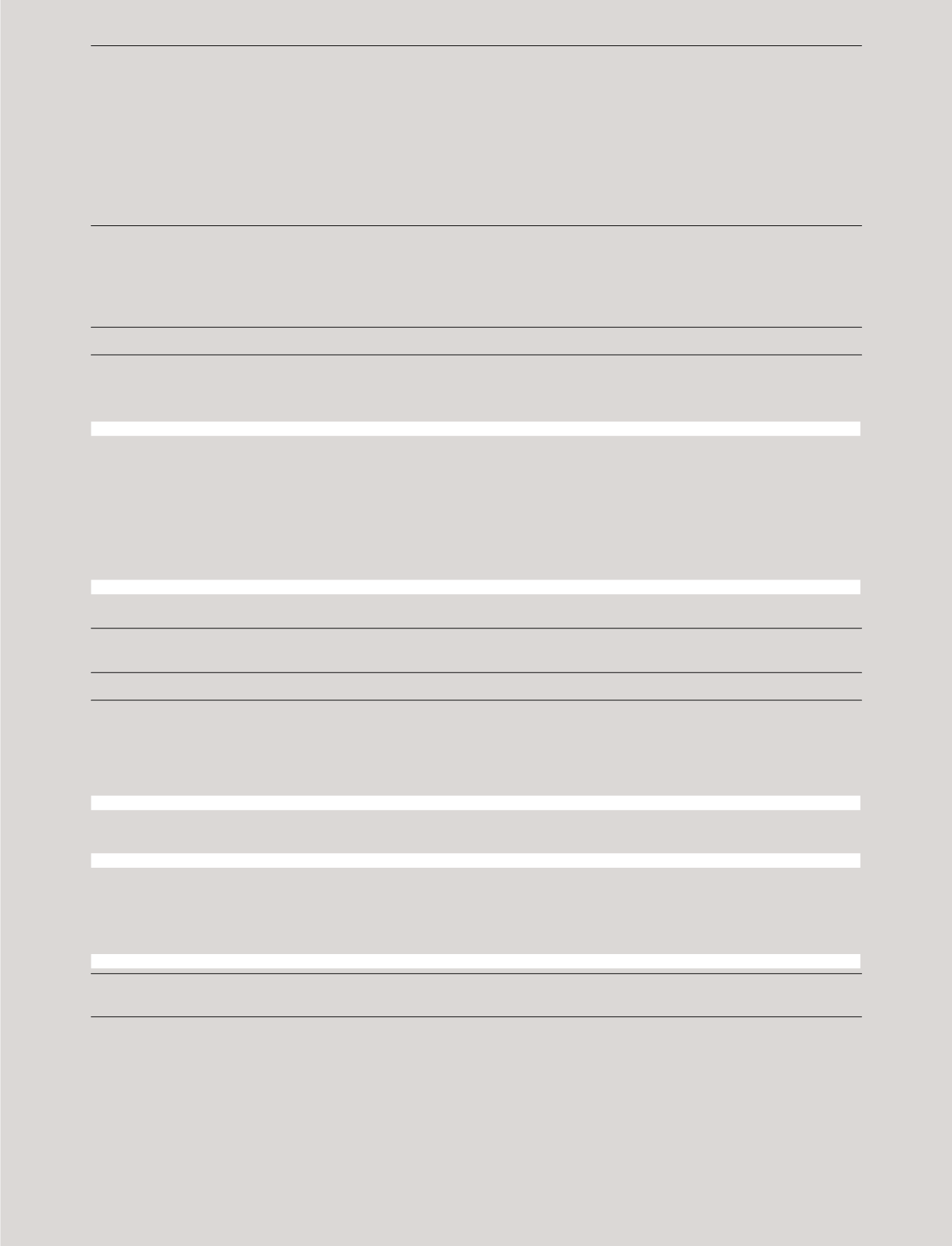

2.5 TAXATION

Income tax expense

DKKmillion

2014

2013

Current income tax charge

786

561

Adjustment concerning previous years

35

136

Impact of change in tax rates

17

-57

Change in deferred tax

-64

-118

Total income tax expense

774

522

Tax reconciliation

Profit before tax

3,872

2,742

Corporate tax rate inDenmark, 24.5% (2013: 25%)

949

686

Tax effect of:

Differences in foreign subsidiaries’ tax rates compared toDanish tax rate

18

52

Impact of change in tax rates

17

-57

Non-taxable income and non-deductible expenses

-243

-292

Adjustment concerning previous years

35

136

Adjustments of deferred tax assets, net

-2

-3

Total income tax expense

774

522

Effective income tax rate

20.0%

19.0%

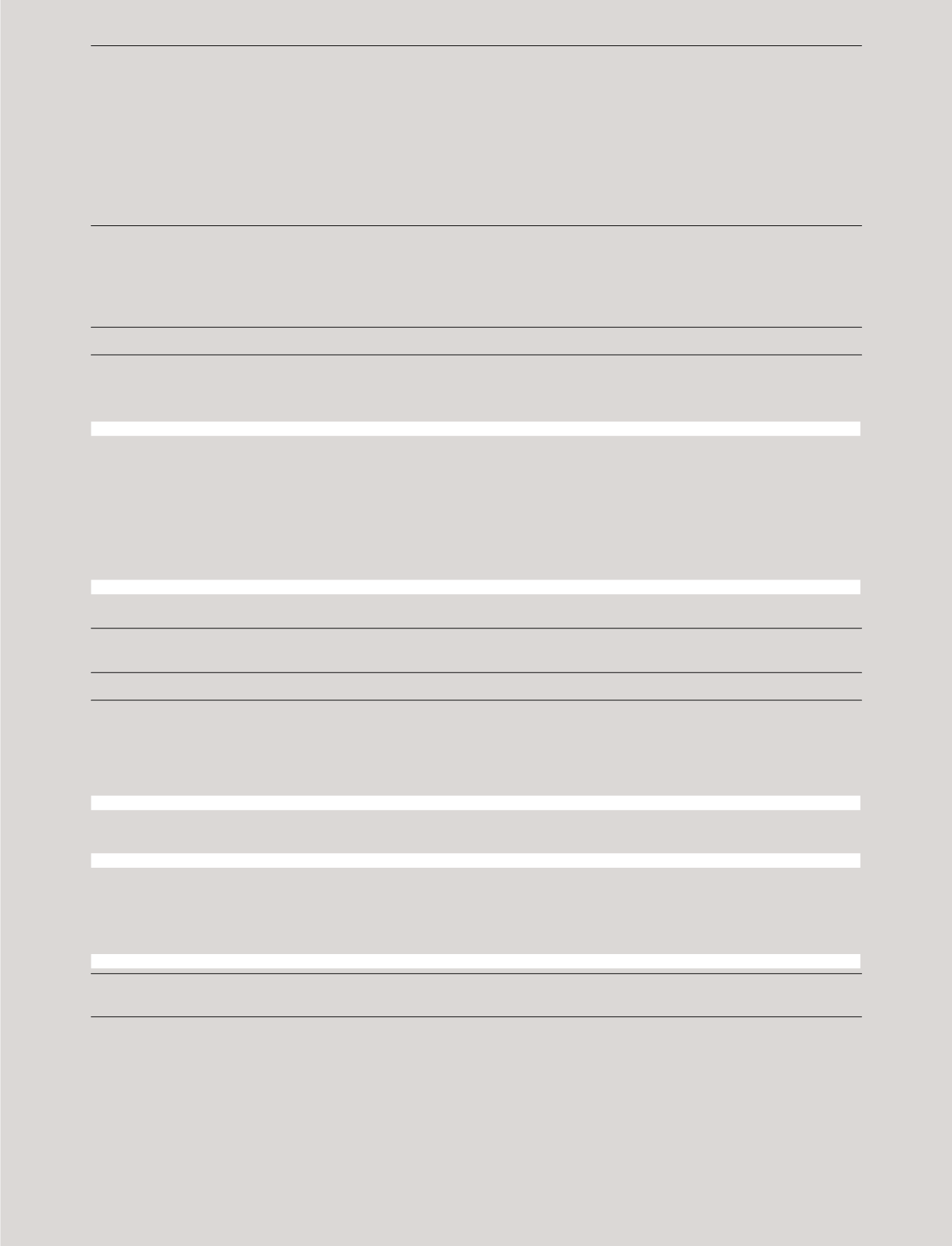

Deferred tax

DKKmillion

2014

2013

Deferred tax at 1 January

195

362

Exchange rate adjustments

-21

14

Change in deferred tax - recognised in income statement

-64

-118

Change in deferred tax - recognised in statement of comprehensive income

-5

-6

Change in deferred tax - recognised in statement of changes in equity

-99

-

Impact of change in theDanish tax rate

17

-57

Deferred tax at 31December

23

195

Deferred tax assets

407

276

Deferred tax liabilities

430

471

Deferred tax, net

23

195

Specification of deferred tax

Intangible assets

527

534

Property, plant and equipment

-206

-13

Non-current assets and liabilities

-298

-327

Tax loss carry-forwards

0

1

Deferred tax, net

23

195

Unrecognised share of tax loss carry-forwards

79

62

Latent tax liability on undistributed dividends

1

277

246

1

The latent tax liability on undistributed dividends relates to a dividend tax of 10%, whichwill be payable if retained earnings earned before 1 September 2012

are distributed as dividends from PANDORA ProductionCo. Ltd. to PANDORAA/S. At present,Management does not intend todistribute this dividend.